Expeditors International (EXPD, Financial), a leading logistics and freight forwarding company, has recently been in the spotlight following a recent analyst report. B of A Securities, represented by analyst Ken Hoexter, downgraded the stock's rating from 'Neutral' to 'Underperform'. The decision reflects cautious sentiment despite an increase in the price target.

Notably, B of A Securities adjusted the price target for Expeditors International (EXPD, Financial) to USD 118.00, a slight increase from the previous target of USD 117.00. This adjustment marks a 0.85% rise in the price target. The raised target indicates some expectation for growth, although it accompanies a less favorable rating.

Investors and stakeholders in Expeditors International (EXPD, Financial) will be closely watching the developments following this downgrade, particularly in light of the higher price target which suggests potential value recognition. The downgrade on July 11, 2025, emphasizes a shift in analyst sentiment despite the marginal uplift in anticipated stock value.

Wall Street Analysts Forecast

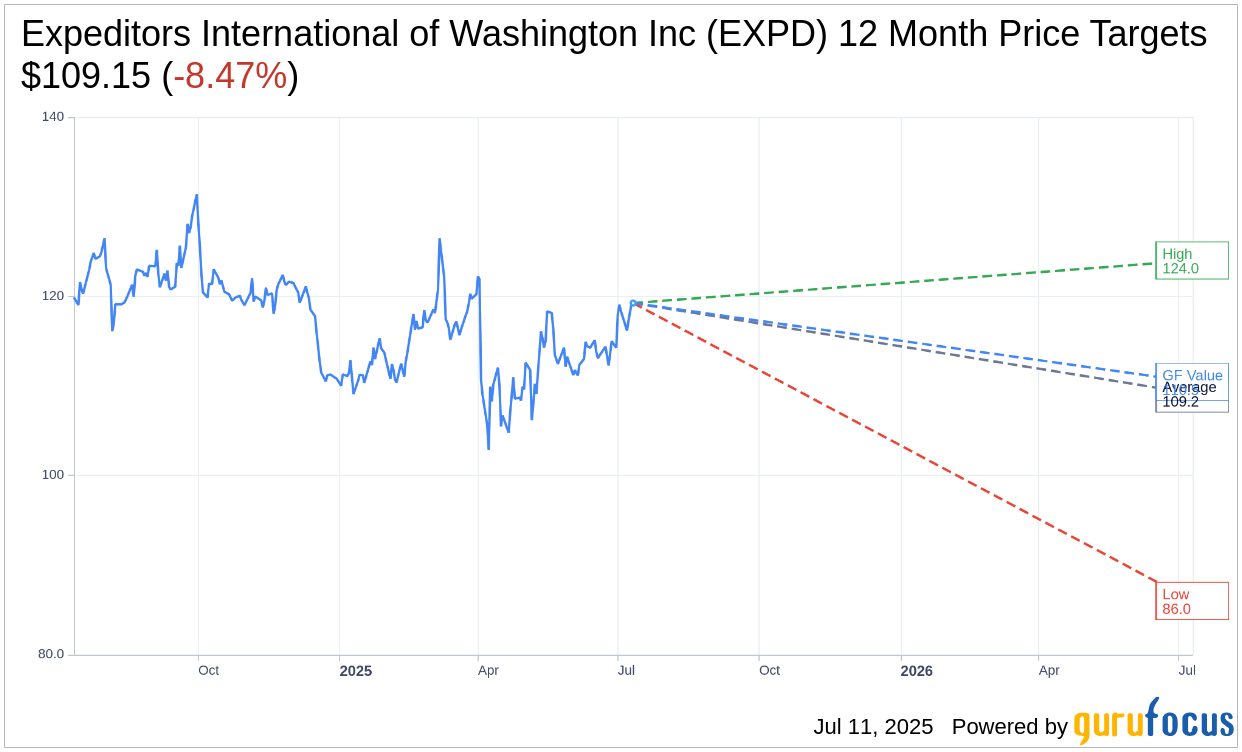

Based on the one-year price targets offered by 13 analysts, the average target price for Expeditors International of Washington Inc (EXPD, Financial) is $109.15 with a high estimate of $124.00 and a low estimate of $86.00. The average target implies an downside of 8.47% from the current price of $119.25. More detailed estimate data can be found on the Expeditors International of Washington Inc (EXPD) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, Expeditors International of Washington Inc's (EXPD, Financial) average brokerage recommendation is currently 3.5, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Expeditors International of Washington Inc (EXPD, Financial) in one year is $110.46, suggesting a downside of 7.37% from the current price of $119.25. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Expeditors International of Washington Inc (EXPD) Summary page.