Crinetics Pharmaceuticals (CRNX, Financial) has announced that it will present new findings from its clinical development program for PALSONIFY, an investigational oral treatment for acromegaly, at the Endocrine Society’s Annual Meeting, ENDO 2025. Notably, key updates include open-label extension data from the pivotal PATHFNDR-1 and PATHFNDR-2 trials. These presentations will highlight the sustained clinical efficacy and safety of PALSONIFY over long-term use, demonstrating stable maintenance of IGF-1 levels in patients.

Furthermore, additional data underscore the reduction of symptom burden among patients, indicating decreased symptom severity and fewer symptom flare-ups. These insights aim to showcase the potential of PALSONIFY as a viable long-term treatment option for those managing acromegaly.

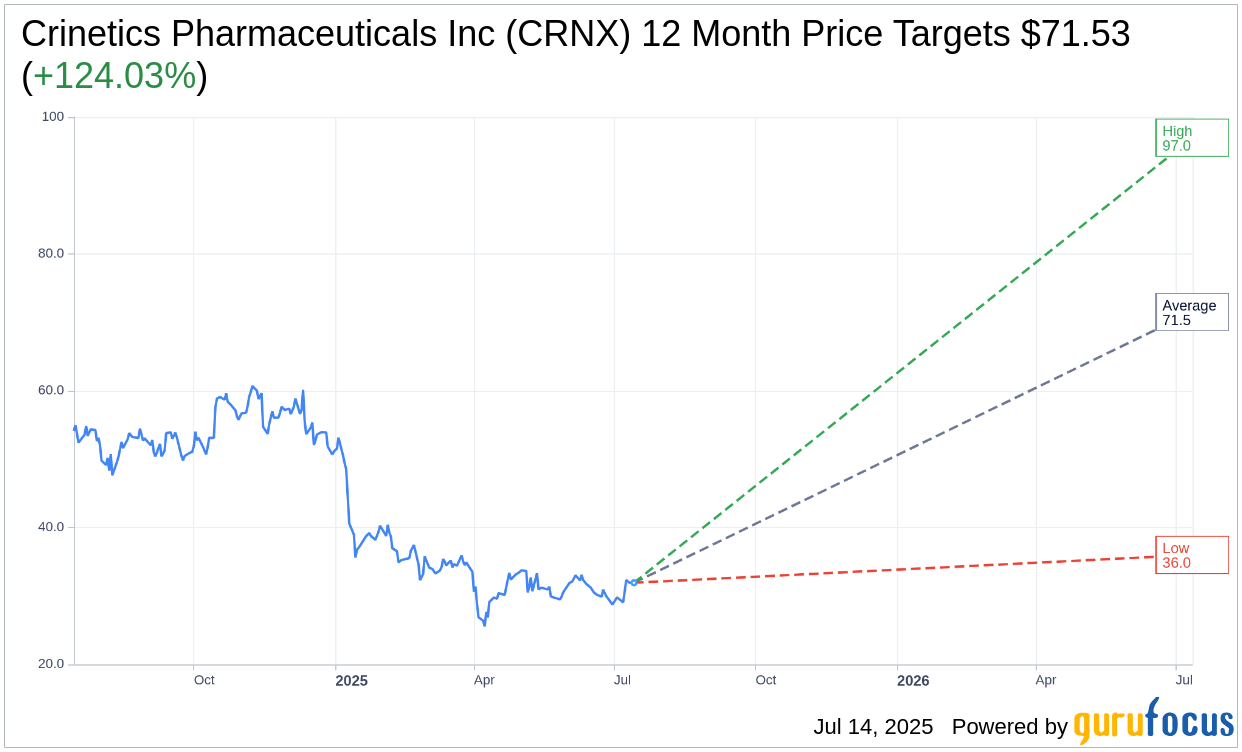

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for Crinetics Pharmaceuticals Inc (CRNX, Financial) is $71.53 with a high estimate of $97.00 and a low estimate of $36.00. The average target implies an upside of 124.03% from the current price of $31.93. More detailed estimate data can be found on the Crinetics Pharmaceuticals Inc (CRNX) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, Crinetics Pharmaceuticals Inc's (CRNX, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Crinetics Pharmaceuticals Inc (CRNX, Financial) in one year is $103.17, suggesting a upside of 223.11% from the current price of $31.93. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Crinetics Pharmaceuticals Inc (CRNX) Summary page.

CRNX Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Crinetics Pharmaceuticals Inc (CRNX, Financial) is strategically positioned for long-term sustainable growth with a focus on the anticipated commercial launch of their first products this year.

- The company has a robust pipeline, including two late-stage candidates and three additional candidates in pre-clinical studies.

- Crinetics Pharmaceuticals Inc (CRNX) has a strong financial position with $1.3 billion on the balance sheet, allowing continued investment in their pipeline and support for prospective launches.

- The anticipated launch of Paltustine for acromegaly is a pivotal milestone, with positive feedback from healthcare professionals and strong patient advocacy partnerships.

- Regulatory engagement with the FDA and European Medicines Agency is proceeding on track, with no disruptions anticipated for the Paltustine NDA review.

Negative Points

- Research and development expenses increased by 43% compared to the same period in 2024, primarily due to additional personnel and increased manufacturing costs.

- Selling, general, and administrative expenses rose by 71% compared to the same period in 2024, driven by growth to support ongoing programs and the planned commercial launch.

- Cash used in operations increased significantly, with expectations for cash use in operations to be between $340 and $380 million for 2025.

- The company anticipates a measured uptake of Paltustine during early launch, with coverage expected to build progressively over the first 6 to 9 months.

- There is a significant unmet need for safe, highly efficacious, easy-to-administer treatments, indicating challenges in meeting current market demands.