Neurocrine Biosciences (NBIX, Financial) has released new findings from their CAHtalyst Adult study involving the drug Crenessity. The study highlights that patients achieved sustainable and more physiological doses of glucocorticoids, while levels of adrenocorticotropic hormone, 17-hydroxyprogesterone, and androstenedione remained stable or decreased compared to baseline levels. This data adds to the previous one-year results of the CAHtalyst Pediatric study and was shared at the Endocrine Society's Annual Meeting, ENDO 2025, held from July 12-15 in San Francisco.

The findings underscore the significance of Crenessity in managing classic congenital adrenal hyperplasia (CAH). According to the company's Chief Medical Officer, these results demonstrate Crenessity's ability to effectively balance ACTH and adrenal steroids in adults, facilitating lower and more physiological steroid doses, which lead to enhanced clinical outcomes.

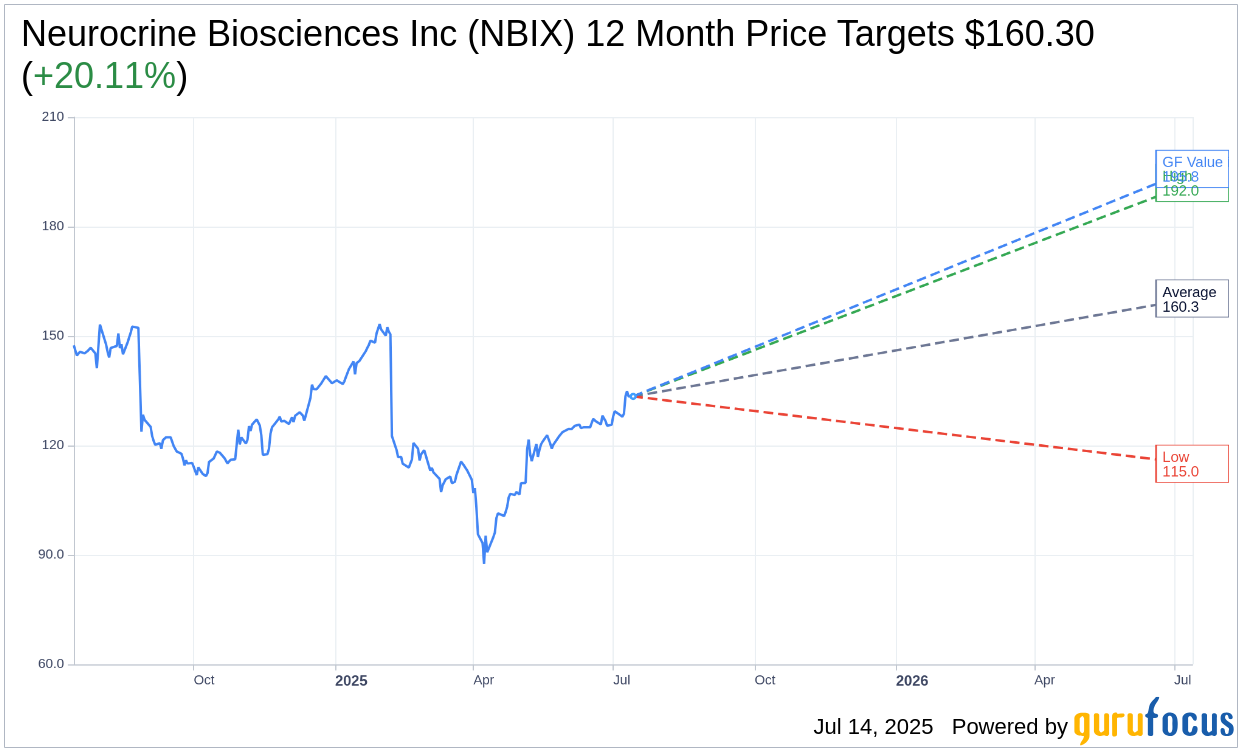

Wall Street Analysts Forecast

Based on the one-year price targets offered by 24 analysts, the average target price for Neurocrine Biosciences Inc (NBIX, Financial) is $160.30 with a high estimate of $192.00 and a low estimate of $115.00. The average target implies an upside of 20.11% from the current price of $133.46. More detailed estimate data can be found on the Neurocrine Biosciences Inc (NBIX) Forecast page.

Based on the consensus recommendation from 27 brokerage firms, Neurocrine Biosciences Inc's (NBIX, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Neurocrine Biosciences Inc (NBIX, Financial) in one year is $195.83, suggesting a upside of 46.73% from the current price of $133.46. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Neurocrine Biosciences Inc (NBIX) Summary page.

NBIX Key Business Developments

Release Date: May 05, 2025

- INGREZZA Product Sales: $545 million in first quarter product sales.

- CRENESSITY Net Revenue: $15 million in the first full quarter of launch.

- 2025 Sales Guidance for INGREZZA: Reaffirmed at $2.5 billion to $2.6 billion.

- R&D Expense: $45 million in milestone expense for the initiation of osavampator Phase III program in MDD.

- Cash Balance: Approximately $1.8 billion.

- Shares Retired: 3.6 million shares over the past two quarters.

- CRENESSITY Enrollment Forms: 413 enrollment forms with 70% of dispenses receiving reimbursement.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Neurocrine Biosciences Inc (NBIX, Financial) reported record new patient starts for INGREZZA in the first quarter, indicating strong market demand.

- The company successfully launched CRENESSITY, achieving $15 million in net revenue with 70% of dispensers receiving reimbursement.

- Neurocrine Biosciences Inc (NBIX) expanded formulary coverage for INGREZZA in Medicare Part D, significantly increasing patient access.

- The company initiated multiple Phase III studies for its pipeline, including osavampator and NBI-'568, demonstrating progress in R&D.

- Neurocrine Biosciences Inc (NBIX) maintains a strong financial position with approximately $1.8 billion in cash, supporting future growth and investment.

Negative Points

- First quarter sales for INGREZZA were impacted by one less order week and patient reauthorization processes, affecting revenue.

- The reauthorization process for continuing patients was more challenging than in previous years, impacting patient retention.

- Gross-to-net dynamics and contracting activities are expected to impact INGREZZA's financial performance in the short term.

- The launch of CRENESSITY is still in its early stages, and long-term adoption and reimbursement trends remain uncertain.

- The Inflation Reduction Act has influenced payer behavior, creating challenges in the reimbursement dynamics for specialty medicines like INGREZZA.