Key Insights:

- Occidental Petroleum faces production restrictions in the Gulf operations, impacting Q2 sales volumes.

- Despite the drop in Q2 estimates, overall production guidance remains unchanged.

- Analysts project an 8.60% potential upside from the current stock price with a mixed "Hold" recommendation.

Occidental Petroleum's Production Update

Occidental Petroleum (OXY) recently experienced a 1.6% decline in its share price, driven by reported production constraints in its U.S. Gulf operations during the second quarter. The company attributes these setbacks to external factors and maintenance delays, resulting in estimated Q2 sales volumes of 125,000 barrels of oil equivalent per day, which fall short of previously forecasted expectations. Despite this setback, Occidental has maintained its overall production guidance, reassuring investors of its strategic focus.

Wall Street Analysts’ Forecast and Outlook

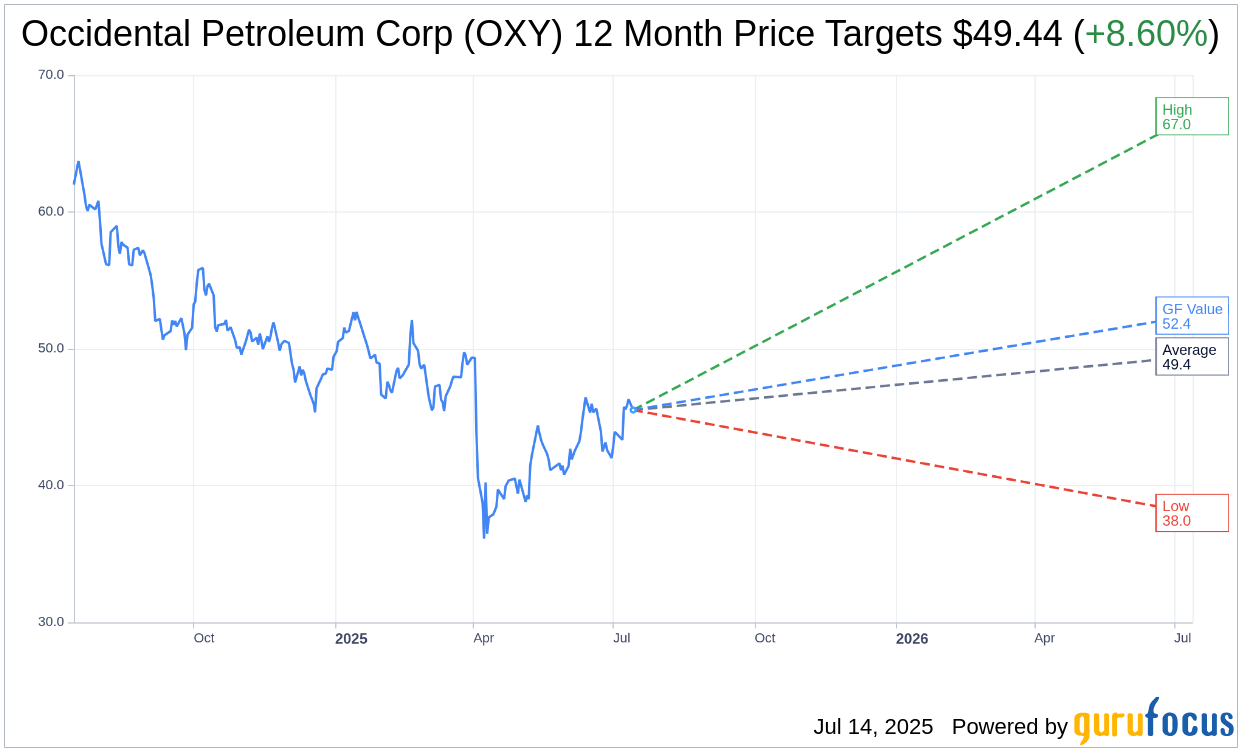

The analysis of Occidental Petroleum Corp's future reveals a nuanced perspective from 23 financial analysts. Their average one-year price target stands at $49.44, with the potential for the stock price to reach as high as $67.00 or dip to a low of $38.00. With the current price at $45.52, this average target represents an anticipated upside of 8.60%. Investors interested in detailed projections can explore them further on the Occidental Petroleum Corp (OXY, Financial) Forecast page.

Brokerage Recommendations and GF Value Estimation

Occidental Petroleum Corp's stock garners a consensus "Hold" rating from 26 brokerage firms, reflected in an average recommendation score of 2.7 on a 1-5 scale, where 1 indicates a "Strong Buy" and 5 denotes a "Sell". This cautious stance suggests that analysts recommend maintaining positions while weighing the stock's future potential.

According to GuruFocus's proprietary GF Value metric, Occidental Petroleum Corp's estimated value in one year is $52.43, implying a potential upside of 15.18% from its current price point of $45.52. The GF Value metric, exclusive to GuruFocus, is derived from historical trading multiples, past business growth, and prospective performance estimates. For more comprehensive insights, investors can visit the Occidental Petroleum Corp (OXY, Financial) Summary page.