- Major Surge: The Trade Desk (TTD, Financial) soared 14% in after-hours trading due to its imminent inclusion in the S&P 500 Index.

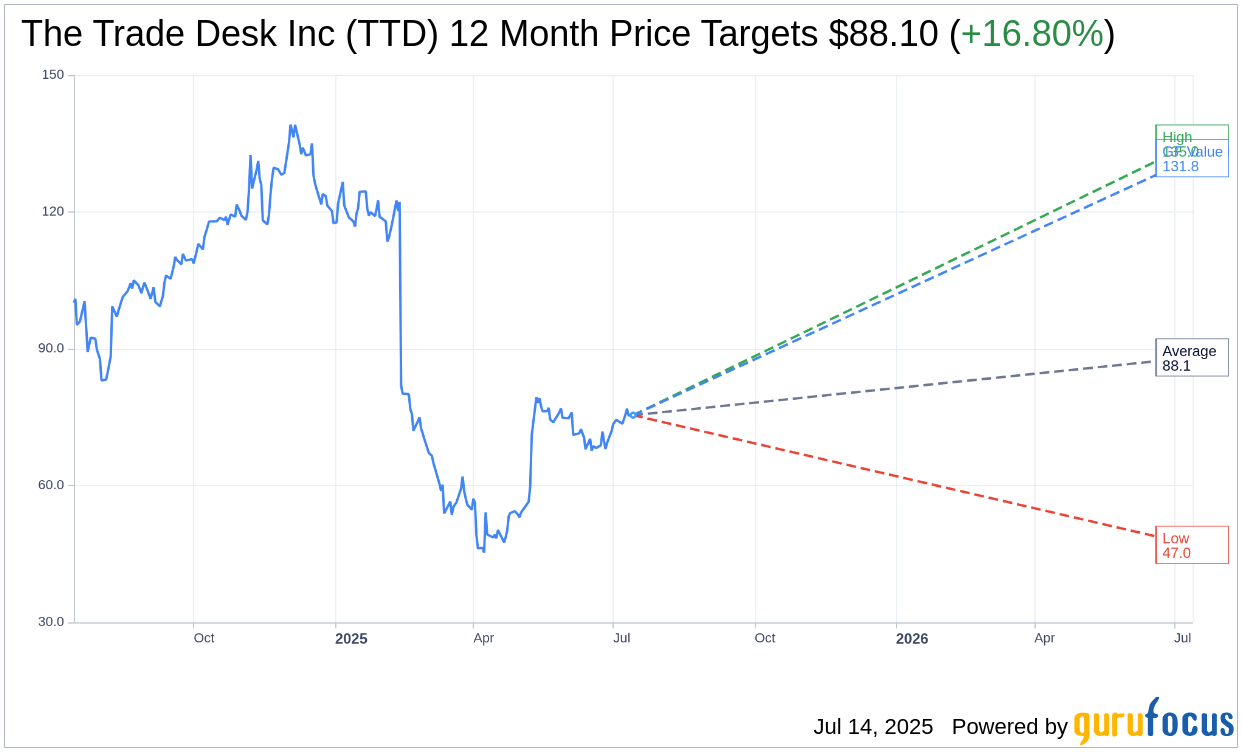

- Analyst Insights: Average analyst price target suggests a potential 16.80% upside.

- Valuation Metrics: GuruFocus estimates indicate a potential 74.72% upside based on GF Value.

The digital advertising powerhouse, The Trade Desk (TTD), has made headlines as its stock skyrocketed 14% in after-hours trading. This surge follows the announcement of its upcoming addition to the S&P 500 Index, where it will replace ANSYS before markets open on July 18. However, it's notable that despite this boost, TTD's stock has experienced a year-to-date decline of over 35%.

Wall Street Analysts' Insights on The Trade Desk

According to 33 top analysts, The Trade Desk Inc (TTD, Financial) holds a promising one-year price target. Their average target price is pegged at $88.10, with forecasts ranging from a high of $135.00 to a low of $47.00. This suggests a potential upside of 16.80% from its current price of $75.43. For more in-depth information, visit The Trade Desk Inc (TTD) Forecast page.

Brokerage Recommendations and GF Value Estimation

The consensus among 40 brokerage firms places The Trade Desk Inc (TTD, Financial) at an average recommendation of 2.1, subtly hinting at an "Outperform" status within the market. This rating operates on a scale from 1 to 5, where 1 signifies a Strong Buy, and 5 suggests a Sell stance.

Adding another layer of intrigue, GuruFocus estimates propose an anticipated GF Value of $131.79 for The Trade Desk Inc (TTD, Financial) in the coming year. This estimate presents a compelling upside of 74.72% from its current position at $75.43. The GF Value is a proprietary metric by GuruFocus, reflecting the fair trading value of the stock, meticulously calculated from historical trading multiples, past business growth, and potential future business performance. For a detailed analysis, explore the The Trade Desk Inc (TTD) Summary page.