Synergy CHC has announced a significant partnership with McKesson (MCK, Financial) Canada to enhance the distribution of its FOCUSfactor cognitive health supplements. This strategic move involves McKesson, the largest pharmaceutical distributor in Canada, which will enable FOCUSfactor to reach a wide network of pharmacy and health-centric retail outlets across the nation. The partnership is set to commence in the fourth quarter of 2025, and will include distribution through McKesson-operated stores as well as various independent retailers.

Additionally, Synergy CHC is preparing for further market expansion by participating in the upcoming ECRM Beverage Show in Dallas, Texas. This event will provide the company an opportunity to engage with major national buyers as they plan to introduce their Focus + Energy beverage line. FOCUSfactor's presence will also extend to retail chains such as Gabe’s and Old Time Pottery later this summer, bringing its products to new markets in the Mid-Atlantic and Southeast regions of the United States.

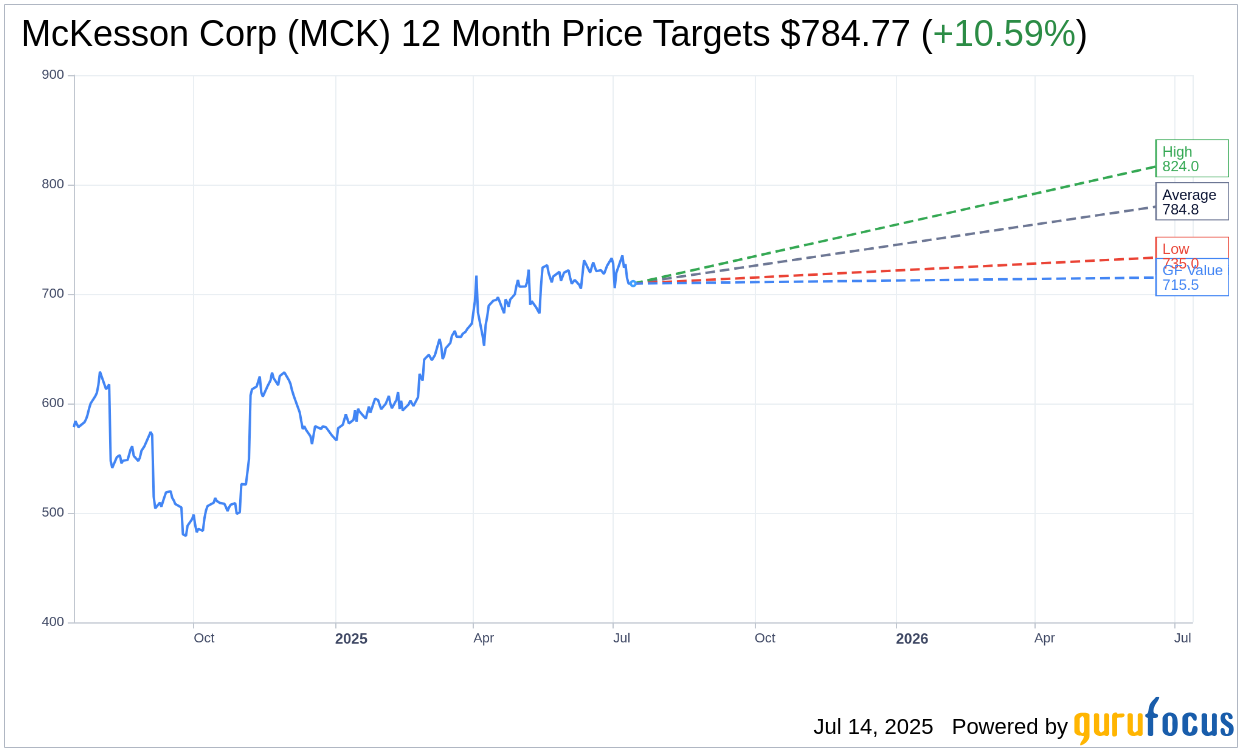

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for McKesson Corp (MCK, Financial) is $784.77 with a high estimate of $824.00 and a low estimate of $735.00. The average target implies an upside of 10.59% from the current price of $709.59. More detailed estimate data can be found on the McKesson Corp (MCK) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, McKesson Corp's (MCK, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for McKesson Corp (MCK, Financial) in one year is $715.47, suggesting a upside of 0.83% from the current price of $709.59. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the McKesson Corp (MCK) Summary page.

MCK Key Business Developments

Release Date: May 08, 2025

- Full Year Revenue: $359 billion, a 16% increase from the prior year.

- Adjusted Earnings Per Diluted Share (EPS): $33.05, a 20% year-over-year growth.

- Cash Returned to Shareholders: $3.5 billion.

- Fourth Quarter Revenue: $90.8 billion, a 19% increase.

- Fourth Quarter EPS: $10.12.

- Fourth Quarter Gross Profit: $3.4 billion, a 2% increase.

- Fourth Quarter Operating Expenses: $1.9 billion, a 10% decrease.

- Fourth Quarter Operating Profit: $1.6 billion, a 24% increase.

- US Pharmaceutical Segment Revenue: $83.2 billion, a 21% increase.

- Prescription Technology Solutions Revenue: $1.3 billion, a 13% increase.

- Medical Surgical Solutions Revenue: $2.9 billion, a 1% increase.

- International Segment Revenue: $3.5 billion, a 2% decrease.

- Free Cash Flow: $7.5 billion in the fourth quarter.

- Fiscal 2026 Revenue Growth Outlook: 11% to 15%.

- Fiscal 2026 EPS Outlook: $36.75 to $37.55.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- McKesson Corp (MCK, Financial) reported a 16% increase in full-year consolidated revenues, reaching a record $359 billion.

- Adjusted earnings per diluted share grew by 20%, surpassing long-term growth targets.

- The company returned $3.5 billion of cash to shareholders, demonstrating strong cash flow management.

- Strategic acquisitions in oncology and other specialties, such as PRISM Vision and Core Ventures, are expected to accelerate growth.

- The Prescription Technology Solutions segment experienced double-digit growth in adjusted operating profit, driven by strong demand for access and affordability solutions.

Negative Points

- The divestiture of Canadian businesses, including Rexall and Well.ca, resulted in lower contributions from the International segment.

- Operating expenses decreased by 10% due to divestitures and cost optimization, which may indicate potential downsizing or restructuring.

- The Medical Surgical segment experienced softer volumes in the primary care market, impacting growth.

- The company faces a dynamic market environment with uncertainties in policies and macroeconomic conditions.

- Free cash flow guidance for fiscal 2026 is lower than the previous year, reflecting potential cash outflows for acquisitions.