Summary:

- Super Micro Computer (SMCI, Financial) presents a promising investment opportunity in the data center sector.

- Analysts predict a potential upside of 41.21% based on GuruFocus' GF Value estimate.

- The stock is valued attractively at 1.3 times sales, indicating room for growth.

Super Micro Computer (SMCI) stands out as an attractive option for investors eyeing the dynamic data center industry. The company is trading at a favorable valuation, priced at 1.3 times sales and nearly 22 times earnings. Although Super Micro has rebounded from past accounting issues, the stock still hasn't reached its previous heights, hinting at significant growth prospects ahead.

Wall Street Analysts Forecast

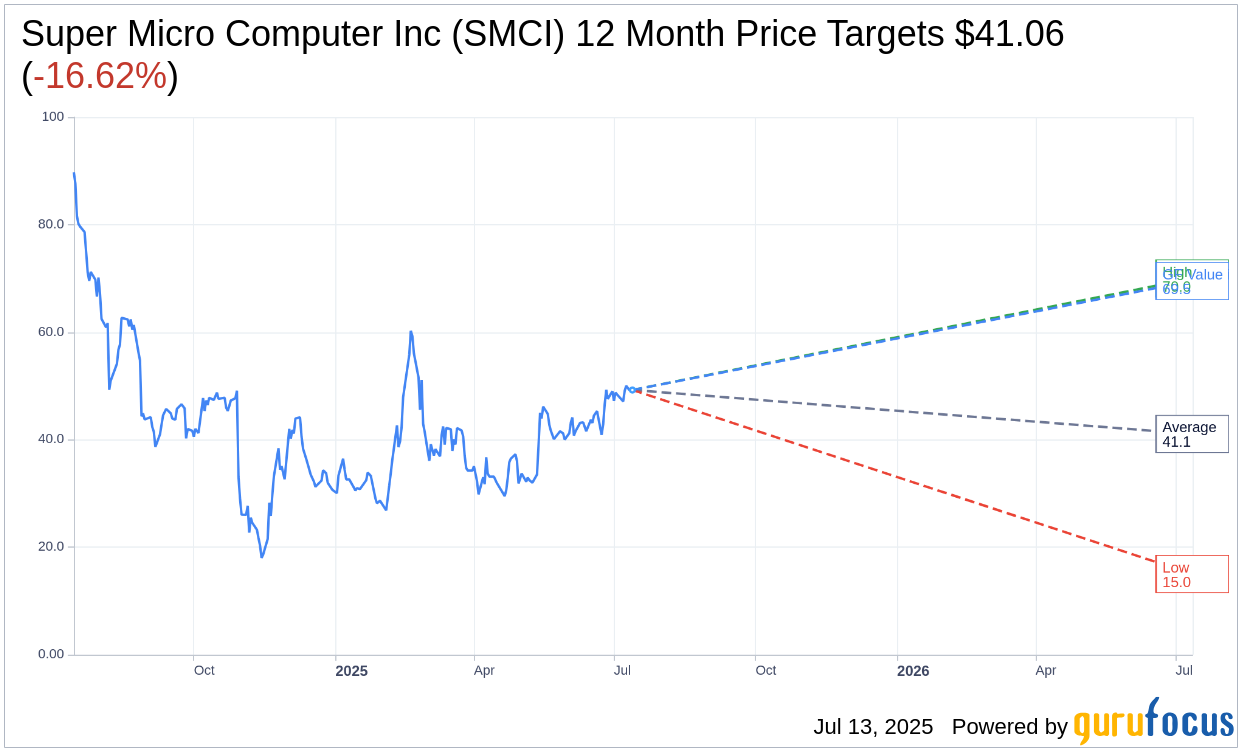

According to insights from 16 analysts, the average one-year price target for Super Micro Computer Inc (SMCI, Financial) is $41.06, with projections spanning a high of $70.00 and a low of $15.00. This average suggests a potential downside of 16.62% from the current stock price of $49.24. For more comprehensive estimate data, visit the Super Micro Computer Inc (SMCI) Forecast page.

Consensus from 18 brokerage firms rates Super Micro Computer Inc (SMCI, Financial) at an average of 2.8, indicating a "Hold" status. The recommendation scale ranges from 1 to 5, where 1 is a Strong Buy, and 5 indicates a Sell.

In terms of GuruFocus estimates, the anticipated GF Value for SMCI in one year is projected at $69.53. This suggests a potential upside of 41.21% from its current price point of $49.24. The GF Value represents GuruFocus' assessment of the stock's fair trading value, calculated through historical multiples, past business growth, and future performance estimates. Explore more detailed information on the Super Micro Computer Inc (SMCI, Financial) Summary page.