Thermo Fisher Scientific (TMO, Financial) has been upgraded by Scotiabank from a 'Sector Perform' rating to an 'Outperform' status. The bank adjusted its price target for the stock to $590, a slight decrease from the previous target of $605. This decision reflects the belief that the most challenging scenarios for companies in the life science tools sector have already been largely included in current valuations. Scotiabank indicates that the underlying sector fundamentals remain strong, with anticipated growth acceleration into 2026 and beyond. Based on these factors, the bank foresees additional growth potential for Thermo Fisher and has therefore boosted its rating.

Wall Street Analysts Forecast

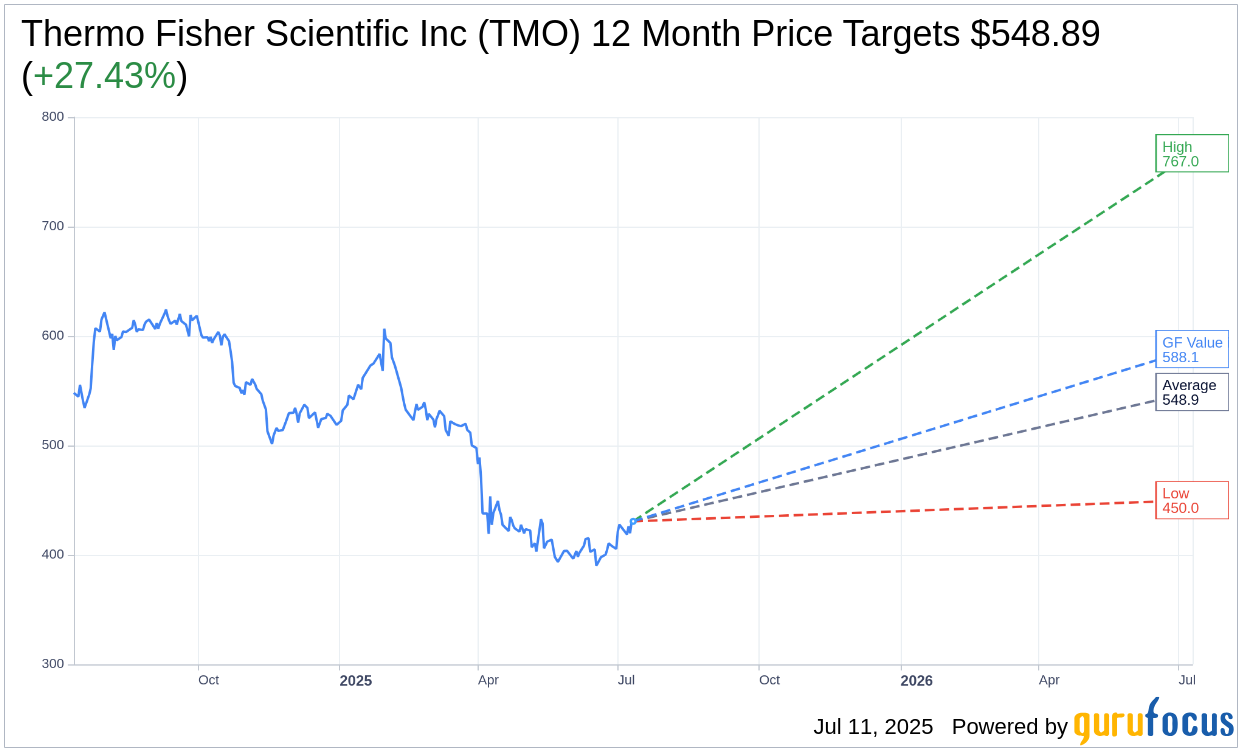

Based on the one-year price targets offered by 27 analysts, the average target price for Thermo Fisher Scientific Inc (TMO, Financial) is $548.89 with a high estimate of $767.00 and a low estimate of $450.00. The average target implies an upside of 27.43% from the current price of $430.73. More detailed estimate data can be found on the Thermo Fisher Scientific Inc (TMO) Forecast page.

Based on the consensus recommendation from 31 brokerage firms, Thermo Fisher Scientific Inc's (TMO, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Thermo Fisher Scientific Inc (TMO, Financial) in one year is $588.09, suggesting a upside of 36.53% from the current price of $430.73. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Thermo Fisher Scientific Inc (TMO) Summary page.

TMO Key Business Developments

Release Date: April 23, 2025

- Revenue: $10.36 billion for Q1.

- Adjusted Operating Income: $2.27 billion for Q1.

- Adjusted Operating Margin: 21.9% for Q1.

- Adjusted EPS: $5.15 per share, a 1% increase for Q1.

- GAAP EPS: $3.98, up 15% from Q1 last year.

- Organic Revenue Growth: 1% for Q1.

- Free Cash Flow: $370 million for Q1.

- Cash Flow from Operations: $720 million for Q1.

- Share Repurchases: $2 billion in Q1.

- Dividend Increase: 10% in Q1.

- 2025 Revenue Guidance: $43.3 billion to $44.2 billion.

- 2025 Adjusted EPS Guidance: $21.76 to $22.84.

- R&D Expense: $342 million in Q1, 7.5% of manufacturing revenue.

- Net Interest Expense: Approximately $100 million for Q1.

- Adjusted Tax Rate: 10% for Q1.

- Average Diluted Shares: 379 million for Q1.

- Leverage Ratio: 3.2x gross debt to adjusted EBITDA at end of Q1.

- Adjusted ROIC: 11.4% for Q1.

- Life Science Solutions Revenue Growth: 2% organic growth in Q1.

- Analytical Instruments Revenue Growth: 3% organic growth in Q1.

- Specialty Diagnostics Revenue Growth: 4% organic growth in Q1.

- Laboratory Products and Biopharma Services Revenue: Decreased 1% organic in Q1.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Thermo Fisher Scientific Inc (TMO, Financial) delivered strong financial performance in Q1 2025, with revenue of $10.36 billion and adjusted EPS growth of 1% to $5.15 per share.

- The company demonstrated excellent execution across all dimensions, translating revenue performance into earnings that exceeded expectations.

- Thermo Fisher Scientific Inc (TMO) launched several innovative products, including the Thermo Scientific Vulcan Automated Lab and the next-generation Thermo Scientific Transcend, enhancing their market leadership.

- The company continued to strengthen its commercial engine and deepen its trusted partner status with customers, which is expected to accelerate innovation and productivity.

- Thermo Fisher Scientific Inc (TMO) successfully executed its capital deployment strategy, including a $4.1 billion acquisition agreement for Solventum's Purification & Filtration business and $2 billion in share repurchases.

Negative Points

- Revenue in the Academic and Government segment declined due to macroeconomic conditions in the US and China.

- The company faced a 3% headwind from the combined impact of two fewer selling days and the runoff of pandemic-related revenue.

- Thermo Fisher Scientific Inc (TMO) updated its 2025 guidance to reflect macroeconomic uncertainties, including tariffs and US policy changes, which are expected to impact revenue and adjusted EPS.

- The company anticipates a $400 million revenue headwind due to US-China tariffs, affecting sales of US-made products in China.

- The updated guidance reflects a $500 million reduction in revenue expectations due to policy changes impacting US Academic and Government customers and clinical trials related to vaccines.