Mizuho Securities has revised its price target for Enphase Energy (ENPH, Financial), a leading global energy technology company. The price target has been adjusted from $53.00 to $50.00, reflecting a 5.66% decrease. Despite the lower price target, the firm has maintained its "Outperform" rating for the stock. The announcement was made by analyst Maheep Mandloi on July 14, 2025.

The decision comes amidst fluctuating market conditions that have impacted the expectations for Enphase Energy (ENPH, Financial). With the adjusted price target in mind, investors may need to reconsider their strategies, although the maintained rating suggests a continued confidence in the company's potential for growth and performance within the energy sector.

Enphase Energy (ENPH, Financial) remains a subject of interest for investors looking to capitalize on opportunities within the renewable energy landscape. As always, it is recommended for stakeholders to stay informed on any further developments and market trends that might influence the company's stock performance.

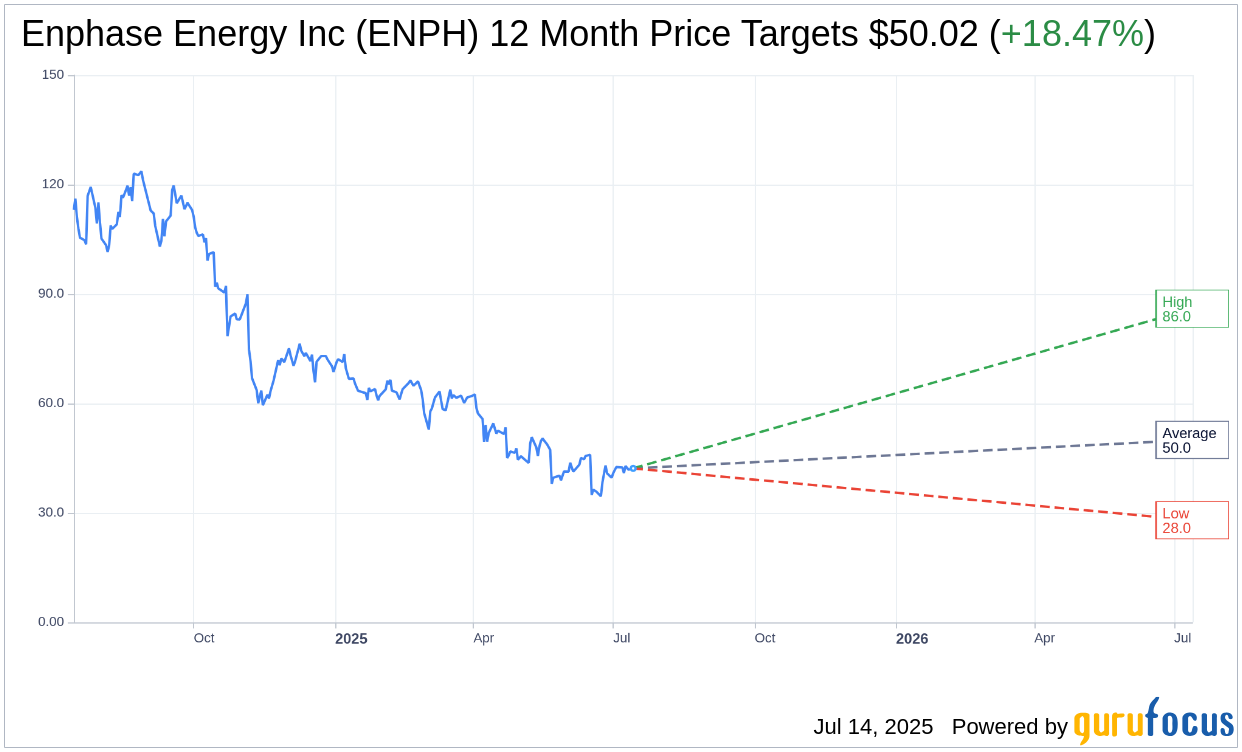

Wall Street Analysts Forecast

Based on the one-year price targets offered by 33 analysts, the average target price for Enphase Energy Inc (ENPH, Financial) is $50.02 with a high estimate of $86.00 and a low estimate of $28.00. The average target implies an upside of 18.47% from the current price of $42.22. More detailed estimate data can be found on the Enphase Energy Inc (ENPH) Forecast page.

Based on the consensus recommendation from 37 brokerage firms, Enphase Energy Inc's (ENPH, Financial) average brokerage recommendation is currently 3.1, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Enphase Energy Inc (ENPH, Financial) in one year is $100.44, suggesting a upside of 137.9% from the current price of $42.22. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Enphase Energy Inc (ENPH) Summary page.