Goldman Sachs has adjusted its price target for Sensata Technologies (ST, Financial), raising it to $36 from the previous $30, while maintaining a Buy rating on the stock. This change is part of a broader analysis of the U.S. Autos and Industrial Tech sectors. The revision reflects expectations of reduced tariff impacts compared to initial projections, although the firm predicts a slowdown in U.S. auto sales in the latter half of the year due to pre-buying and anticipated higher prices stemming from tariffs.

The investment bank now forecasts U.S. auto sales to reach 15.75 million units in 2025 and 15.50 million units in 2026, revising its earlier estimates of 15.40 million and 15.25 million units, respectively.

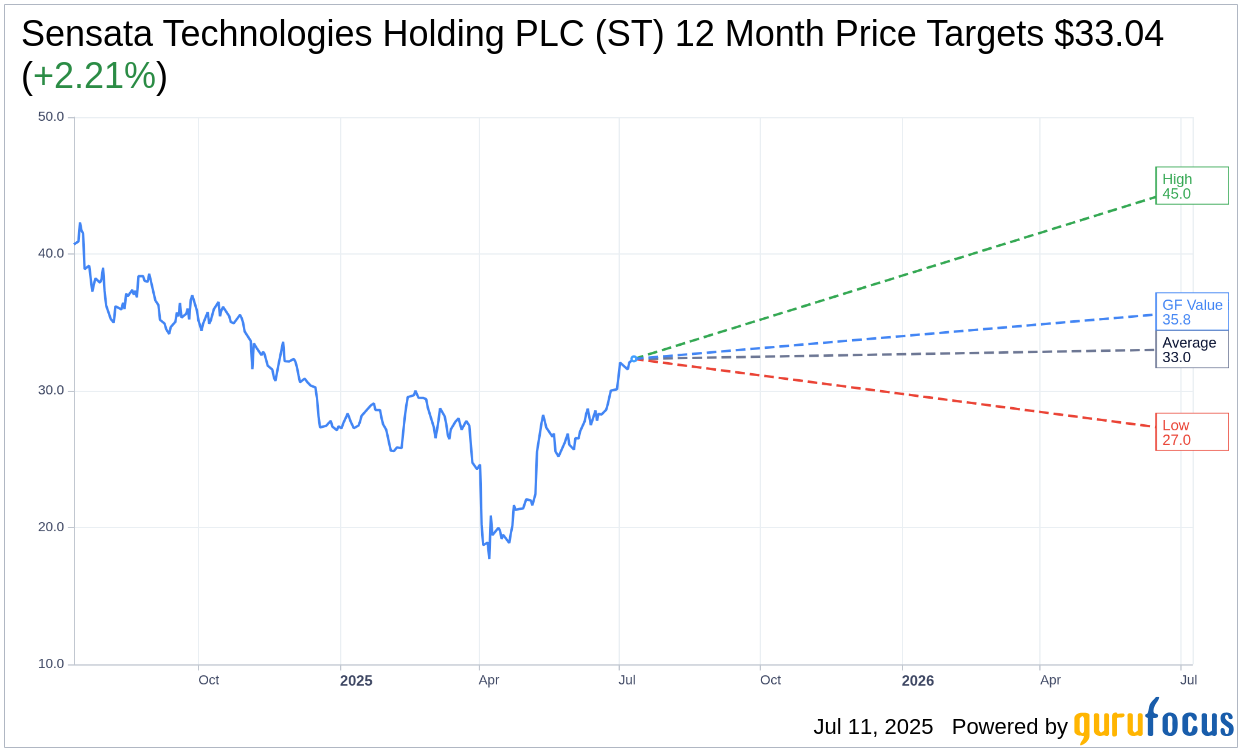

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Sensata Technologies Holding PLC (ST, Financial) is $33.04 with a high estimate of $45.00 and a low estimate of $27.00. The average target implies an upside of 2.21% from the current price of $32.33. More detailed estimate data can be found on the Sensata Technologies Holding PLC (ST) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, Sensata Technologies Holding PLC's (ST, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Sensata Technologies Holding PLC (ST, Financial) in one year is $35.80, suggesting a upside of 10.73% from the current price of $32.33. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Sensata Technologies Holding PLC (ST) Summary page.

ST Key Business Developments

Release Date: May 08, 2025

- Revenue: $911 million for Q1 2025, compared to $1.007 billion in Q1 2024.

- Adjusted Operating Income: $167 million, with a margin of 18.3%.

- Adjusted Earnings Per Share: $0.78, exceeding guidance by $0.07.

- Free Cash Flow Conversion: Improved by 26 percentage points to 74%.

- Free Cash Flow: $87 million, up 35% from $64 million in Q1 2024.

- Sensing Solutions Revenue: $261 million, up 3% year over year after adjustments.

- Sensing Solutions Operating Margin: 29.2% in Q1 2025.

- Performance Sensing Revenue: $650 million, a decrease of about 9% year over year.

- Performance Sensing Operating Margin: 22% in Q1 2025.

- Share Repurchases: Approximately 3.5 million shares for $100 million.

- Dividend: $18 million returned to shareholders, with a $0.12 per share rate.

- Return on Invested Capital (ROIC): Increased to 10.2% from 9.7% year over year.

- Q2 2025 Revenue Guidance: $910 million to $940 million.

- Q2 2025 Adjusted Operating Income Guidance: $169 million to $177 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Sensata Technologies Holding PLC (ST, Financial) exceeded the high end of its guidance for revenue, adjusted operating income, and adjusted earnings per share in Q1 2025.

- The company improved its free cash flow conversion by 26 percentage points year over year to 74%, demonstrating strong cash management.

- Sensata has successfully mitigated more than 95% of its gross tariff exposure through exemptions, customer agreements, and other actions.

- The company reported a significant win in Japan with Mazda for exhaust and fuel sensors, indicating strong market penetration in Asia.

- Sensata's Sensing Solutions segment returned to growth, with a 3% year-over-year increase in revenue, driven by stability in industrials and aerospace and growth in gas leak detection sensing products.

Negative Points

- Revenue for Q1 2025 was $911 million, down from $1.007 billion in Q1 2024, reflecting the impact of divestitures and market challenges.

- Performance Sensing segment revenue decreased by about 9% year over year, with challenges in the automotive and heavy vehicle off-road businesses.

- The company faces ongoing challenges from tariffs, with approximately $20 million in tariff costs expected in Q2 2025.

- Sensata experienced a ransomware incident in early April, temporarily impacting operations for about two weeks.

- The macroeconomic environment remains uncertain, with potential impacts on automotive production and industrial demand due to tariffs and regulatory shifts.