UBS has revised its stance on Corebridge (CRBG, Financial), moving its rating from Sell to Neutral. The financial services firm set a new price target of $37 for the stock. This adjustment reflects changes in the firm's outlook on Corebridge's business prospects.

Wall Street Analysts Forecast

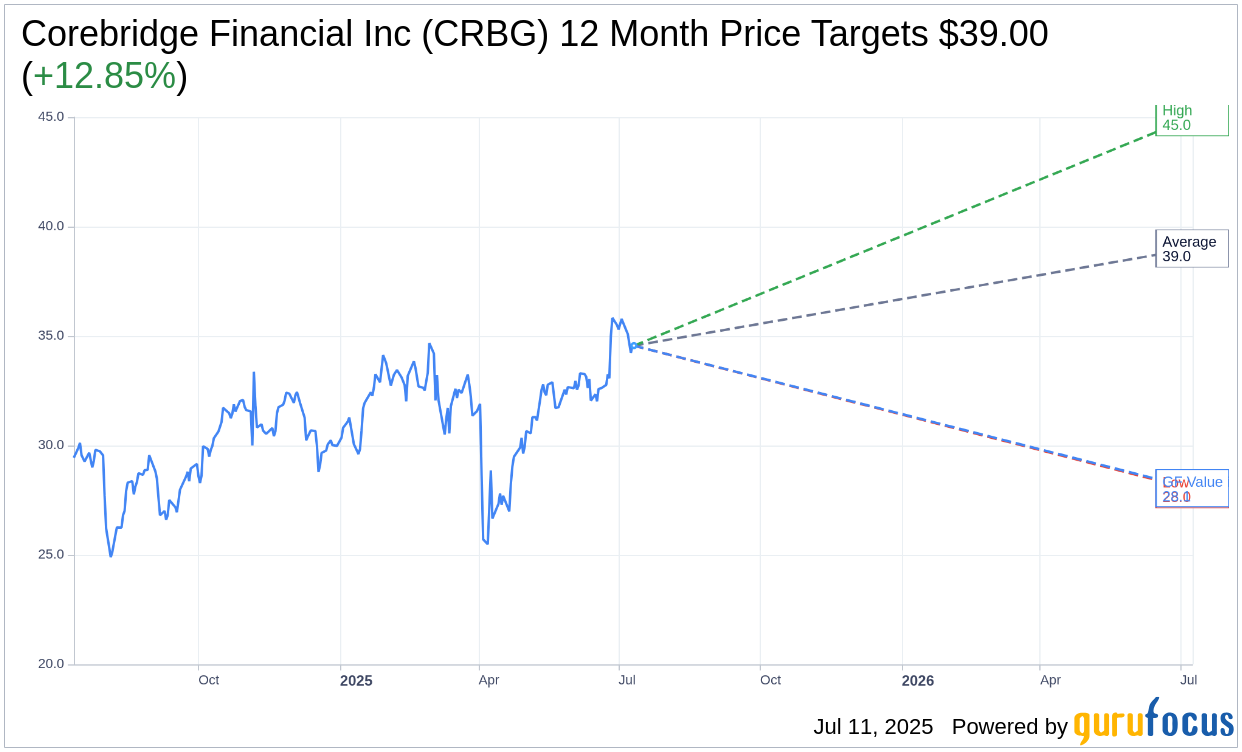

Based on the one-year price targets offered by 12 analysts, the average target price for Corebridge Financial Inc (CRBG, Financial) is $39.00 with a high estimate of $45.00 and a low estimate of $28.00. The average target implies an upside of 12.85% from the current price of $34.56. More detailed estimate data can be found on the Corebridge Financial Inc (CRBG) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Corebridge Financial Inc's (CRBG, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Corebridge Financial Inc (CRBG, Financial) in one year is $28.05, suggesting a downside of 18.84% from the current price of $34.56. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Corebridge Financial Inc (CRBG) Summary page.

CRBG Key Business Developments

Release Date: May 06, 2025

- Operating Earnings Per Share (EPS): $1.16

- Return on Equity (ROE): 11.8%

- Shareholder Returns: $454 million returned, 70% payout ratio

- Holding Company Liquidity: $2.4 billion

- Premiums and Deposits: $9.3 billion

- Individual Retirement Premiums and Deposits: $4.7 billion

- RILA Product Sales: Over $260 million in the first quarter

- Group Retirement In-Plan Average Enrollments: Up 9%

- Group Retirement In-Plan Average Deposits: Up 10%

- Advisory and Brokerage Business AUMA Growth: 5% year over year

- GIC Reserves Growth: 48% year over year

- Adjusted Pretax Operating Income: $810 million

- Run Rate Operating EPS: $1.21

- Adjusted ROE: 12.3%

- Base Spread Income Decline: 3% year over year

- Fee Income Growth: 1% year over year

- Underwriting Margin Improvement: 12% year over year

- General Operating Expenses Increase: 5% year over year

- Individual Retirement Net Inflows: $1.1 billion

- Group Retirement Core Earnings: $167 million

- Life Insurance Adjusted Pretax Operating Income Increase: 23% year over year

- Institutional Markets Reserve Growth: 17% year over year

- Investment Portfolio: $223 billion, 97% in fixed income and short-term investments

- Investment Grade Fixed Maturities: 95%

- Cash on Hand at Holding Company: $1.4 billion

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Corebridge Financial Inc (CRBG, Financial) reported strong first-quarter results with operating earnings per share of $1.16 and a return on equity (ROE) of 11.8%.

- The company returned $454 million to shareholders, achieving a payout ratio of 70%.

- Corebridge's balance sheet remains resilient with $2.4 billion in holding company liquidity and a high-quality investment portfolio.

- The company is experiencing robust demand for its annuity products, driven by favorable market and demographic conditions.

- Corebridge continues to invest in digital capabilities and expand its product offerings, enhancing its competitive position in the market.

Negative Points

- Corebridge's annualized alternative investment returns were $0.06 short of long-term expectations, largely due to real estate equity returns.

- Base spread income declined by 3% year-over-year, impacted by Fed rate actions and dynamics in Group Retirement.

- The company anticipates elevated surrenders in individual retirement products in the latter half of the year.

- Corebridge's first-quarter general operating expenses were 5% higher year-over-year, reflecting business growth and higher compensation expenses.

- The company expects alternative investment returns to fall short of long-term expectations in 2025 due to current market uncertainty.