Key Highlights:

- Hyperscale Data (GPUS, Financial) reduces debt by over $20 million, focusing on AI data centers.

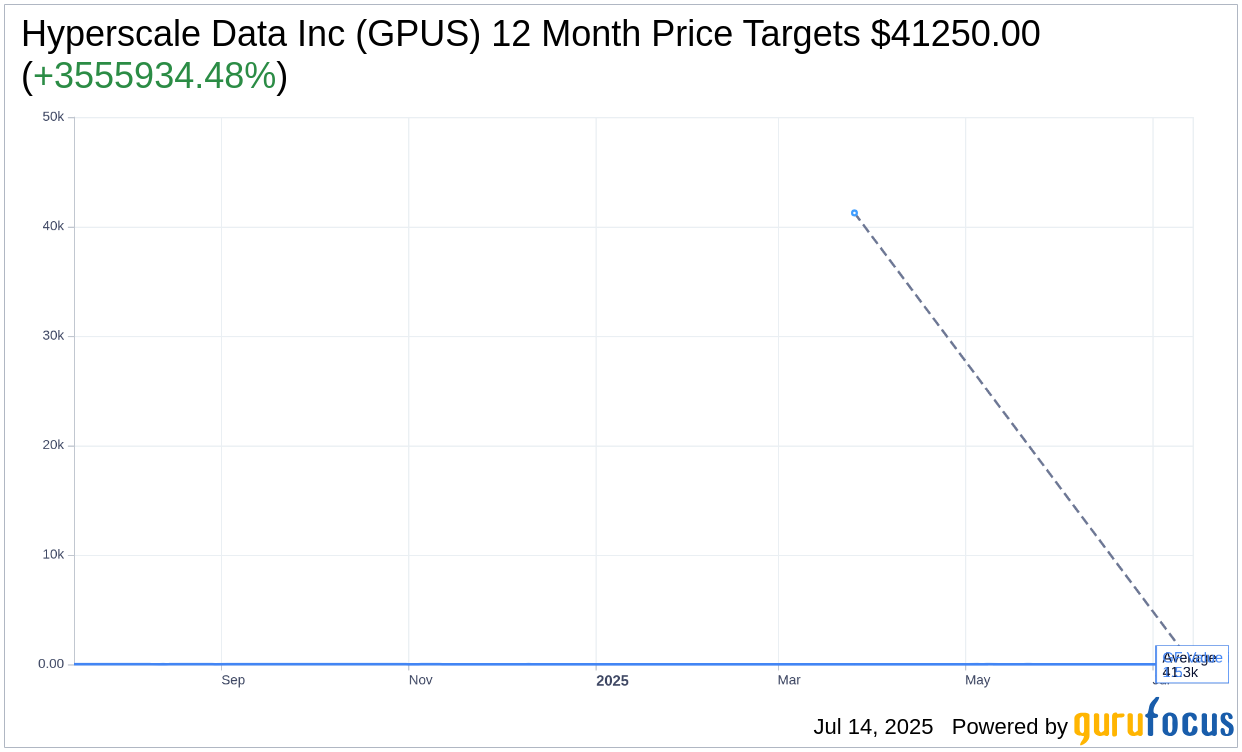

- Wall Street's sole analyst projects a 3,555,934.48% potential upside for GPUS.

- GuruFocus estimates a 27.59% growth potential based on GF Value metrics.

Hyperscale Data (GPUS) has strategically cut its debt obligations by over $20 million, significantly bolstering its financial stability as the company shifts its focus to artificial intelligence data centers. This financial restructuring is directed towards the establishment of a major AI hub in Michigan, with ambitious plans to boost its power capacity by 40 megawatts.

Wall Street Analysts Forecast

Currently, only one analyst has provided a one-year price target for Hyperscale Data Inc (GPUS, Financial), setting the average target at an astounding $41,250.00. Both the high and low estimates align perfectly at this figure, suggesting an unparalleled potential upside of 3,555,934.48% from the stock's current trading price of $1.16. For more in-depth estimates and analysis, please visit the Hyperscale Data Inc (GPUS) Forecast page.

The general consensus from the solitary brokerage firm covering GPUS indicates an "Outperform" status, scoring an average brokerage recommendation of 2.0. This rating is on a scale from 1 to 5, where 1 represents a Strong Buy and 5 signifies a Sell.

Understanding GF Value Estimates

According to GuruFocus assessments, the one-year estimated GF Value for Hyperscale Data Inc (GPUS, Financial) is projected to be $1.48, indicating a potential gain of 27.59% from the current value of $1.16. The GF Value is a reflective measure of the stock's fair trading value, determined by examining historical trading multiples, past business growth, and projected future performance metrics. For further detailed insights, you can explore the data on the Hyperscale Data Inc (GPUS) Summary page.