Morgan Stanley has revised its price target for Caesars (CZR, Financial), increasing it to $32 from $31, while maintaining an Equal Weight rating. This adjustment follows Boyd's definitive agreement to divest its 5% interest in FanDuel for $1.75 billion, before taxes. Analysts suggest that the valuation set on the FanDuel deal could temporarily enhance the value of U.S. gaming assets, as it might lead the market to expect similar transactions or apply comparable valuations to related assets.

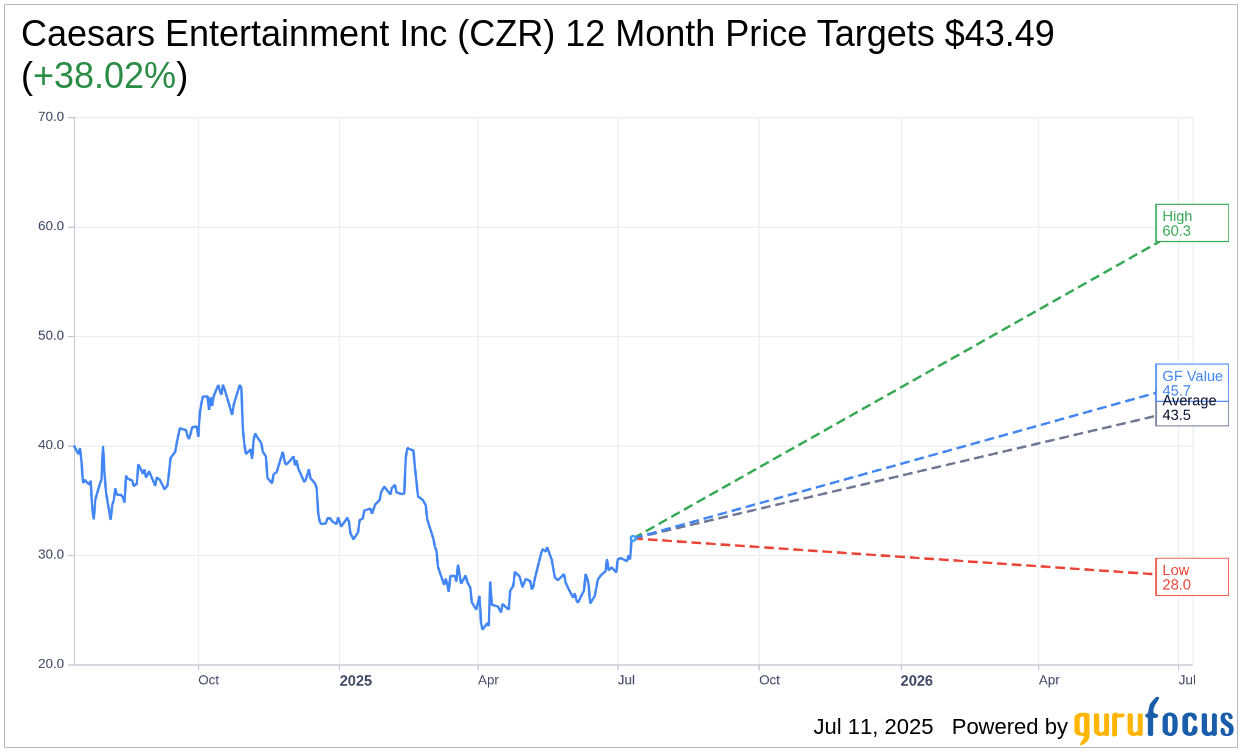

Wall Street Analysts Forecast

Based on the one-year price targets offered by 17 analysts, the average target price for Caesars Entertainment Inc (CZR, Financial) is $43.49 with a high estimate of $60.34 and a low estimate of $28.00. The average target implies an upside of 38.02% from the current price of $31.51. More detailed estimate data can be found on the Caesars Entertainment Inc (CZR) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, Caesars Entertainment Inc's (CZR, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Caesars Entertainment Inc (CZR, Financial) in one year is $45.74, suggesting a upside of 45.16% from the current price of $31.51. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Caesars Entertainment Inc (CZR) Summary page.

CZR Key Business Developments

Release Date: April 29, 2025

- Consolidated Net Revenues: $2.8 billion, increased 2% year over year.

- Total Adjusted EBITDA: $884 million, increased 4% year over year.

- Las Vegas Same-Store Adjusted EBITDAR: $433 million, essentially flat year over year.

- Las Vegas EBITDA Margins: 43.2%, up 50 basis points year over year.

- Regional Segment Adjusted EBITDAR: $440 million, up 2% year over year.

- Caesars Digital Net Revenue: $335 million, up 19% year over year.

- Caesars Digital Adjusted EBITDA: $43 million, up $38 million year over year.

- Sports Betting Net Revenue Growth: 9% year over year.

- iCasino Net Revenue Growth: 53% year over year.

- Full Year CapEx Expectation: Approximately $600 million, excluding Virginia joint venture.

- Interest Expense Expectation: Approximately $775 million for 2025.

- Stock Repurchase: $100 million at an average price of $23.84 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Caesars Entertainment Inc (CZR, Financial) reported a 2% increase in consolidated net revenues to $2.8 billion and a 4% increase in total adjusted EBITDA to $884 million year over year.

- The Las Vegas segment achieved the third-best Q1 performance on record, with same-store adjusted EBITDAR of $433 million and improved EBITDA margins by 50 basis points.

- Caesars Digital segment saw a 19% increase in net revenue to $335 million and a significant rise in adjusted EBITDA by $38 million year over year.

- The Regional segment experienced a 2% increase in adjusted EBITDAR, driven by stable same-store trends and contributions from New Orleans and Danville.

- Caesars Entertainment Inc (CZR) successfully implemented cost controls in labor, marketing, and reinvestment levels, leading to a flow-through rate exceeding their annual 50% target.

Negative Points

- Las Vegas occupancy and cash ADR were slightly down, and the segment faced tough comparisons due to the Super Bowl and weather disruptions.

- The Regional segment was negatively affected by weather disruptions and the loss of an extra operating day compared to the previous year.

- Caesars Digital faced challenges with poor hold during March Madness, impacting revenue growth.

- The company anticipates a decline in skin revenues and World Series of Poker revenues, which could impact future quarters.

- Caesars Entertainment Inc (CZR) is cautious about potential economic impacts from policy changes in the US, which could affect future performance.