Key Insights:

- Mitsubishi UFJ Financial Group (MUFG, Financial) is ramping up its global securitization strategy with a 25% increase in staff, particularly targeting North America.

- The company is diversifying into non-traditional asset classes like aircraft and data centers to boost profitability.

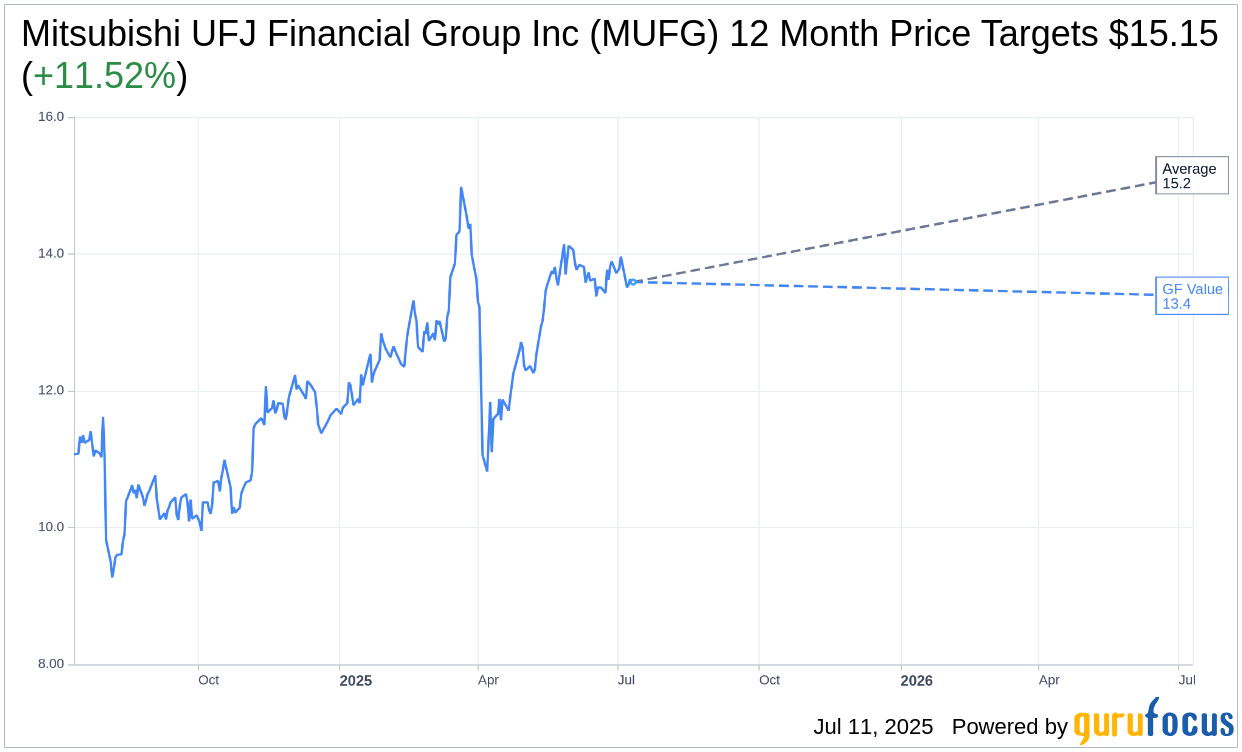

- Analyst forecasts show a potential 11.52% upside, with the stock currently rated as a "Hold."

Expanding Securitization in North America

Mitsubishi UFJ Financial Group (MUFG) is strategically expanding its global reach by intensifying its securitization efforts in North America. The bank is increasing its workforce by 25%, focusing on asset classes that deviate from the norm, such as aircraft and data centers. This approach aims to enhance profitability and set MUFG apart from traditional asset-backed securities.

Wall Street Analysts' Insights

Analyst forecasts for Mitsubishi UFJ Financial Group Inc (MUFG, Financial) offer an average one-year price target of $15.16. This target suggests a potential upside of 11.52% from its present value of $13.59. For a deeper dive into these projections, visit the Mitsubishi UFJ Financial Group Inc (MUFG) Forecast page.

The current consensus recommendation from brokerage firms stands at a 3.0 rating for Mitsubishi UFJ Financial Group Inc (MUFG, Financial), signaling a "Hold" status. The rating scale extends from 1 (Strong Buy) to 5 (Sell), placing MUFG in the middle of the spectrum.

Evaluating GF Value

According to GuruFocus estimates, the projected GF Value for Mitsubishi UFJ Financial Group Inc (MUFG, Financial) in the coming year is $13.39. This estimate indicates a slight downside of 1.47% from its current trading price of $13.59. The GF Value, developed by GuruFocus, represents the stock's fair trading price, considering historical multiples, past growth, and future business performance projections. For more detailed information, explore the Mitsubishi UFJ Financial Group Inc (MUFG) Summary page.