In a bold move to solidify its leadership in technology, Meta Platforms Inc. (META, Financial) plans to invest significantly in artificial intelligence infrastructure. Under the guidance of CEO Mark Zuckerberg, the company is gearing up to launch an advanced supercluster named Prometheus by 2026, leading to a 1% increase in META's stock.

Wall Street Analysts' Insights on Meta Platforms

- Meta is investing heavily in AI, projecting future growth with the Prometheus supercluster.

- Analysts suggest a 1.10% upside potential from its current stock price.

- Consensus indicates an "Outperform" rating with a 1.8 average recommendation score.

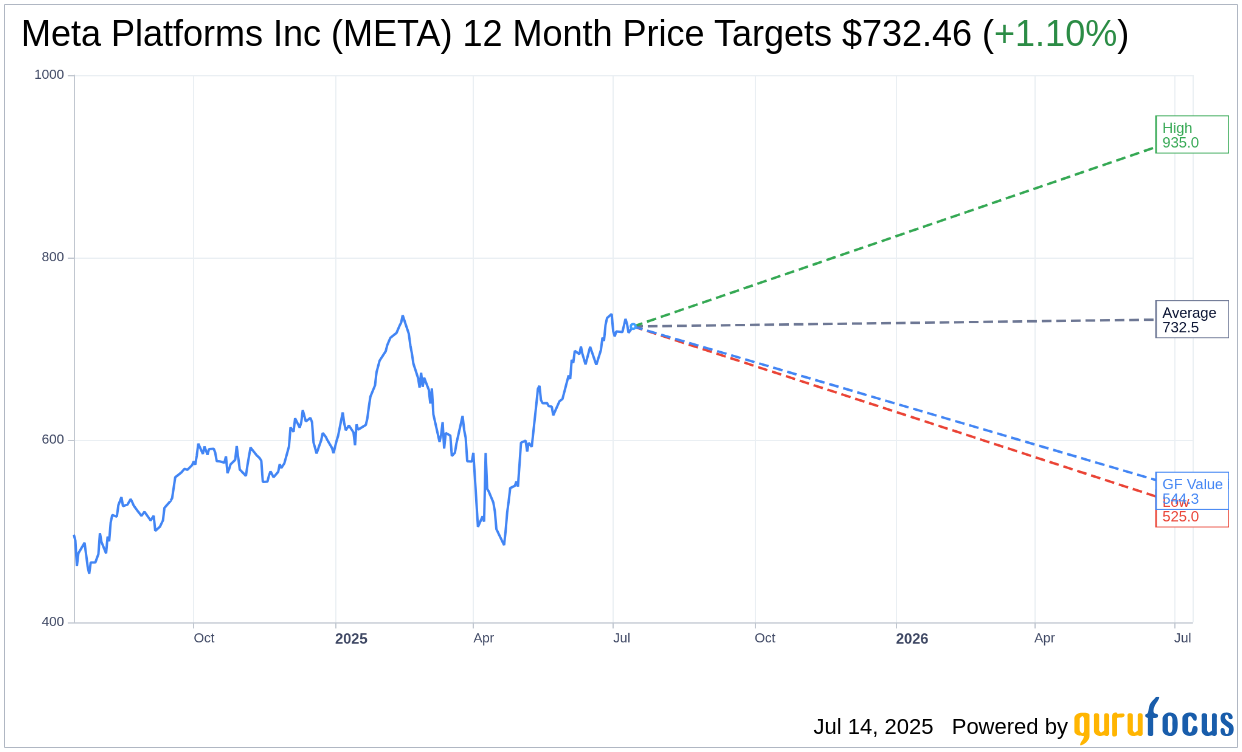

Financial analysts are optimistic about Meta Platforms' future, providing a one-year average target price of $732.46. These insights are derived from 61 analysts, with predictions ranging from a high of $935.00 to a low of $525.00. Considering the current trading price of $724.47, this average target implies a potential upside of 1.10%. Investors can explore more detailed projections on the Meta Platforms Inc (META, Financial) Forecast page.

Furthermore, based on consensus from 71 brokerage firms, Meta Platforms Inc. (META, Financial) holds a strong position with an average recommendation score of 1.8, categorizing it as "Outperform." This rating scale, ranging from 1 (Strong Buy) to 5 (Sell), underscores the market's confidence in META's growth trajectory.

In contrast, GuruFocus' proprietary GF Value analysis estimates the fair value of Meta Platforms Inc. (META, Financial) at $544.27 over the next year, suggesting a potential downside of 24.87% from its current price of $724.465. The GF Value is calculated considering META's historical trading multiples, past growth, and future business performance expectations. Investors can delve deeper into these valuations on the Meta Platforms Inc (META) Summary page.