On July 10, 2025, UBS analyst Douglas Harter updated his position on MFA Financial (MFA, Financial), maintaining a "Neutral" rating for the stock. This decision aligns with his prior assessment, indicating no change in the overall rating perspective.

The report highlights a revised price target, with a slight adjustment from the prior valuation. The updated price target for MFA Financial (MFA, Financial) has been raised from $9.50 to $10.00 USD, marking a 5.26% increase. This adjustment reflects a continuing stable outlook on the company's performance, as per the neutral stance maintained by UBS.

MFA Financial (MFA, Financial) continues to trade on the NYSE, where it remains a point of interest under market watch by investors and analysts alike. The latest analysis by UBS provides insights for stakeholders looking to evaluate the company's market position and future potential developments.

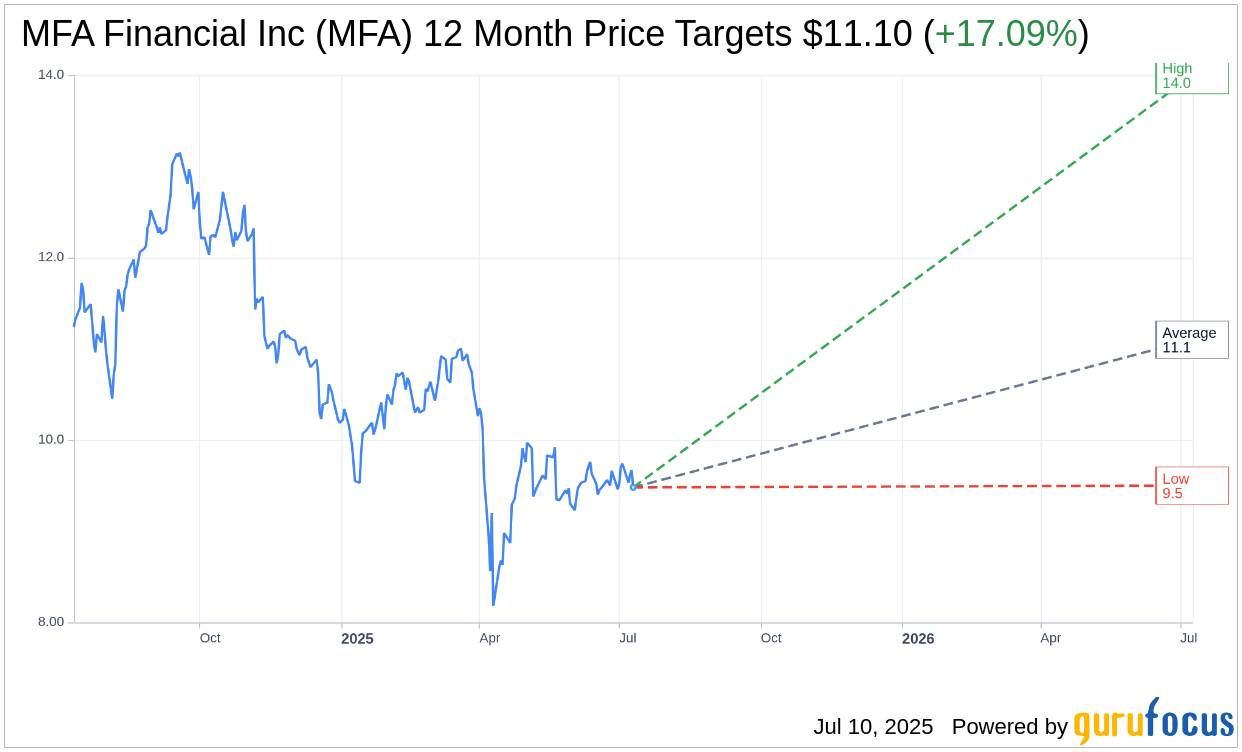

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for MFA Financial Inc (MFA, Financial) is $11.10 with a high estimate of $14.00 and a low estimate of $9.50. The average target implies an upside of 17.09% from the current price of $9.48. More detailed estimate data can be found on the MFA Financial Inc (MFA) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, MFA Financial Inc's (MFA, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.