Capricor Therapeutics (CAPR, Financial) received a Complete Response Letter (CRL) from the U.S. Food and Drug Administration regarding its Biologics License Application (BLA) for Deramiocel, a cell therapy aimed at treating cardiomyopathy linked to Duchenne muscular dystrophy. The FDA concluded its review but stated the application does not currently fulfill the statutory requirement for substantial evidence of effectiveness, necessitating further clinical data.

The CRL also highlighted unresolved issues within the Chemistry, Manufacturing, and Controls section, despite Capricor's belief that these were addressed in prior communications. However, due to timing, the FDA did not review these materials. The agency indicated it will restart the review process upon resubmission and invited Capricor to request a Type A meeting to discuss the path forward.

Capricor intends to provide additional evidence from its ongoing Phase 3 HOPE-3 trial—a randomized, double-blind, placebo-controlled study involving 104 patients—with results expected in the third quarter of 2025. With positive outcomes, Capricor aims to resolve the FDA's concerns and advance the approval process for Deramiocel, demonstrating its commitment to the Duchenne muscular dystrophy community.

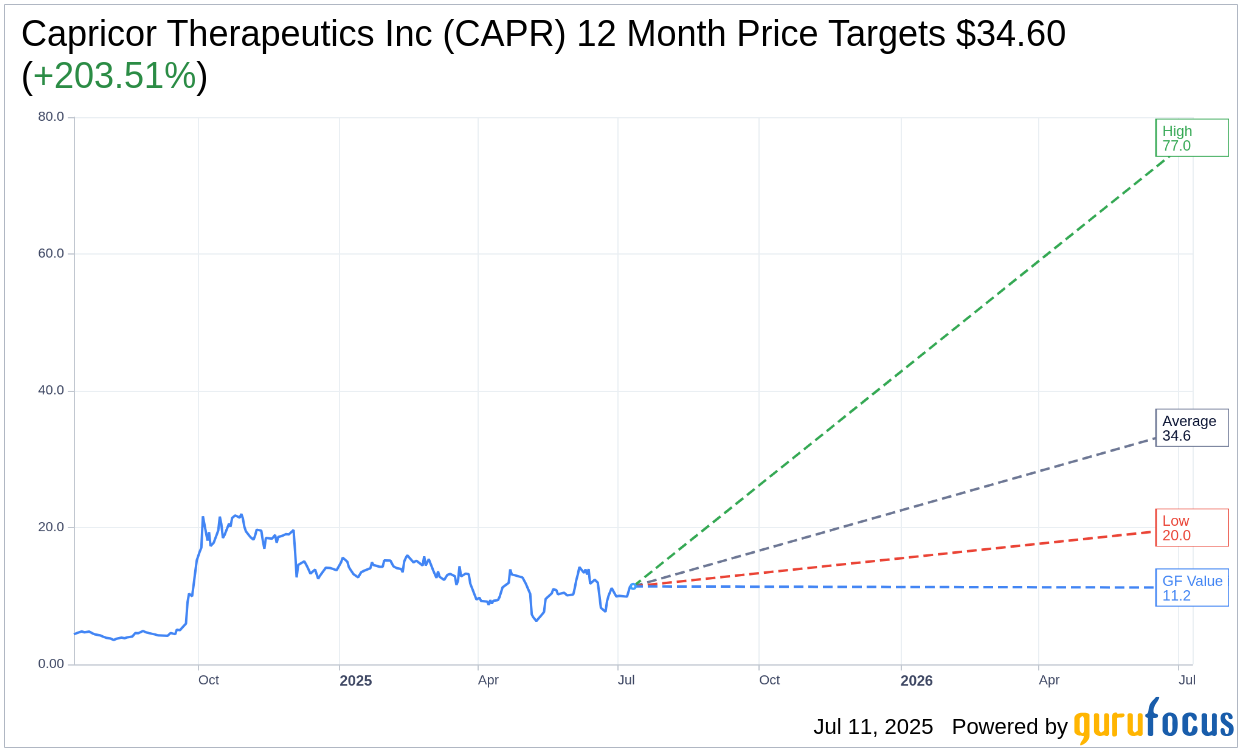

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Capricor Therapeutics Inc (CAPR, Financial) is $34.60 with a high estimate of $77.00 and a low estimate of $20.00. The average target implies an upside of 203.51% from the current price of $11.40. More detailed estimate data can be found on the Capricor Therapeutics Inc (CAPR) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Capricor Therapeutics Inc's (CAPR, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Capricor Therapeutics Inc (CAPR, Financial) in one year is $11.23, suggesting a downside of 1.49% from the current price of $11.4. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Capricor Therapeutics Inc (CAPR) Summary page.

CAPR Key Business Developments

Release Date: May 13, 2025

- Cash Position: Approximately $144.8 million as of March 31, 2025.

- Revenue: $0 for Q1 2025, compared to approximately $4.9 million for Q1 2024.

- Research and Development Expenses: Approximately $16.2 million for Q1 2025, compared to approximately $10.1 million in Q1 2024.

- General and Administrative Expenses: Approximately $3.1 million for Q1 2025, compared to approximately $1.8 million in Q1 2024.

- Net Loss: Approximately $24.4 million for Q1 2025, compared to a net loss of approximately $9.8 million for Q1 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Capricor Therapeutics Inc (CAPR, Financial) is on track with its BLA seeking full approval for its product candidate, damy cell, for treating Duchenne muscular dystrophy (DMD) cardiomyopathy.

- The company has a strong safety record for damy cell, demonstrated in over 700 infusions treating more than 250 patients.

- Capricor Therapeutics Inc (CAPR) is transitioning from a translational medicine company to a commercial stage entity, actively working with its commercial partner NS Pharma on launch readiness in the United States.

- The company has a robust cash position with approximately $145 million, providing a financial runway into 2027 without additional cash infusions.

- Capricor Therapeutics Inc (CAPR) is actively expanding its manufacturing capabilities, with plans to operationalize additional clean rooms by mid to late 2026 to meet potential demand.

Negative Points

- Revenues for the first quarter of 2025 were zero, compared to approximately $4.9 million in the first quarter of 2024.

- Operating expenses have increased, with research and development expenses rising to approximately $16.2 million in Q1 2025 from $10.1 million in Q1 2024.

- The net loss for the first quarter of 2025 was approximately $24.4 million, compared to a net loss of $9.8 million in the first quarter of 2024.

- There is uncertainty regarding the outcome of the FDA advisory committee meeting, which could impact the approval process for damy cell.

- Negotiations for European distribution with Nippon Shinyaku have been extended, indicating potential delays or challenges in finalizing agreements for the European market.