BTIG analyst Gregory Lewis has increased the price target for Seadrill (SDRL, Financial) from $28 to $33, maintaining a Buy rating. This adjustment was made within a comprehensive analysis of the Offshore Oil Services sector. Over the past year, there has been a noticeable shift towards higher quality trades in offshore services. Despite a slowdown in drilling activities, this is perceived as a temporary phase in the market cycle, with 7th generation utilization remaining strong and commanding higher prices compared to 6th generation floaters, according to the analyst.

Wall Street Analysts Forecast

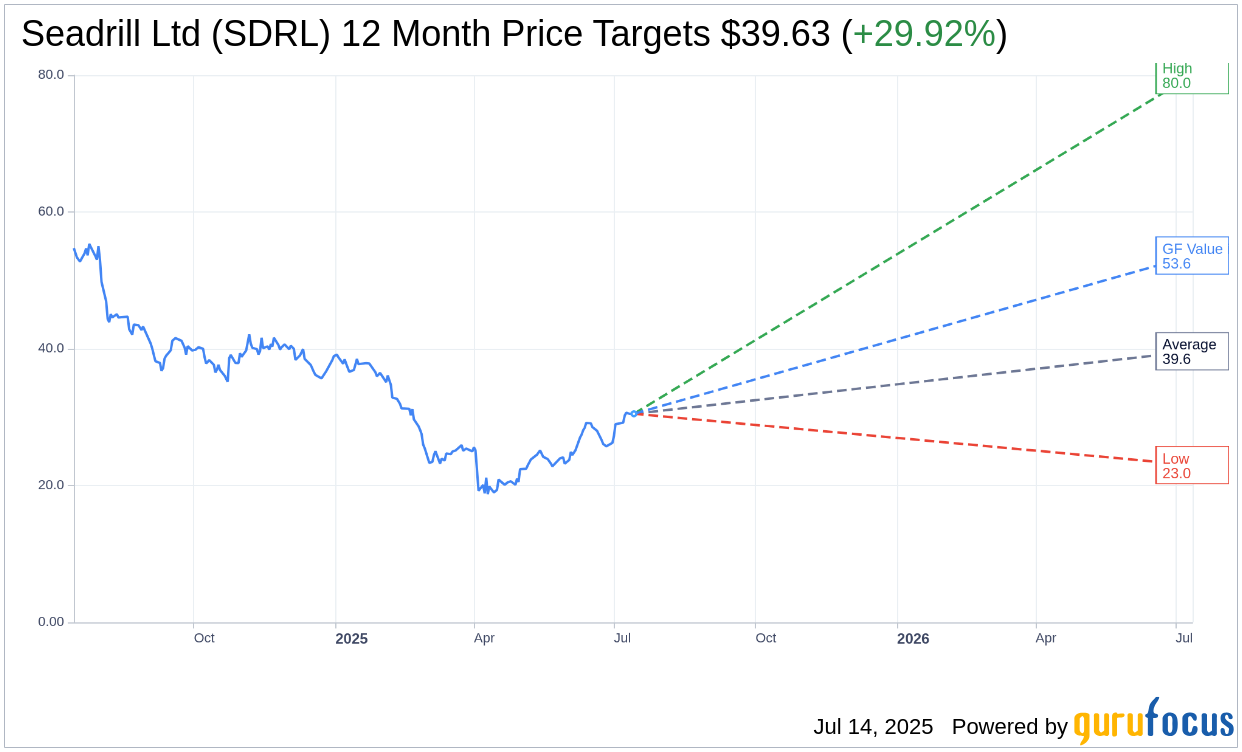

Based on the one-year price targets offered by 8 analysts, the average target price for Seadrill Ltd (SDRL, Financial) is $39.63 with a high estimate of $80.00 and a low estimate of $23.00. The average target implies an upside of 29.92% from the current price of $30.50. More detailed estimate data can be found on the Seadrill Ltd (SDRL) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Seadrill Ltd's (SDRL, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Seadrill Ltd (SDRL, Financial) in one year is $53.63, suggesting a upside of 75.84% from the current price of $30.5. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Seadrill Ltd (SDRL) Summary page.

SDRL Key Business Developments

Release Date: May 12, 2025

- EBITDA: $73 million for Q1 2025.

- Economic Utilization: 84% for the quarter.

- Cash: $430 million at the end of Q1 2025.

- Backlog: $2.8 billion extending through 2028 and into 2029.

- Total Operating Revenues: $335 million, an increase of $46 million from the prior quarter.

- Contract Drilling Revenues: $248 million, up $44 million sequentially.

- Total Operating Expenses: $317 million, down from $323 million in the prior quarter.

- Adjusted EBITDA: $73 million, up from $28 million in the prior quarter.

- Gross Principal Debt: $625 million at the end of Q1 2025.

- Net Cash Used in Operations: $27 million for Q1 2025.

- Full Year Revenue Guidance: $1.3 billion to $1.36 billion.

- Full Year Adjusted EBITDA Guidance: $320 million to $380 million.

- Full Year Capital Expenditures Guidance: $250 million to $300 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Seadrill Ltd (SDRL, Financial) delivered an EBITDA of $73 million in the first quarter, showing a significant improvement from the previous quarter.

- The company closed the first quarter with a strong cash position of $430 million and a durable contract backlog of $2.8 billion extending through 2028 and into 2029.

- Seadrill Ltd (SDRL) received special endorsements for outstanding service delivery from major clients, highlighting the company's operational excellence.

- The company is actively engaged in discussions for multiple contract awards expected in the second half of 2025 and 2026, indicating potential future growth.

- Seadrill Ltd (SDRL) maintains a robust balance sheet with gross principal debt of $625 million and a long debt maturity timeline until 2030, providing financial stability.

Negative Points

- Economic utilization for the quarter was 84%, impacted by downtime and teething issues with rigs in Brazil, affecting overall performance.

- Global macroeconomic uncertainty and OPEC's supply decisions are causing volatility in commodity prices, impacting client investment confidence.

- The US Gulf market is expected to face increased competition and downward pressure on rates in 2025 due to rigs rolling off contracts.

- The company is facing challenges in the African market with a reduction in floater demand expected in 2025 before a potential rebound in 2027.

- Seadrill Ltd (SDRL) is involved in ongoing mediation with Petrobras regarding delayed penalty notices, creating uncertainty around the resolution timeline.