Zimmer Biomet Holdings (ZBH, Financial) has entered into an agreement to purchase all outstanding shares of Monogram Technologies for $4.04 per share in cash, valuing Monogram at approximately $177 million in equity and $168 million in enterprise value. Monogram shareholders will also receive a contingent value right, offering an additional $12.37 per share in cash if specific milestones are reached by 2030.

This acquisition, approved by the boards of both companies, aims to integrate Monogram's innovative robotic technologies into Zimmer Biomet’s existing ROSA Robotics platform. Monogram’s CT-based, AI-navigated knee arthroplasty technology, which was cleared by the FDA in March 2025, is expected to launch with Zimmer Biomet implants in 2027. Moreover, a fully autonomous version is in development, promising enhanced safety and efficiency and opening possibilities for applications beyond knee surgery.

Zimmer Biomet plans to use its cash reserves and debt financing to fund the transaction, maintaining its financial priorities. The acquisition is intended to boost Zimmer Biomet's growth in the robotics sector and expand its market share in orthopedic solutions. The deal is expected to be neutral to earnings through 2027 and accretive from 2028 onward, with closing expected later this year pending regulatory approvals and other conditions.

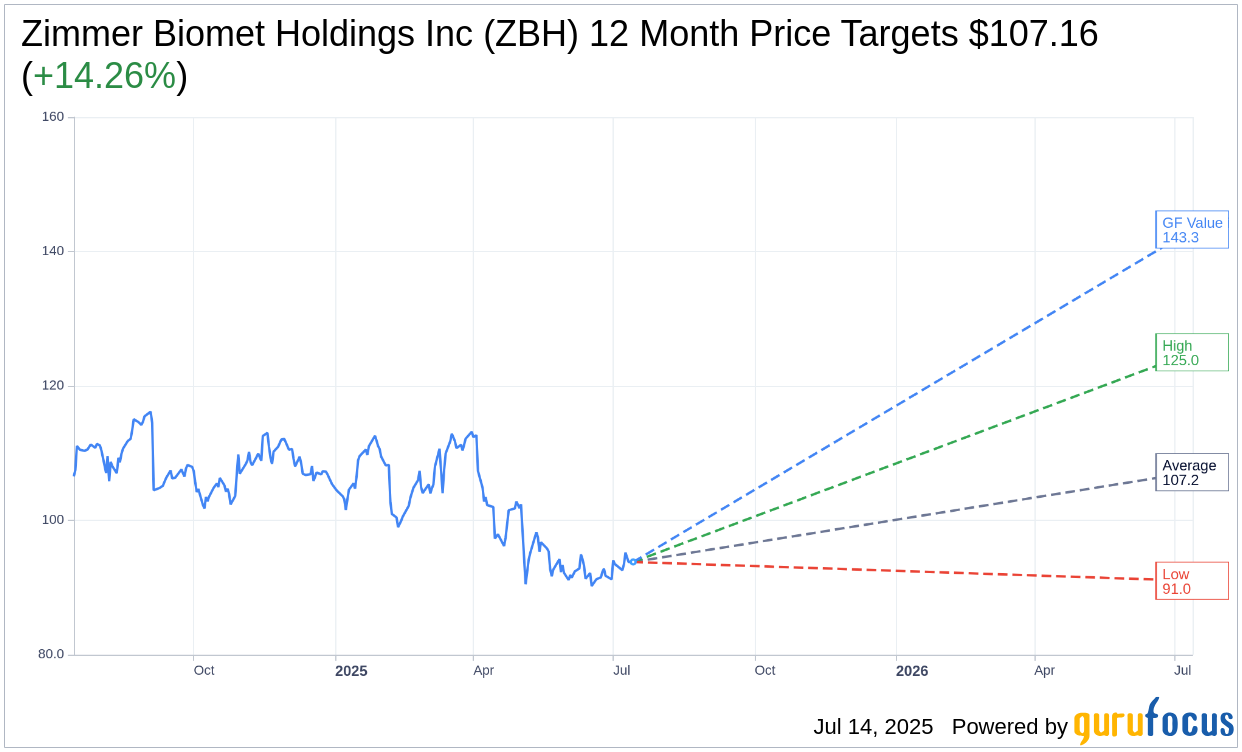

Wall Street Analysts Forecast

Based on the one-year price targets offered by 25 analysts, the average target price for Zimmer Biomet Holdings Inc (ZBH, Financial) is $107.16 with a high estimate of $125.00 and a low estimate of $91.00. The average target implies an upside of 14.26% from the current price of $93.79. More detailed estimate data can be found on the Zimmer Biomet Holdings Inc (ZBH) Forecast page.

Based on the consensus recommendation from 31 brokerage firms, Zimmer Biomet Holdings Inc's (ZBH, Financial) average brokerage recommendation is currently 2.6, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Zimmer Biomet Holdings Inc (ZBH, Financial) in one year is $143.28, suggesting a upside of 52.77% from the current price of $93.79. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Zimmer Biomet Holdings Inc (ZBH) Summary page.

ZBH Key Business Developments

Release Date: May 05, 2025

- Revenue: $1.909 billion, an increase of 1.1% on a reported basis and 2.3% excluding the impact of foreign currency.

- Adjusted Earnings Per Share (EPS): $1.81, compared to $1.94 in the prior year.

- Free Cash Flow: $279 million.

- US Sales Growth: 1.3%, driven by nearly 4% growth in both Hips and S.E.T.

- International Sales Growth: 3.7%, driven by mid-single digit growth in Knees and high-single digit growth in S.E.T.

- Adjusted Gross Margin: 71.5%.

- Adjusted Operating Margin: 26.2%.

- Adjusted Tax Rate: 18.2%.

- Days on Hand (DOH): Reduced by almost 47 days compared to Q1 2024, ending at approximately 370 days.

- 2025 Revenue Growth Guidance: 5.7% to 8.2% reported sales growth.

- 2025 EPS Guidance: $7.90 to $8.10.

- 2025 Free Cash Flow Guidance: $750 million to $850 million.

- Impact of Paragon 28 Acquisition: Expected to contribute 270 basis points to sales growth in 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Zimmer Biomet Holdings Inc (ZBH, Financial) reported a 2.3% growth in first-quarter sales on a constant currency basis, with standout performance in US Hips and mid-single digit growth in S.E.T.

- The company is maintaining its full-year organic constant currency revenue growth expectations of 3% to 5%, excluding the Paragon 28 acquisition.

- Zimmer Biomet Holdings Inc (ZBH) successfully integrated the Paragon 28 acquisition, with the entire US sales channel and senior leadership team joining the company.

- The company is focusing on innovation and diversification, with new product launches such as the Oxford Partial Cementless Knee and the Iodine-Surface-Treated Hip Stem.

- Zimmer Biomet Holdings Inc (ZBH) is committed to operational excellence, optimizing its US sales channel, and expanding its ASC offerings and robotic platforms.

Negative Points

- Zimmer Biomet Holdings Inc (ZBH) updated its 2025 adjusted EPS guidance to $7.90 to $8.10, down from the previous $8.15 to $8.35, due to tariffs and modest dilution from the Paragon 28 acquisition.

- The company faces a $60 million to $80 million headwind from tariffs in 2025, with the majority of the impact expected in the second half of the year.

- Zimmer Biomet Holdings Inc (ZBH) reported a decline in Technology & Data, Bone Cement, and Surgical segments by 3.5% due to tough comps and a mix shift towards ROSA volume-based placements.

- The company's adjusted gross margin and operating margin were lower than the prior year, impacted by higher COGS capitalization, upfront investments, and higher interest expenses.

- Zimmer Biomet Holdings Inc (ZBH) anticipates a reduction in 2025 free cash flow to $750 million to $850 million, down from $1.1 billion to $1.2 billion, due to tariff-related headwinds and one-time costs from the Paragon 28 acquisition.