Jefferies has commenced its coverage on BridgeBio (BBIO, Financial), assigning a Buy rating and setting a price target of $70. The research firm is optimistic about the potential of Attruby, which could achieve blockbuster status with projected sales of $4 billion in treating transthyretin amyloid cardiomyopathy. Analysts highlight that there is potential for growth if Attruby demonstrates superior real-world results compared to Pfizer’s tafamidis. Jefferies considers the current valuation of BridgeBio shares to offer a compelling risk/reward opportunity.

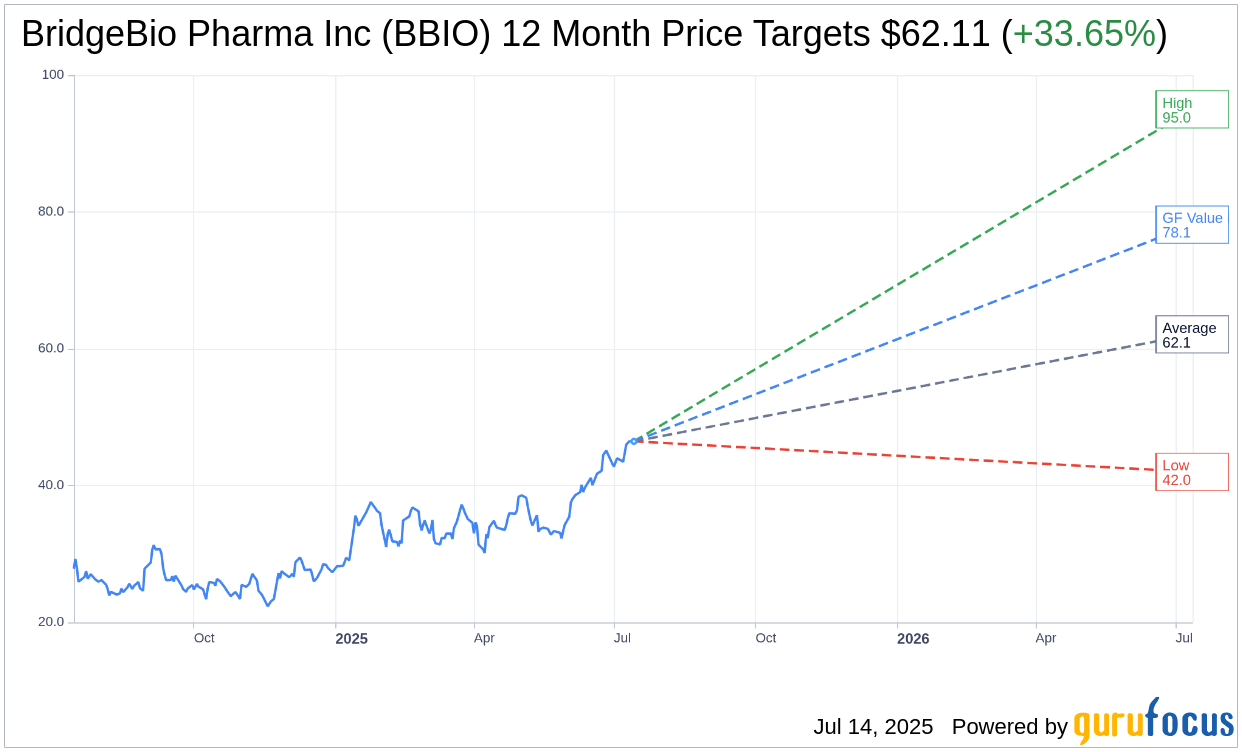

Wall Street Analysts Forecast

Based on the one-year price targets offered by 19 analysts, the average target price for BridgeBio Pharma Inc (BBIO, Financial) is $62.11 with a high estimate of $95.00 and a low estimate of $42.00. The average target implies an upside of 33.65% from the current price of $46.47. More detailed estimate data can be found on the BridgeBio Pharma Inc (BBIO) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, BridgeBio Pharma Inc's (BBIO, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for BridgeBio Pharma Inc (BBIO, Financial) in one year is $78.14, suggesting a upside of 68.15% from the current price of $46.47. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the BridgeBio Pharma Inc (BBIO) Summary page.

BBIO Key Business Developments

Release Date: April 29, 2025

- Total Revenue: $116.6 million for Q1 2025.

- Attruby Net Product Revenue: $36.7 million.

- License and Services Revenue: $79.9 million, primarily from BEYONTTRA's EU approval.

- Total Operating Expenses: $218.4 million, up from $210.2 million in the same period last year.

- Stock-Based Compensation Expense: $29.4 million, compared to $28.9 million in Q1 2024.

- R&D Expense: $111.4 million, down from $141 million in the same period last year.

- SG&A Expense: $106.4 million, up from $65.8 million in the same period last year.

- Restructuring Expense: $0.6 million, compared to $3.4 million in the same period last year.

- Cash and Cash Equivalents: $540.6 million at the end of the quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- BridgeBio Pharma Inc (BBIO, Financial) reported strong revenue of $36.7 million from the launch of Attruby, indicating positive market reception.

- Attruby demonstrated a 42% relative risk reduction in cardiovascular hospitalization and mortality at 30 months, with a 50% reduction in cardiovascular hospitalization.

- The company has a robust pipeline with three Phase III readouts expected in the next year, including efforts in chronic hypoparathyroidism.

- BridgeBio Pharma Inc (BBIO) has a strong financial position with $540.6 million in cash and cash equivalents, excluding anticipated regulatory milestone payments.

- The company is expanding its market presence with the rapid enrollment of trials and positive progress in key additional markets, such as hypochondroplasia.

Negative Points

- Operating expenses increased to $218.4 million in Q1 2025, reflecting continued investment in the Attruby brand and late-stage pipeline.

- SG&A expenses rose significantly to $106.4 million, driven by the commercial rollout of Attruby.

- The company faces competition in the ATTR-CM market, with new entrants potentially impacting market share.

- There is uncertainty regarding the long-term sustainability of current growth rates, particularly in the face of potential market saturation.

- The company acknowledges potential risks and uncertainties that could cause actual results to differ materially from forward-looking statements.