Roth Capital has revised its price target for Byrna Technologies (BYRN, Financial), reducing it from $37 to $33 while maintaining a Buy rating for the shares. According to the firm, Byrna posted strong results in the second quarter, with sales aligning with previous forecasts and a robust operational performance leading adjusted EBITDA to exceed expectations. Despite this positive outcome, Roth Capital cites a slightly reduced profit outlook and additional growth risks as factors for the adjusted price target.

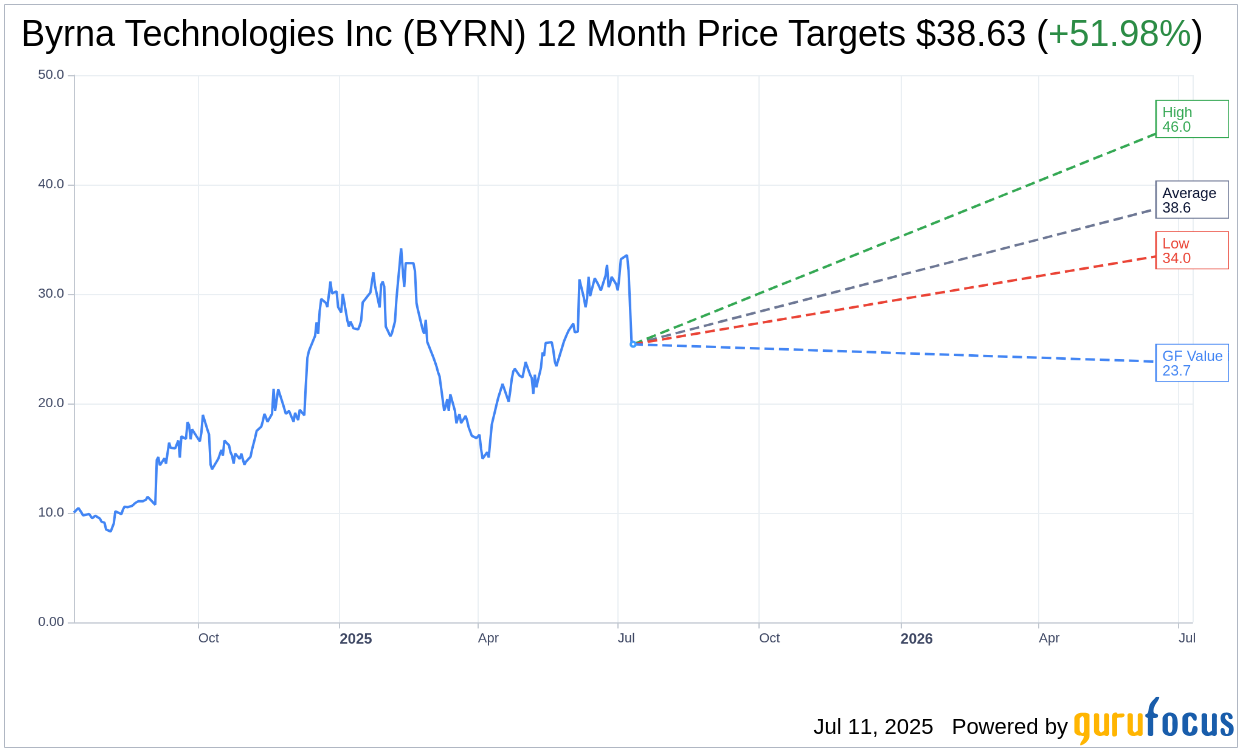

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Byrna Technologies Inc (BYRN, Financial) is $38.63 with a high estimate of $46.00 and a low estimate of $34.00. The average target implies an upside of 51.98% from the current price of $25.42. More detailed estimate data can be found on the Byrna Technologies Inc (BYRN) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Byrna Technologies Inc's (BYRN, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Byrna Technologies Inc (BYRN, Financial) in one year is $23.72, suggesting a downside of 6.67% from the current price of $25.415. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Byrna Technologies Inc (BYRN) Summary page.

BYRN Key Business Developments

Release Date: July 10, 2025

- Net Revenue: $28.5 million for Q2 2025, a 41% increase from $20.3 million in Q2 2024.

- Gross Profit: $17.6 million, maintaining a 62% gross margin.

- Operating Expenses: $14.2 million, up from $10.6 million in Q2 2024.

- Net Income: $2.4 million, compared to $2.1 million in Q2 2024.

- Adjusted EBITDA: $4.3 million, up from $2.8 million in Q2 2024.

- Cash and Equivalents: $13 million as of May 31, 2025, down from $25.7 million at November 30, 2024.

- Inventory: $32.3 million, compared to $20 million at November 30, 2024.

- Dealer Sales Increase: $3.9 million, a 106% increase, largely due to Sportsman's Warehouse.

- International Sales: $2.6 million, an 86% increase from the prior year period.

- Store Locations: 59 Sportsman's Warehouse locations stocking Byrna products, with plans to expand to 140 by year-end.

- Company-Owned Store Sales: Averaged $69,000 in sales per store in May, annualizing to approximately $800,000 per store.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Byrna Technologies Inc (BYRN, Financial) reported a 41% year-over-year revenue growth, reaching $28.5 million for Q2 2025.

- The launch of the Compact Launcher significantly contributed to the revenue increase and is expected to boost future sales, especially with its recent availability on Amazon.

- Dealer sales increased by 106%, largely driven by initial stocking orders from Sportsman's Warehouse.

- International sales grew by 86% compared to the prior year, indicating strong global demand.

- The company-owned retail stores are performing exceptionally well, with some already profitable and exceeding sales expectations.

Negative Points

- Operating expenses increased to $14.2 million from $10.6 million in the previous year, driven by higher selling expenses and marketing costs.

- Cash, cash equivalents, and marketable securities decreased significantly from $25.7 million to $13 million due to increased inventory levels.

- There is a noted softness in consumer sentiment, leading to higher abandoned cart rates and potential sticker shock among customers.

- The company faces economic headwinds due to falling consumer confidence and uncertainty over interest rates and tariffs.

- Despite the growth, there is some cannibalization of the LE Launcher by the Compact Launcher, although the latter has better margins.