Ericsson (ERIC, Financial) posted its second-quarter revenue at SEK 56.13 billion, showing a decline from SEK 59.85 billion in the same period last year. The company's CEO, Borje Ekholm, highlighted that the quarter reflected effective execution of strategic goals, achieving the highest adjusted EBITA margin seen in three years due to ongoing cost-saving measures. Ericsson has successfully reduced its cost base and continues to drive toward greater efficiencies. In the Americas, growth remains strong while European markets show signs of stabilization.

The global customer base for fixed wireless access services has surpassed 160 million, significantly increasing network demand. While 5G standalone adoption is still in the early stages, it is essential to support advanced AI applications requiring low latency and improved uplink functions. Ericsson plans to boost its investments in AI, including projects within the Swedish AI factory consortium, to enhance innovation and internal efficiency. The company is also expanding its network API reach, with Aduna extending this offering to the three major service providers in Japan.

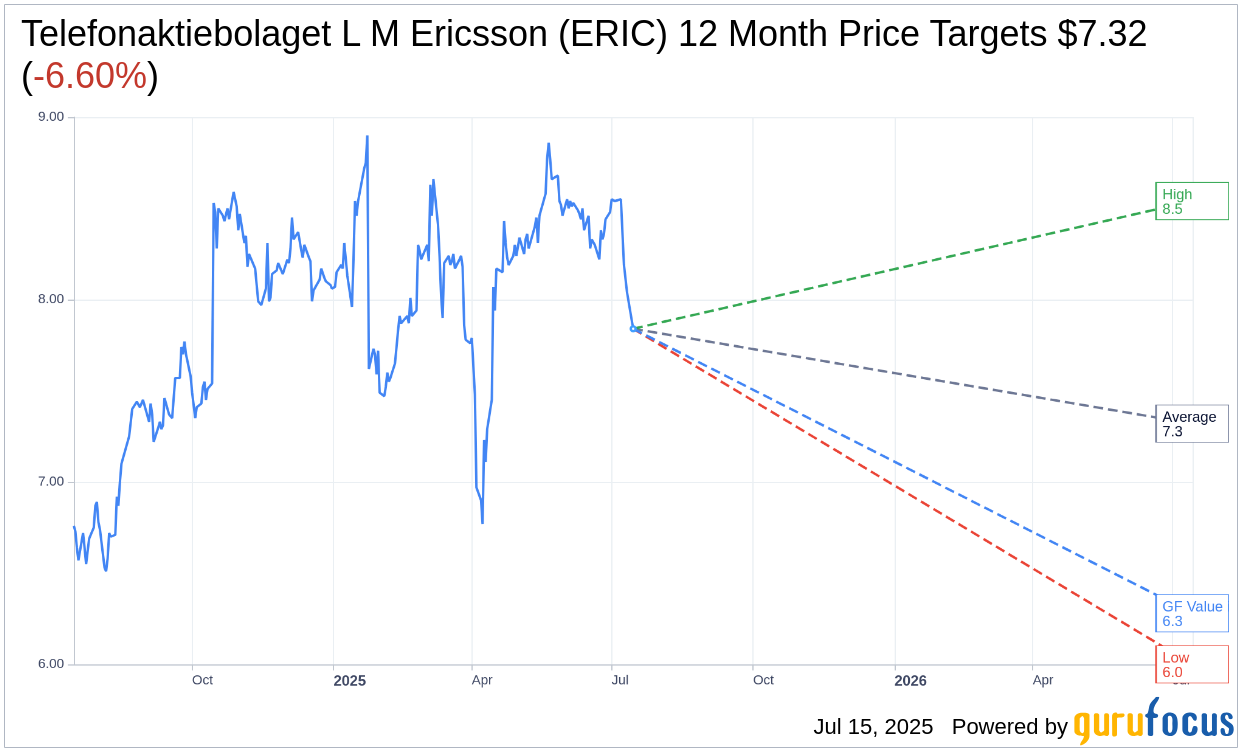

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Telefonaktiebolaget L M Ericsson (ERIC, Financial) is $7.32 with a high estimate of $8.54 and a low estimate of $6.00. The average target implies an downside of 6.60% from the current price of $7.84. More detailed estimate data can be found on the Telefonaktiebolaget L M Ericsson (ERIC) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Telefonaktiebolaget L M Ericsson's (ERIC, Financial) average brokerage recommendation is currently 3.3, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Telefonaktiebolaget L M Ericsson (ERIC, Financial) in one year is $6.28, suggesting a downside of 19.9% from the current price of $7.84. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Telefonaktiebolaget L M Ericsson (ERIC) Summary page.

ERIC Key Business Developments

Release Date: April 15, 2025

- Net Sales: SEK 55 billion, with a 3% reported increase including a currency benefit of SEK 1.8 billion.

- Gross Margin: 48.5%, up from 42.7% last year.

- EBITA Margin: 12.6%, supported by increased gross income.

- Operating Expenses: SEK 20.5 billion, flat compared to the prior year.

- Cash Flow: SEK 2.7 billion, a slight decline compared to last year.

- Networks Sales: SEK 35.6 billion, with a 6% year-on-year increase.

- Networks Gross Margin: 51%, benefiting from product and market mix.

- Networks EBITA: SEK 7.5 billion, with a significant year-on-year margin increase to 21%.

- Cloud Software & Services Gross Margin: 39.9%, benefiting from a higher software share.

- Enterprise Sales: Decreased by 1%, with organic sales down 7%.

- Free Cash Flow: SEK 2.7 billion before M&A.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Telefonaktiebolaget L M Ericsson (ERIC, Financial) reported a strong gross margin of 48.5% for Q1 2025, an improvement from 42.7% the previous year.

- The company achieved an EBITA margin of 12.6%, supported by increased gross income.

- Sales in the Americas market area increased by 20% year-over-year, with strong growth in North America.

- The Cloud Software and Services segment reported its first positive first quarter ever, indicating progress in strategic priorities.

- Telefonaktiebolaget L M Ericsson (ERIC) announced new partnerships to accelerate the development of programmable networks, enhancing its leadership in mobile networks.

Negative Points

- Sales in Europe, Middle East, and Africa declined by 7% year-over-year, with Europe remaining stable but offset by declines in other regions.

- Sales in Southeast Asia, Oceania, and India decreased by 17% year-over-year due to normalized operator investment levels in India.

- The company faces intense competition from Chinese vendors, particularly impacting sales in Latin America.

- The macroeconomic environment and tariffs are creating uncertainties that could affect customer behaviors and investment decisions.

- Telefonaktiebolaget L M Ericsson (ERIC) experienced a decline in free cash flow to SEK 2.7 billion, partly due to seasonal payments and early payments in Q4.