Barclays has revised its price target for Check Point (CHKP, Financial), increasing it from $230 to $245. The investment firm has maintained an Equal Weight rating on the company's shares. This adjustment is part of a broader review of targets within the security, design, and vertical software-as-a-service sectors, conducted in anticipation of upcoming earnings reports.

Wall Street Analysts Forecast

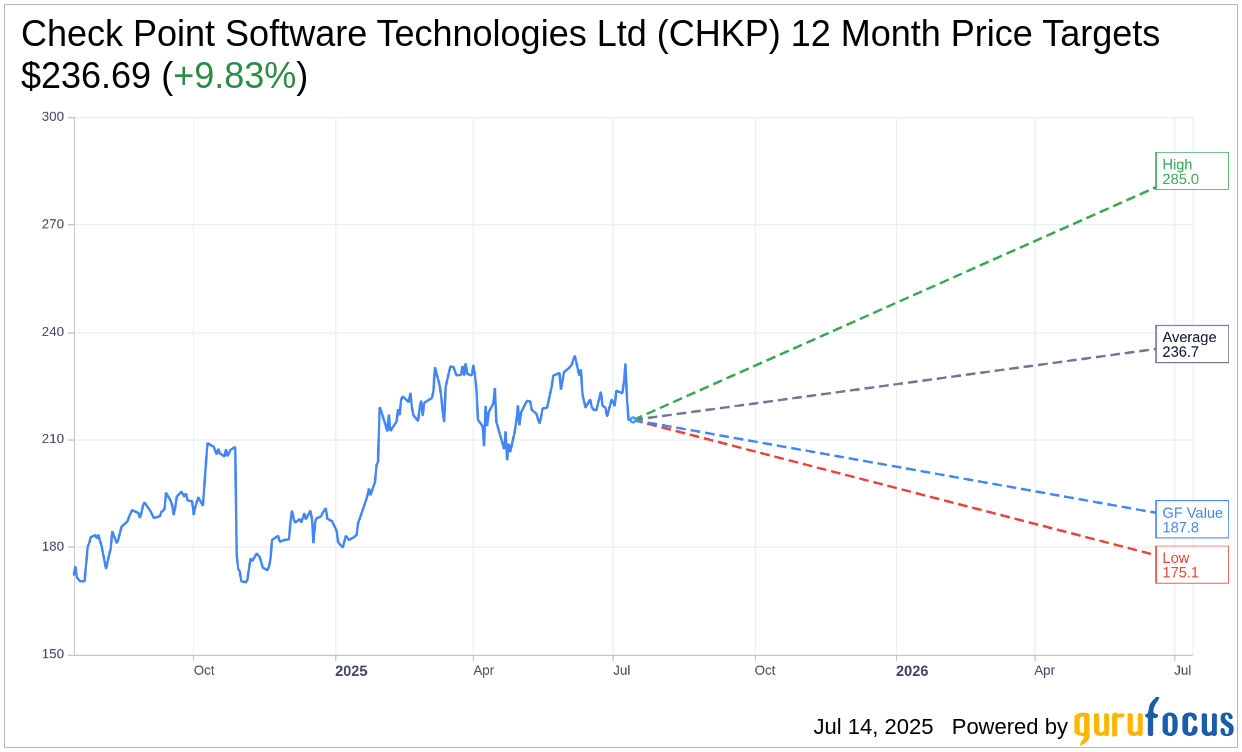

Based on the one-year price targets offered by 31 analysts, the average target price for Check Point Software Technologies Ltd (CHKP, Financial) is $236.69 with a high estimate of $285.00 and a low estimate of $175.12. The average target implies an upside of 9.83% from the current price of $215.50. More detailed estimate data can be found on the Check Point Software Technologies Ltd (CHKP) Forecast page.

Based on the consensus recommendation from 40 brokerage firms, Check Point Software Technologies Ltd's (CHKP, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Check Point Software Technologies Ltd (CHKP, Financial) in one year is $187.78, suggesting a downside of 12.86% from the current price of $215.5. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Check Point Software Technologies Ltd (CHKP) Summary page.