In recent developments, Mach Natural Resources (MNR, Financial) has caught the attention of the investment community following a price target update from Raymond James. As of July 14, 2025, the investment firm, represented by analyst John Freeman, has raised the price target for MNR from $21.00 to $22.00 USD.

The adjustment in price target reflects an increase of 4.76% over the previous target, indicating Raymond James' positive outlook on the stock's potential performance. Despite the revision in the price target, the firm's rating for Mach Natural Resources remains unchanged at "Strong Buy."

This announcement is particularly significant as it reinforces Raymond James' confidence in Mach Natural Resources' future growth prospects. Investors may find these updates crucial for making informed decisions regarding their portfolios. Keep an eye on MNR as it continues to navigate the market landscape.

Wall Street Analysts Forecast

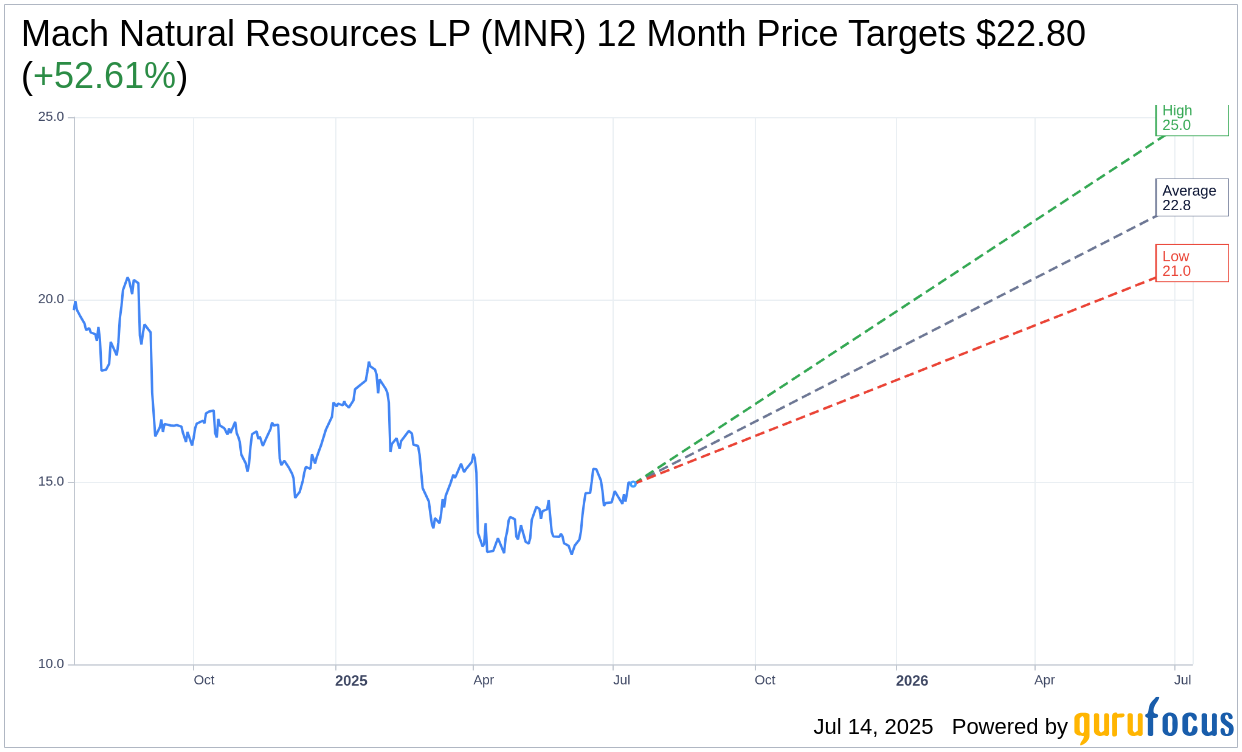

Based on the one-year price targets offered by 5 analysts, the average target price for Mach Natural Resources LP (MNR, Financial) is $22.80 with a high estimate of $25.00 and a low estimate of $21.00. The average target implies an upside of 52.61% from the current price of $14.94. More detailed estimate data can be found on the Mach Natural Resources LP (MNR) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Mach Natural Resources LP's (MNR, Financial) average brokerage recommendation is currently 1.4, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.