- Nvidia's share price surged by 4% due to renewed access to the Chinese market.

- Analyst price targets indicate a potential 8.68% upside from the current price.

- GuruFocus estimates an impressive 70.85% potential upside in the next year.

Nvidia (NVDA, Financial) shares experienced a notable 4% increase after the company announced its plans to resume sales of its H20 GPUs to Chinese customers. This decision was made possible following assurances from the U.S. government regarding export licenses, allowing Nvidia to navigate past previous restrictions. This development is part of an initial trade agreement that aims to foster technological exports between the U.S. and China.

Wall Street Analysts Forecast

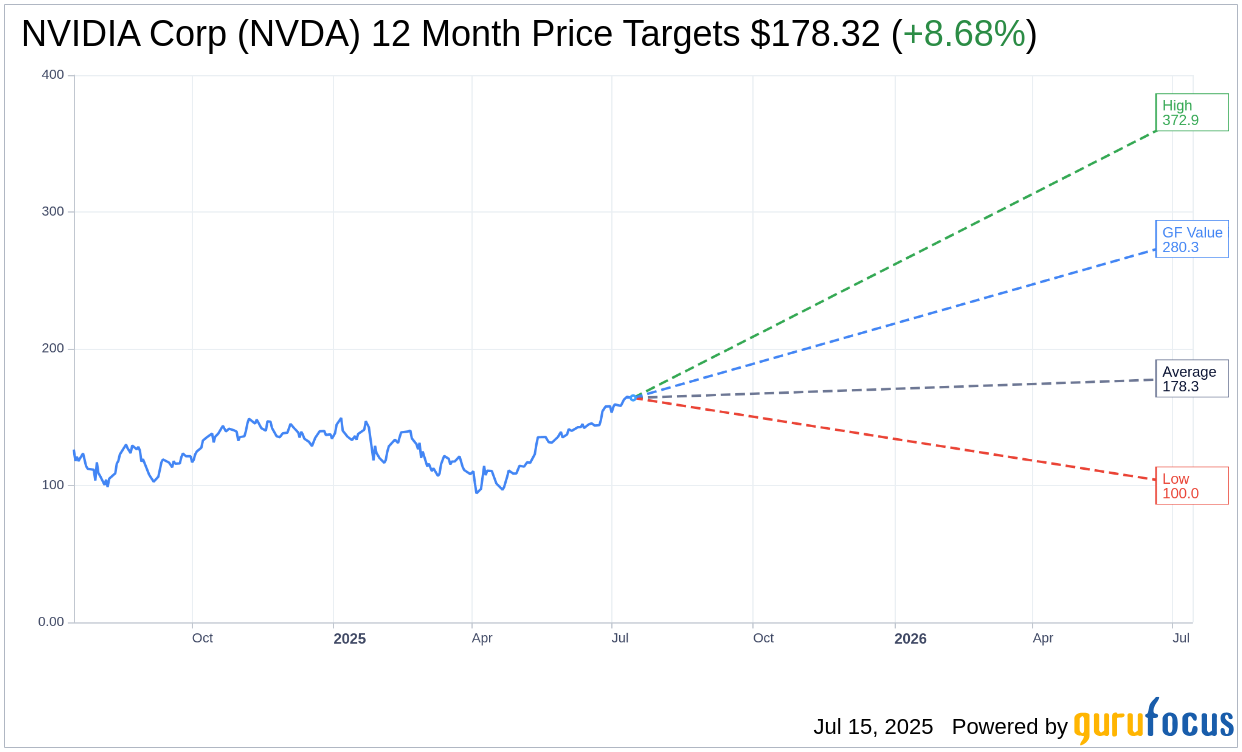

According to insights from 53 analysts, the average one-year price target for NVIDIA Corp (NVDA, Financial) stands at $178.32. This projection includes a high estimate of $372.87 and a low estimate of $100.00. These figures suggest an 8.68% potential upside from the current price of $164.07. For more detailed forecast information, visit the NVIDIA Corp (NVDA) Forecast page.

Moreover, the consensus recommendation from 66 brokerage firms gives NVIDIA Corp (NVDA, Financial) an average recommendation of 1.8, signifying an "Outperform" status. The rating system ranges from 1, which indicates a Strong Buy, to 5, representing a Sell recommendation.

GuruFocus GF Value Estimates

GuruFocus estimates place the GF Value of NVIDIA Corp (NVDA, Financial) at $280.31 in one year, implying a substantial potential upside of 70.85% from the current price of $164.07. This GF Value is GuruFocus' assessment of the stock's fair trading value, derived from historical multiples, past business growth, and future performance projections. For more comprehensive data, explore the NVIDIA Corp (NVDA) Summary page.