- Nvidia to resume sales of H20 GPUs in China amid easing trade restrictions.

- Analysts forecast an 8.68% potential upside in Nvidia's stock price.

- GuruFocus estimates a significant 70.85% increase in stock value within a year.

Nvidia (NVDA, Financial), a global leader in graphics processing technology, has announced plans to resume sales of its H20 GPUs to China. This decision follows assurances from the U.S. government regarding the issuance of necessary export licenses. Nvidia had previously halted these sales in April due to stringent export restrictions, but with trade tensions softening, the company aims to reclaim its market position.

Wall Street Analysts' Insights

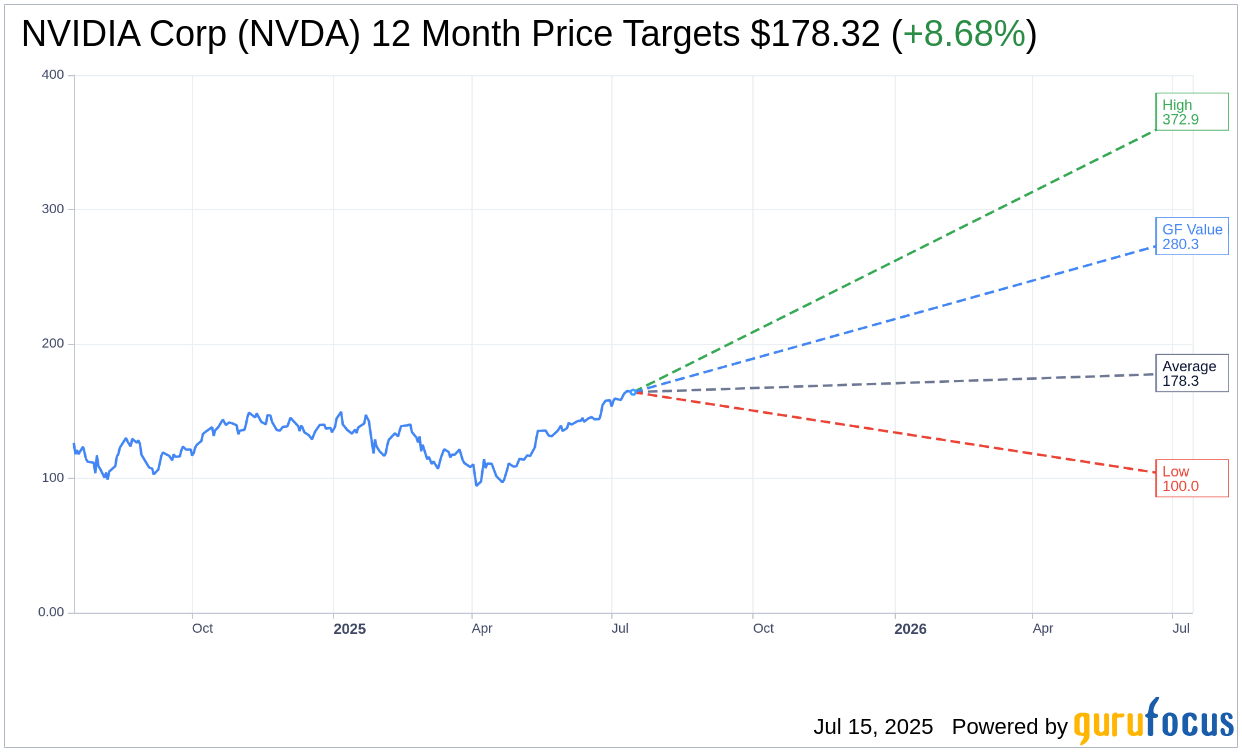

With insights from 53 analysts, the consensus on Nvidia Corp (NVDA, Financial) projects an average target price of $178.32. This spans from a high of $372.87 to a low of $100.00, signaling an anticipated upside of 8.68% from the current trading price of $164.07. For a deeper dive into these projections, refer to the NVIDIA Corp (NVDA) Forecast page.

Furthermore, Nvidia Corp (NVDA, Financial) holds an "Outperform" status with an average brokerage recommendation of 1.8, as determined by 66 different brokerage firms. This rating operates on a scale where 1 stands for Strong Buy, and 5 indicates Sell.

GuruFocus Valuation Estimates

GuruFocus provides an estimated GF Value for Nvidia Corp (NVDA, Financial) at $280.31 within a year, suggesting a robust upside potential of 70.85% from the current price of $164.07. The GF Value represents an amalgamation of historical trading multiples and future business performance forecasts. For comprehensive data, visit the NVIDIA Corp (NVDA) Summary page.