On July 14, 2025, Citigroup analyst Andrew Kaplowitz announced an adjustment in the price target for Johnson Controls Intl (JCI, Financial). The new price target is set at USD 110.00, up from the previous target of USD 94.00. This adjustment represents a 17.02% increase from the prior target.

Despite the raised price target, the investment rating for Johnson Controls Intl (JCI, Financial) remains unchanged at Neutral. This indicates that the analyst maintains a cautious outlook on the stock's performance, while acknowledging the potential for increased share value.

The adjustment reflects Citigroup's updated expectations for the company, taking into account various market and company-specific factors. The unchanged Neutral rating suggests a balanced view of potential risks and rewards associated with investing in the stock at this time.

Investors may find this update significant as it can influence decisions relating to Johnson Controls Intl (JCI, Financial), especially considering the substantial increase in the price target. For those tracking the stock, remaining aware of such analyst changes can provide valuable insights into market sentiment and future performance expectations.

Wall Street Analysts Forecast

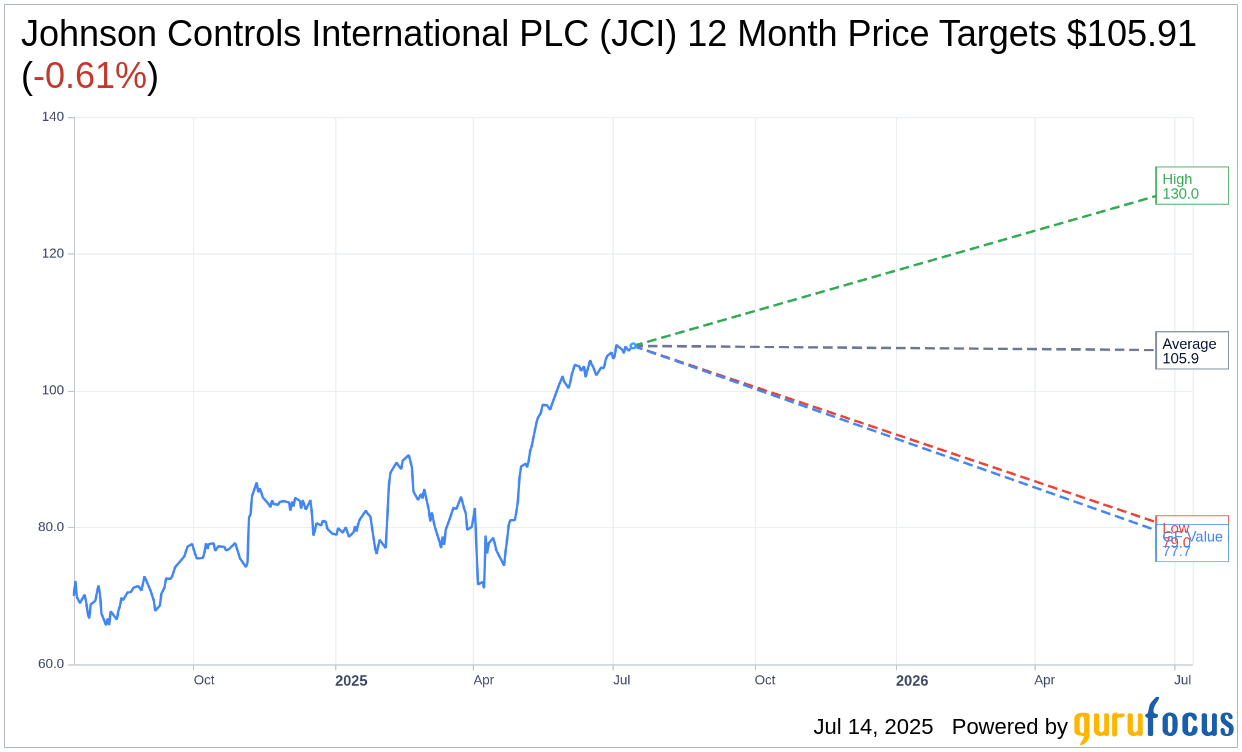

Based on the one-year price targets offered by 18 analysts, the average target price for Johnson Controls International PLC (JCI, Financial) is $105.91 with a high estimate of $130.00 and a low estimate of $79.00. The average target implies an downside of 0.61% from the current price of $106.56. More detailed estimate data can be found on the Johnson Controls International PLC (JCI) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, Johnson Controls International PLC's (JCI, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Johnson Controls International PLC (JCI, Financial) in one year is $77.73, suggesting a downside of 27.06% from the current price of $106.56. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Johnson Controls International PLC (JCI) Summary page.