Lazydays Holdings (GORV, Financial) has executed a 1-for-30 reverse stock split for its common shares, which took effect on July 11 at 5:00 p.m. ET. Following this adjustment, the company’s stock is set to commence trading on a split-adjusted basis starting July 14 under the symbol “GORV” on Nasdaq, and it will be associated with a new CUSIP number. This move is primarily aimed at increasing the per share market price to meet Nasdaq’s minimum bid price requirements.

Wall Street Analysts Forecast

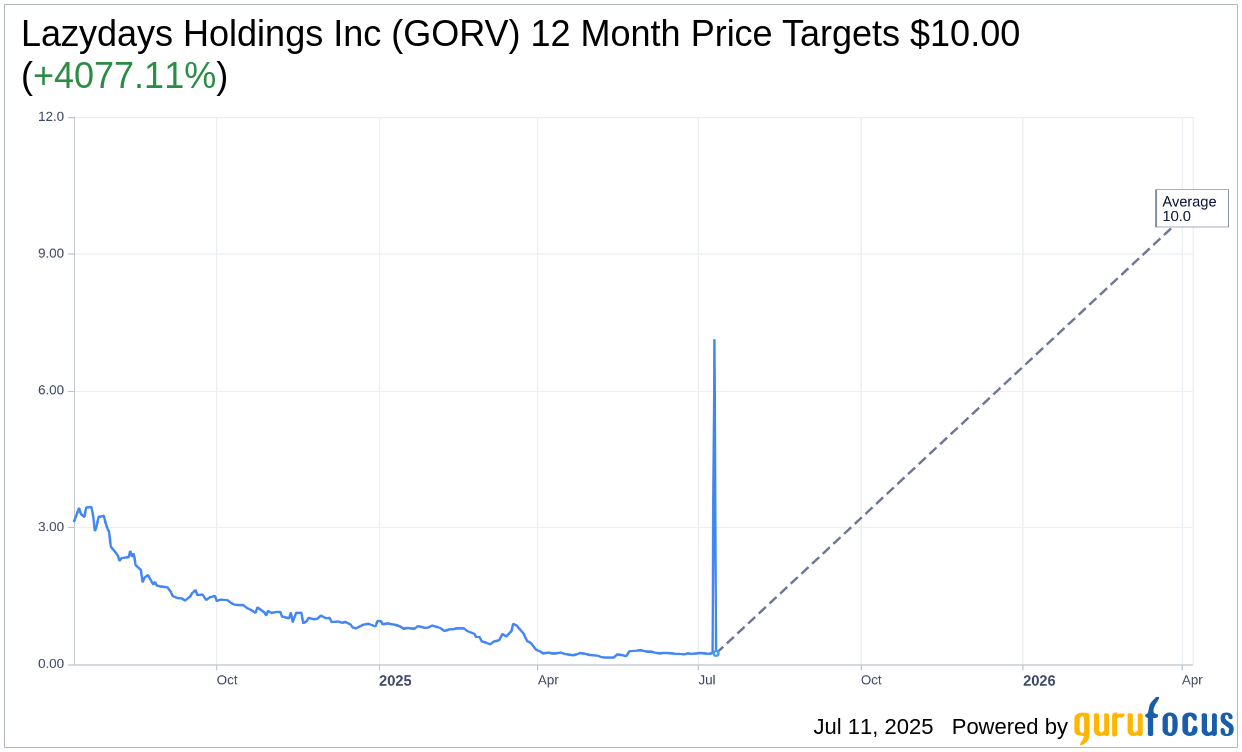

Based on the one-year price targets offered by 1 analysts, the average target price for Lazydays Holdings Inc (GORV, Financial) is $10.00 with a high estimate of $10.00 and a low estimate of $10.00. The average target implies an upside of 4,077.11% from the current price of $0.24. More detailed estimate data can be found on the Lazydays Holdings Inc (GORV) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Lazydays Holdings Inc's (GORV, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Lazydays Holdings Inc (GORV, Financial) in one year is $0.76, suggesting a upside of 217.46% from the current price of $0.2394. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Lazydays Holdings Inc (GORV) Summary page.

GORV Key Business Developments

Release Date: May 15, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Lazydays Holdings Inc (GORV, Financial) successfully reduced its debt by approximately $145 million through the sale of five dealerships to Camping World.

- The company reported a $10 million year-over-year reduction in SGNA expenses due to reduced overhead personnel and marketing costs.

- Gross profit margins increased across all product lines, leading to a notable rise in gross profit despite lower sales volume.

- New and used unit sales increased by 18% and 19% respectively in the first quarter compared to the fourth quarter of 2024.

- The company achieved a gross margin of 24% for the quarter, representing a 10% increase compared to the prior year.

Negative Points

- Unit sales were down 36% or 912 units in the quarter, driven by previously announced divestitures.

- Net sales for the quarter decreased by 39% compared to the prior year period, reflecting a deliberate reduction of inventory and lower store count.

- Pre-owned retail unit sales were down 48% or 655 units during the quarter.

- The company reported a loss from operations of $2.3 million for the quarter, including non-cash impairment charges of $2.9 million.

- Finance and insurance revenue per unit decreased slightly from the fourth quarter, despite strong finance penetration.