Truist has increased its price target for Old National Bancorp (ONB, Financial) from $26 to $27 while maintaining a Buy rating on the company's stock. This adjustment comes as part of a detailed analysis related to the upcoming second-quarter results for regional banks. The analyst highlights positive trends in loan growth and notes the emergence of smaller mergers and acquisitions. Additionally, there is an optimistic economic outlook that has influenced the firm's updated models for the sector. Overall, these developments are expected to enhance ONB's performance in the future.

Wall Street Analysts Forecast

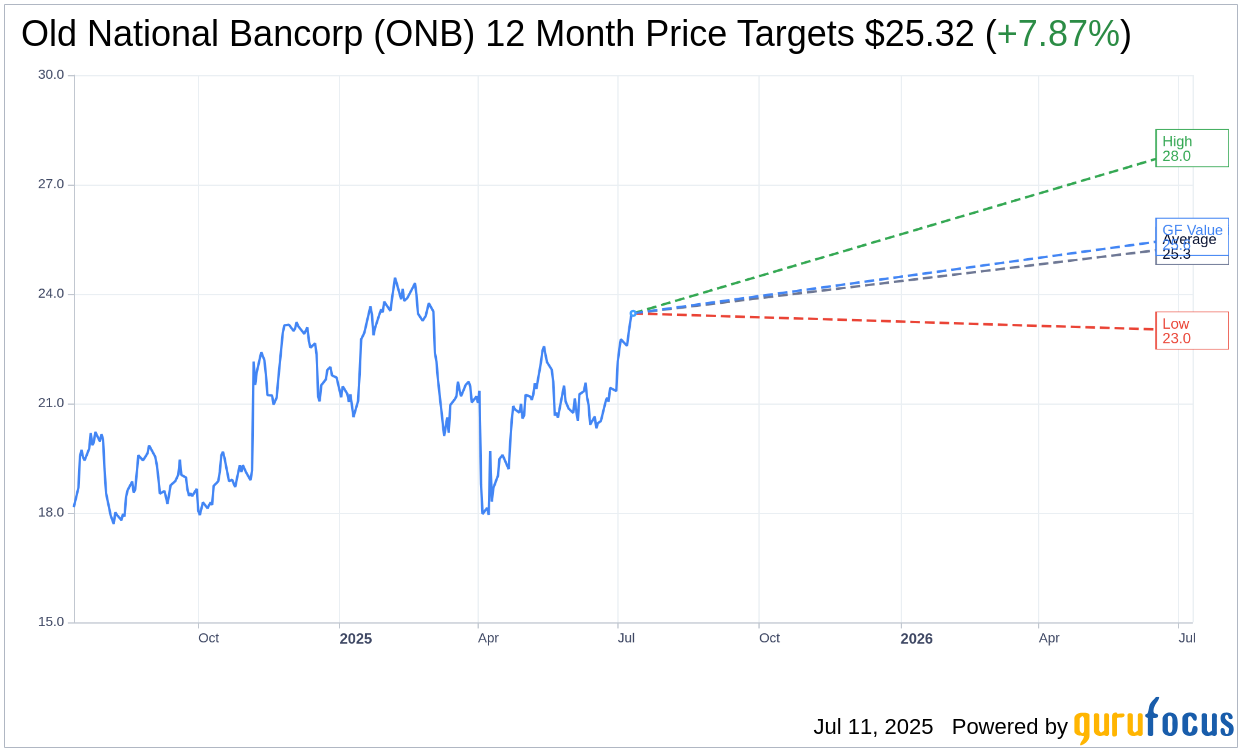

Based on the one-year price targets offered by 11 analysts, the average target price for Old National Bancorp (ONB, Financial) is $25.32 with a high estimate of $28.00 and a low estimate of $23.00. The average target implies an upside of 7.87% from the current price of $23.47. More detailed estimate data can be found on the Old National Bancorp (ONB) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Old National Bancorp's (ONB, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Old National Bancorp (ONB, Financial) in one year is $25.57, suggesting a upside of 8.95% from the current price of $23.47. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Old National Bancorp (ONB) Summary page.

ONB Key Business Developments

Release Date: April 22, 2025

- GAAP Earnings Per Share: $0.44 for Q1 2025.

- Adjusted Earnings Per Share: $0.45, excluding $0.01 per share of merger-related charges.

- Net Interest Income: In line with expectations, with net interest margin down modestly.

- Tangible Book Value Per Share: Increased by 5% from last quarter and 13% year over year.

- CET1 Ratio: 11.62%, up 86 basis points from a year ago.

- Total Loan Growth: 1.5% annualized from last quarter, or 2.3% excluding $70 million of CRE loan sales.

- Total Deposit Growth: 2.1% annualized, with core deposits up nearly 1.7% annualized.

- Noninterest Income: $94 million for the quarter, above guidance.

- Adjusted Noninterest Expenses: $263 million, moderately better than guidance.

- Net Charge-Offs: 24 basis points, or 21 basis points excluding PCD loans.

- Allowance for Credit Losses: 116 basis points, up 2 basis points from the prior quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Old National Bancorp (ONB, Financial) reported better-than-expected first-quarter earnings, demonstrating strong performance in a challenging economic environment.

- The company experienced solid loan growth and a strong deposit franchise, which drove positive results.

- Net interest income and margin performance met expectations, with noninterest income benefiting from gains on loan sales and higher fees from mortgages and service charges.

- The tangible book value increased significantly compared to both the previous quarter and year over year.

- The partnership with Bremer Bank is expected to enhance ONB's footprint, providing greater scale and density in the Upper Midwest, and is anticipated to close earlier than expected, on May 1.

Negative Points

- The macroeconomic environment remains uncertain, which could impact future growth and rate outcomes.

- There is a potential for increased competition in the commercial real estate market, which may affect loan growth.

- The company's guidance assumes three rate cuts, which may not align with actual future Federal Reserve actions.

- Noninterest income has been volatile, with recent quarters showing fluctuations due to discrete items and loan sales.

- The economic uncertainty has led to a cautious approach from clients, potentially impacting future business activities and growth.