Morgan Stanley's analyst, Bob Huang, has increased the price target for Globe Life (GL, Financial) from $125 to $127. Despite this upward adjustment, the analyst maintains an Equal Weight rating for the stock. This change reflects confidence in the company's potential for incremental value, while the Equal Weight stance suggests a balanced outlook on the stock's performance relative to other market options.

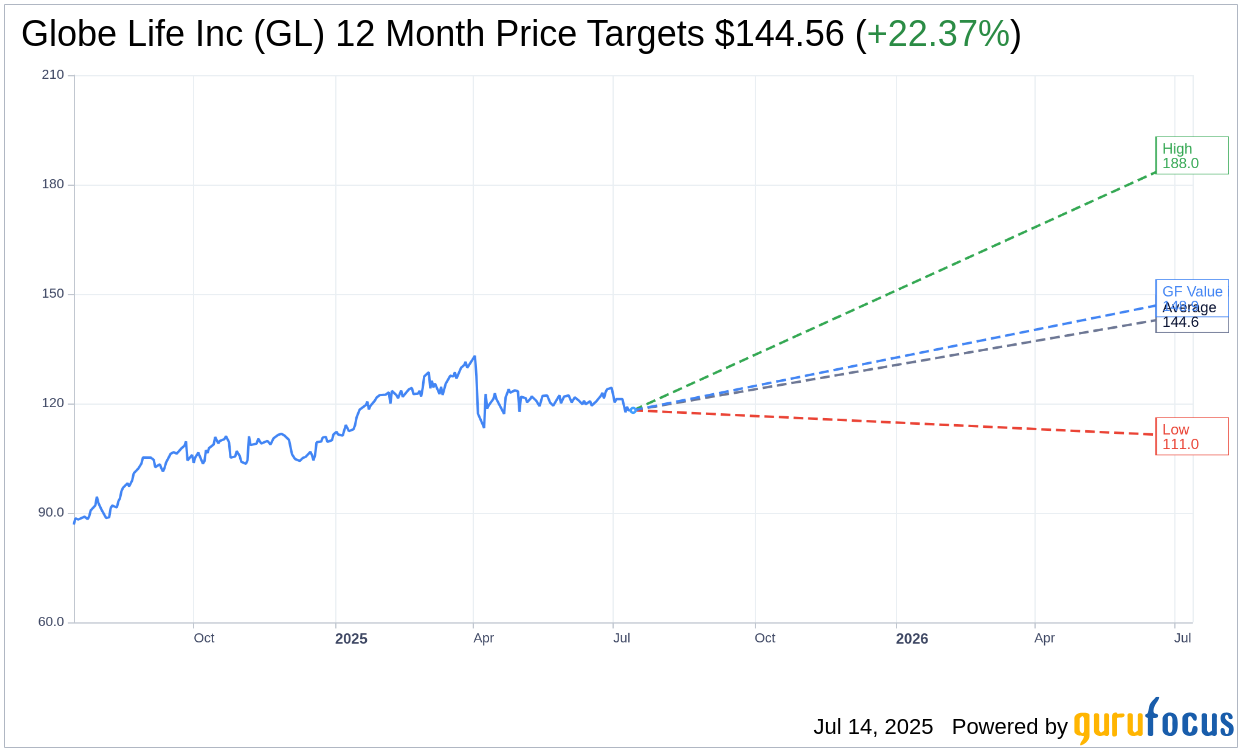

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Globe Life Inc (GL, Financial) is $144.56 with a high estimate of $188.00 and a low estimate of $111.00. The average target implies an upside of 22.37% from the current price of $118.13. More detailed estimate data can be found on the Globe Life Inc (GL) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Globe Life Inc's (GL, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Globe Life Inc (GL, Financial) in one year is $148.86, suggesting a upside of 26.01% from the current price of $118.13. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Globe Life Inc (GL) Summary page.

GL Key Business Developments

Release Date: May 01, 2025

- Net Income: $255 million or $3.01 per share, compared to $254 million or $2.67 per share a year ago.

- Net Operating Income: $259 million or $3.07 per share, a 10% increase from a year ago.

- Return on Equity (GAAP): 19% through March 31.

- Book Value per Share (Excluding AOCI): $87.92, up 11% from a year ago.

- Life Insurance Premium Revenue: Increased 3% to $830 million.

- Life Underwriting Margin: $337 million, up 9% from a year ago.

- Health Insurance Premium Revenue: Grew 8% to $370 million.

- Health Underwriting Margin: Down 10% to $85 million.

- Administrative Expenses: $88 million for the quarter.

- American Income Life Premiums: Up 6% to $438 million.

- Liberty National Life Premiums: Grew 6% to $96 million.

- Family Heritage Health Premiums: Increased 9% to $112 million.

- Direct-to-Consumer Life Premiums: Down 1% to $246 million.

- United American Health Premiums: Increased 13% to $160 million.

- Excess Investment Income: $36 million, down approximately $8 million from a year ago.

- Net Investment Income: $281 million, down 1% from a year ago.

- Share Repurchases: Approximately 1.5 million shares for $177 million at an average price of $121.70 per share.

- RBC Ratio: 316% as of year-end 2024.

- Net Operating Earnings Guidance: Estimated range of $13.45 to $14.05 per diluted share for 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Globe Life Inc (GL, Financial) reported a net operating income increase of 10% from the previous year, reaching $259 million or $3.07 per share.

- Life insurance premium revenue grew by 3% to $830 million, with a 9% increase in life underwriting margin driven by premium growth and lower policy obligations.

- The company expects life premium revenue to grow around 4% for the year, with life underwriting margins anticipated to be between 42% and 44%.

- Health insurance premium revenue increased by 8% to $370 million, despite a decrease in health underwriting margin due to higher claim costs.

- Globe Life Inc (GL) repurchased approximately 1.5 million shares for $177 million, returning a total of $197 million to shareholders in the first quarter.

Negative Points

- Health underwriting margin decreased by 10% to $85 million, primarily due to higher claim costs in United American resulting from increased utilization.

- Administrative expenses rose to $88 million, driven by higher information technology, employee, and legal costs.

- Net investment income decreased by 1% from the previous year, impacted by lower short-term interest rates.

- The direct-to-consumer division saw a 1% decline in life premiums and a 12% drop in net life sales due to reduced marketing spend and higher distribution costs.

- The company faces ongoing inquiries from the SEC and DOJ, with no material developments to disclose at this time.