Frequency Electronics Inc (FEIM, Financial) released its 8-K filing on July 10, 2025, announcing impressive financial results for the fourth quarter and full fiscal year 2025. The company, a leader in high-precision timing and frequency control products for various applications, reported significant increases in both revenue and net income compared to the previous fiscal year.

Company Overview and Segment Performance

Frequency Electronics Inc is engaged in the design, development, and manufacture of high-precision timing and frequency control products for space, air, sea, and terrestrial applications. The company operates through two main segments: FEI-NY and FEI-Zyfer, with the majority of its revenues derived from the FEI-NY segment. This segment focuses on precision time and frequency control products used in communication satellites, terrestrial telecommunication stations, and U.S. military systems.

Financial Performance Highlights

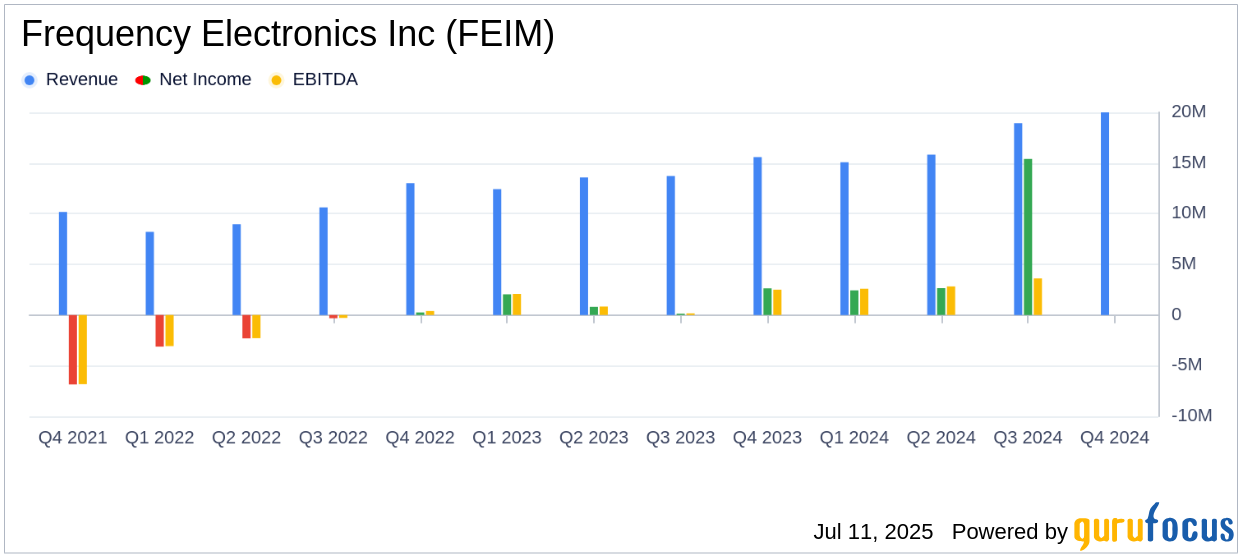

For the fiscal year ended April 30, 2025, Frequency Electronics Inc reported revenues of $69.8 million, a substantial increase from $55.3 million in the previous year. The fourth quarter alone saw revenues of $20.0 million, marking the highest revenue quarter for the company in the past twenty-five years. Operating income for the year was $11.7 million, more than double the $5.0 million reported in fiscal year 2024.

Net income from operations for the fiscal year was $23.8 million, or $2.48 per diluted share, compared to $5.6 million, or $0.59 per diluted share, in the prior year. This remarkable growth underscores the company's successful execution of its strategic initiatives and strong market demand for its products.

Key Financial Metrics and Achievements

Revenues from satellite payloads accounted for 59% of consolidated revenues, increasing from 42% in the previous year. This growth highlights the company's strong position in the space sector. However, revenues from non-space U.S. Government/DOD customers decreased to 38% from 52%, reflecting a shift in revenue composition.

Despite the positive revenue growth, the company reported a net cash outflow from operating activities of $1.4 million, compared to a cash inflow of $8.7 million in the previous year. This change indicates increased investment in growth initiatives and product development.

Strategic Insights and Future Outlook

FEI President and CEO, Tom McClelland commented, “The fourth quarter of fiscal year 2025 was another excellent financial quarter, for the Company. In fact, the fourth quarter was the highest revenue quarter for the company in the past twenty-five years! Margins and operating income were historically high also, resulting in excellent results for the fiscal year. We have demonstrated strong growth over the past several years, and I believe the growth potential for our company is expanding even further.”

The company's backlog at the end of the fiscal year was $70 million, down from $78 million the previous year, indicating potential challenges in securing new contracts. However, the company's strategic investments in quantum sensor applications and other innovative technologies position it well for future growth.

Conclusion

Frequency Electronics Inc's fiscal year 2025 results reflect strong operational performance and strategic growth initiatives. While the company faces challenges in maintaining its backlog and managing cash flow, its focus on innovation and market expansion provides a solid foundation for future success. Investors and stakeholders will be keenly watching how the company navigates these challenges and capitalizes on emerging opportunities in the high-precision timing and frequency control market.

Explore the complete 8-K earnings release (here) from Frequency Electronics Inc for further details.