Perpetua Resources (PPTA, Financial) has successfully expanded its financial resources through a significant public offering and private placement. The company announced that it increased its public offering to $325 million, issuing 24,622,000 common shares priced at $13.20 each. Additionally, in a concurrent private placement, Paulson & Co. acquired 7,575,757 common shares, contributing $100 million.

Capitalizing on the market's interest, National Bank of Canada Financial Markets and BMO Capital Markets fully exercised their option to purchase an extra 3,693,300 common shares. This strategic move resulted in approximately $49 million in additional gross proceeds, ultimately boosting the total raised through the public offering and private placement to around $474 million.

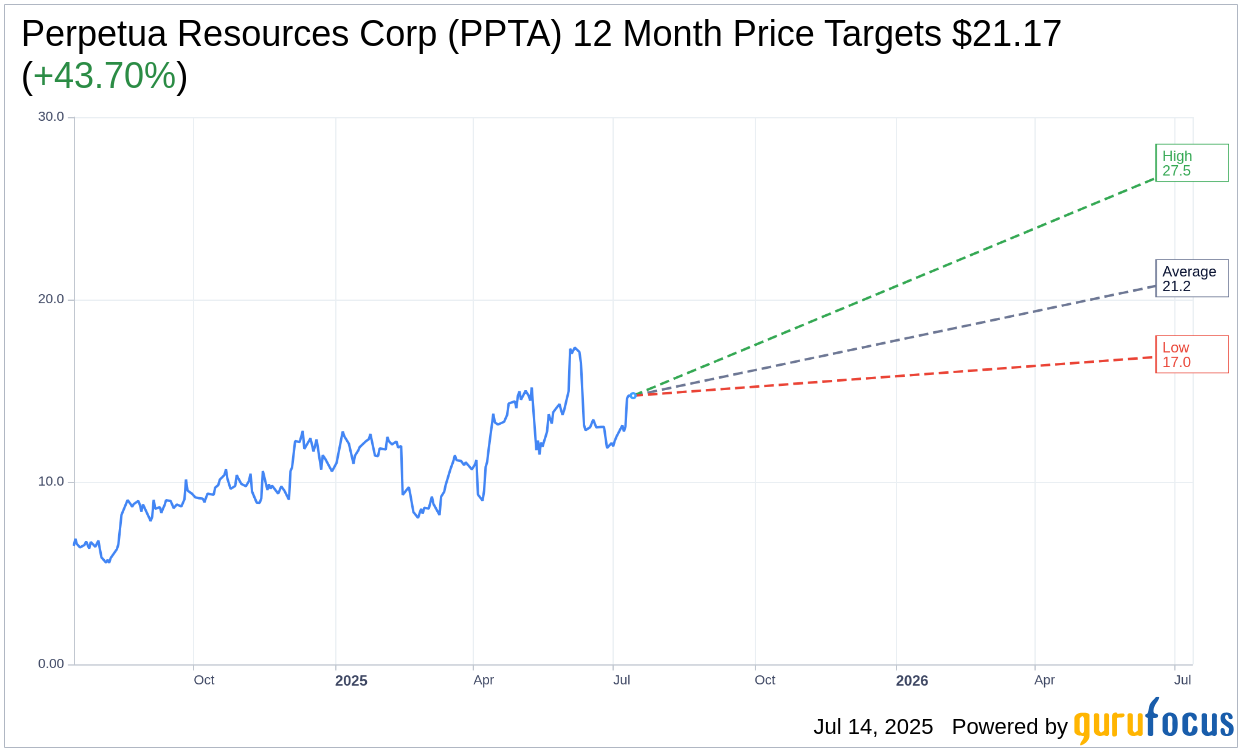

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Perpetua Resources Corp (PPTA, Financial) is $21.17 with a high estimate of $27.50 and a low estimate of $17.00. The average target implies an upside of 43.70% from the current price of $14.73. More detailed estimate data can be found on the Perpetua Resources Corp (PPTA) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Perpetua Resources Corp's (PPTA, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.