Perpetua Resources (PPTA, Financial) is witnessing significant bearish sentiment with an unusual volume of put options, totaling 4,276 contracts, trading at eight times the expected level. The most notable activities are concentrated in the July 2025 $12.50 puts and September 2025 $20 calls, with a combined trading volume approaching 4,600 contracts. The Put/Call Ratio stands at 2.35, indicating a preference for bearish positions. Additionally, the at-the-money implied volatility has increased by more than one point throughout the day. Investors are gearing up for the company's anticipated earnings report on August 14th.

Wall Street Analysts Forecast

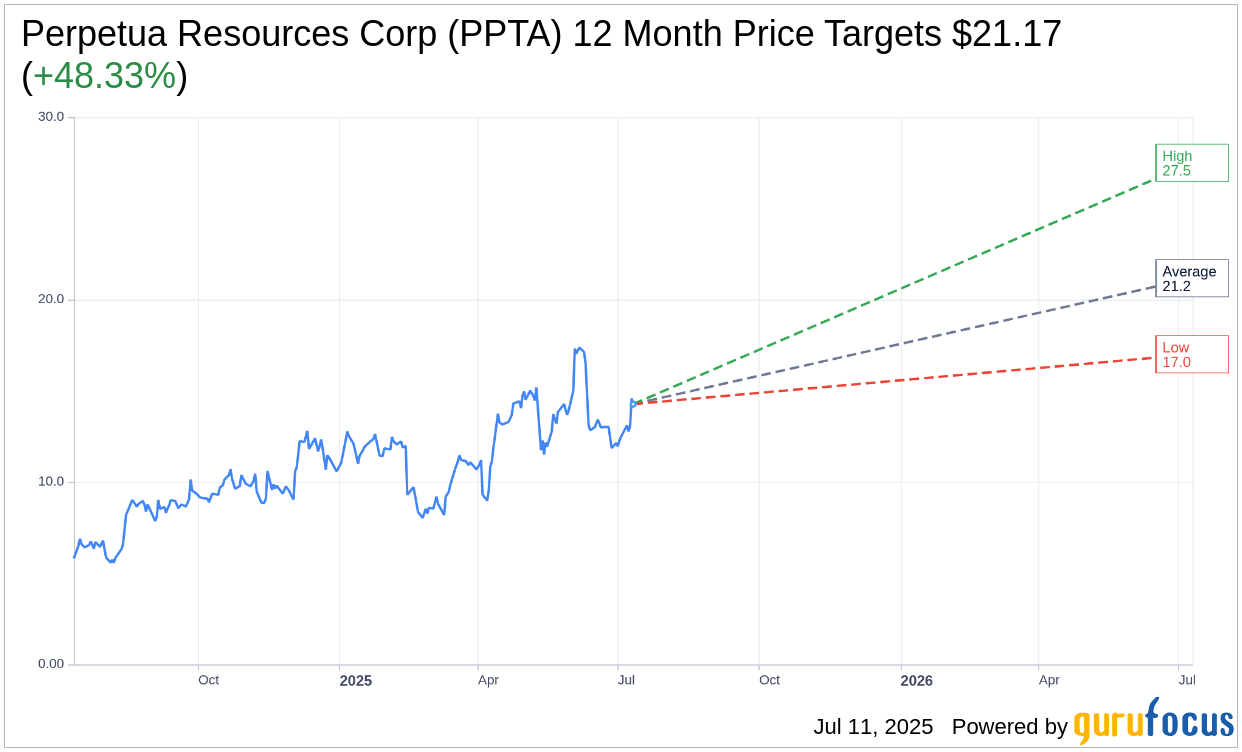

Based on the one-year price targets offered by 3 analysts, the average target price for Perpetua Resources Corp (PPTA, Financial) is $21.17 with a high estimate of $27.50 and a low estimate of $17.00. The average target implies an upside of 48.33% from the current price of $14.27. More detailed estimate data can be found on the Perpetua Resources Corp (PPTA) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Perpetua Resources Corp's (PPTA, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.