Key Highlights:

- J.B. Hunt Transport Services is set to announce its Q2 earnings on July 15th.

- Projected earnings per share show a slight year-over-year decrease to $1.30.

- Analysts forecast a 2.27% upside based on current stock price.

Upcoming Earnings Release

J.B. Hunt Transport Services (JBHT, Financial) is poised to unveil its second-quarter earnings results on July 15th, after the market closes. Current analyst projections are setting the earnings per share at $1.30, marking a modest 1.5% decline compared to the previous year. Similarly, revenues are anticipated to reach approximately $2.92 billion, experiencing a marginal decline of 0.3%. Over recent months, earnings forecasts have undergone two upward and 18 downward revisions, while revenue estimates have seen two upward and 12 downward adjustments.

Wall Street Analysts Forecast

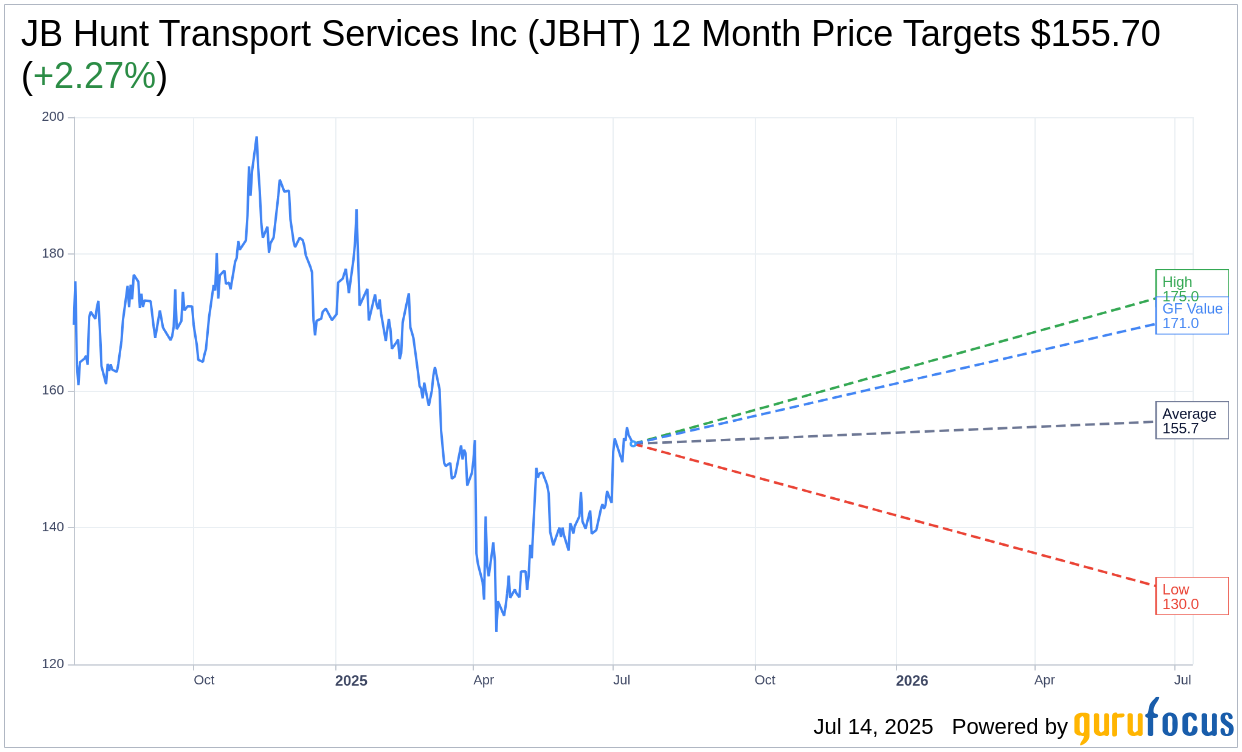

According to consensus estimates from 23 Wall Street analysts, the average one-year price target for J.B. Hunt Transport Services Inc (JBHT, Financial) stands at $155.70. This target suggests a potential upside of 2.27% from the current market price of $152.24, with prediction ranges spanning from a high of $175.00 to a low of $130.00. For those seeking further insight, more comprehensive price target data can be accessed on the JB Hunt Transport Services Inc (JBHT) Forecast page.

Brokerage Recommendations and GF Value

Considering recommendations from 27 brokerage firms, J.B. Hunt Transport Services Inc (JBHT, Financial) receives an average rating of 2.2, translating to an "Outperform" status. The brokerage recommendation system spans from 1 to 5, where 1 signifies a Strong Buy and 5 indicates a Sell.

Utilizing GuruFocus' proprietary metrics, the estimated GF Value for J.B. Hunt Transport Services Inc (JBHT, Financial) is pegged at $171.01 over the next year. This assessment suggests a noteworthy upside potential of 12.33% from the current share price of $152.24. The GF Value is a calculated estimate reflecting the stock's fair trading value, derived from historical trading multiples, prior business growth, and prospective performance estimates. For a more in-depth look at JBHT's valuation metrics, visit the JB Hunt Transport Services Inc (JBHT) Summary page.