Citi has elevated its price target for Rocket Lab (RKLB, Financial), moving it up to $50 from the previous $33, while maintaining a Buy rating on the stock. This upgrade comes as part of the firm's outlook on the aerospace and defense sector, which continues to show strong momentum in the second quarter earnings preview. This positive sentiment reflects Citi's continued confidence in Rocket Lab's growth potential within the industry.

Wall Street Analysts Forecast

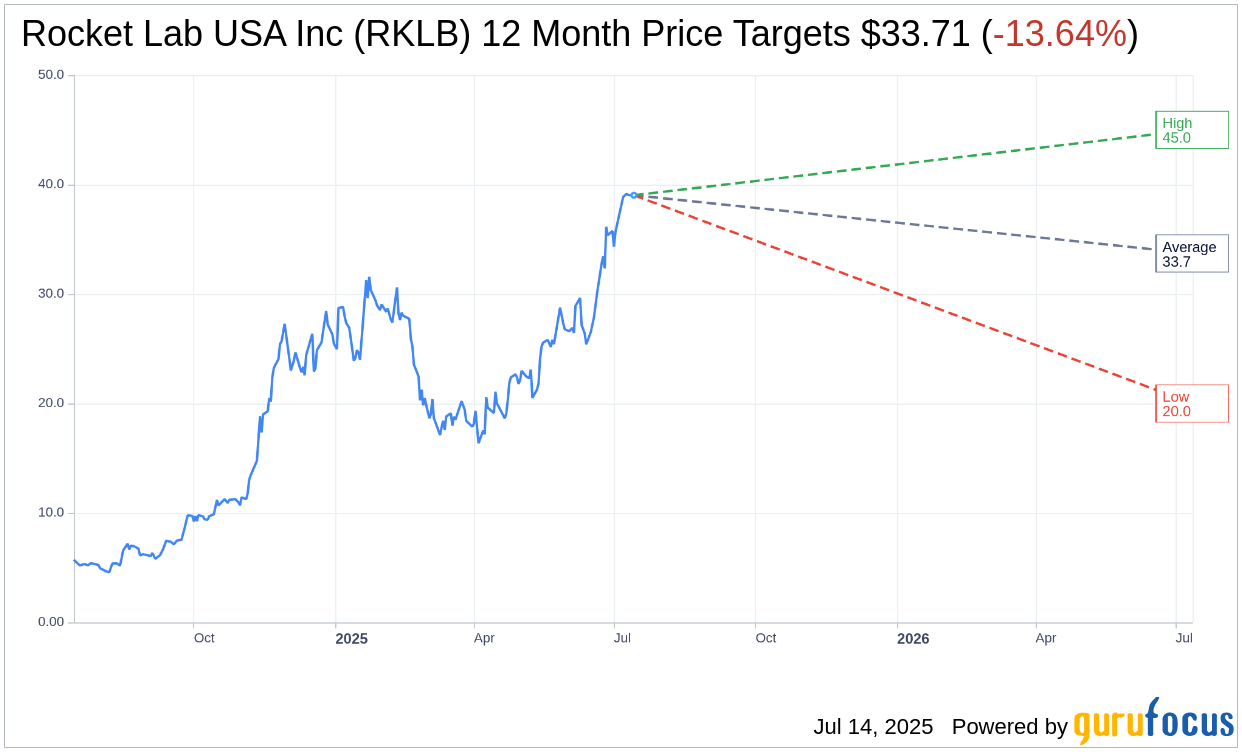

Based on the one-year price targets offered by 12 analysts, the average target price for Rocket Lab USA Inc (RKLB, Financial) is $33.71 with a high estimate of $45.00 and a low estimate of $20.00. The average target implies an downside of 13.64% from the current price of $39.03. More detailed estimate data can be found on the Rocket Lab USA Inc (RKLB) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Rocket Lab USA Inc's (RKLB, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Rocket Lab USA Inc (RKLB, Financial) in one year is $16.96, suggesting a downside of 56.55% from the current price of $39.03. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Rocket Lab USA Inc (RKLB) Summary page.

RKLB Key Business Developments

Release Date: May 08, 2025

- Revenue: $122.6 million, up 32% year-over-year.

- Launch Services Revenue: $35.6 million.

- Space Systems Revenue: $87 million.

- Gross Margin (GAAP): 28.8%.

- Gross Margin (Non-GAAP): 33.4%.

- Total Backlog: $1.067 billion.

- Launch Backlog: $422.2 million.

- Space Systems Backlog: $644.8 million.

- Operating Expenses (GAAP): $94.4 million.

- Operating Expenses (Non-GAAP): $76.8 million.

- R&D Expenses (GAAP): Increased by $6.9 million quarter-on-quarter.

- R&D Expenses (Non-GAAP): Increased by $4 million quarter-on-quarter.

- Cash and Equivalents: $517 million at the end of Q1 2025.

- Adjusted EBITDA Loss: $30 million.

- Q2 2025 Revenue Guidance: $130 million to $140 million.

- Q2 2025 Gross Margin Guidance (GAAP): 30% to 32%.

- Q2 2025 Gross Margin Guidance (Non-GAAP): 34% to 36%.

- Q2 2025 Adjusted EBITDA Loss Guidance: $28 million to $30 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Rocket Lab USA Inc (RKLB, Financial) reported a near-record quarterly revenue of $122.6 million, marking a 32% increase compared to the previous year.

- The company successfully launched five Electron missions with 100% mission success, demonstrating reliable access to space.

- Rocket Lab USA Inc (RKLB) has been selected for the Department of Defense's high-value launch contract in the National Security Space Launch (NSSL) program, highlighting its capability as a launch provider.

- The company is expanding its vertical integration with the acquisition of Mynaric, which specializes in laser-based satellite communications, enhancing its product offerings.

- Rocket Lab USA Inc (RKLB) is making significant progress with its Neutron launch vehicle, targeting its first launch in the second half of the year, which is expected to drive future growth.

Negative Points

- The company experienced a sequential decline in revenue of 7.4% due to a mix of lower-priced Electron missions and a reduction in component businesses.

- Rocket Lab USA Inc (RKLB) reported a negative GAAP operating cash flow of $54.2 million in the first quarter, driven by lumpy cash receipts and continued investment in Neutron.

- The company faces challenges with production and supply chain issues, particularly highlighted in its acquisition of Mynaric.

- There is a high level of fixed overhead and expenses associated with maintaining launch operations, impacting profitability when launch cadence is not optimized.

- Rocket Lab USA Inc (RKLB) is experiencing elevated levels of negative free cash flow, expected to continue until the first launch of Neutron is achieved.