Key Highlights:

- Ramaco Resources (METC, Financial) celebrates a significant share price increase following positive viability results for its Brook Mine.

- Independent assessment forecasts robust financials, including a $1.197 billion pre-tax NPV and $143 million EBITDA by 2029.

- Current analyst ratings suggest a potential downside from the recent high share prices.

Ramaco Resources (METC) recently experienced a notable market leap, with its shares soaring 30.9% to hit a 52-week high of $17.33. This surge followed the release of an independent economic assessment confirming the commercial and technological feasibility of its Brook Mine located in Wyoming. The report outlines a promising pre-tax Net Present Value (NPV) of $1.197 billion and anticipates an annual EBITDA of $143 million by 2029.

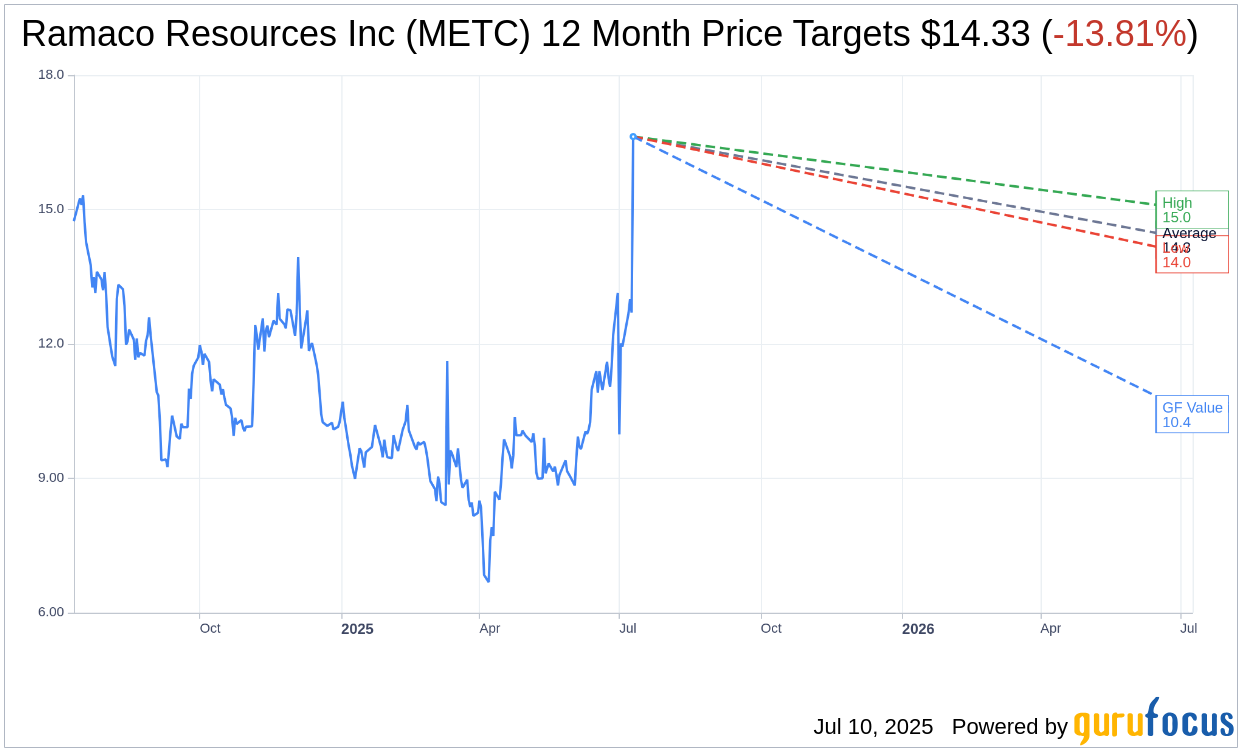

Wall Street Analysts Forecast

Analysts have set price targets for Ramaco Resources Inc (METC, Financial) that present an intriguing perspective for investors. With an average target price of $14.33, and assessments ranging from a low of $14.00 to a high of $15.00, the current share price of $16.63 could imply a potential downside of 13.81%. For more in-depth analysis, investors can explore the Ramaco Resources Inc (METC) Forecast page.

The consensus from three brokerage firms presents an optimistic stance on Ramaco, with an average recommendation of 1.7, signaling an "Outperform" status. The rating system ranges from 1 (Strong Buy) to 5 (Sell), providing a clear indication of market sentiment.

Further, according to GuruFocus estimates, the projected GF Value for Ramaco Resources Inc (METC, Financial) stands at $10.43 for the upcoming year. This estimate suggests a potential downside of 37.28% from the current stock price of $16.63. GF Value represents GuruFocus' calculated fair value, considering historical trading multiples, previous growth trends, and future business performance forecasts. For a comprehensive overview, visit the Ramaco Resources Inc (METC) Summary page.