- Nvidia's strategic move to resume its H20 GPU sales in China could enhance quarterly sales by $8 billion.

- NVIDIA Corp's (NVDA, Financial) stock price is projected to grow, with Wall Street analysts forecasting an average target price of $178.32.

- GuruFocus estimates a significant upside of 70.85% based on their GF Value assessment.

Nvidia (NVDA) has unveiled plans to restart the sales of its H20 graphics processing units (GPUs) in China, a move anticipated to significantly boost the company’s revenue potential. This strategic decision comes on the heels of receiving the necessary licensing assurances from the U.S. government. Analysts predict this development could enhance Nvidia's quarterly sales by a staggering $8 billion, a promising outlook for both the company and the broader tech sector.

Wall Street Analysts Forecast

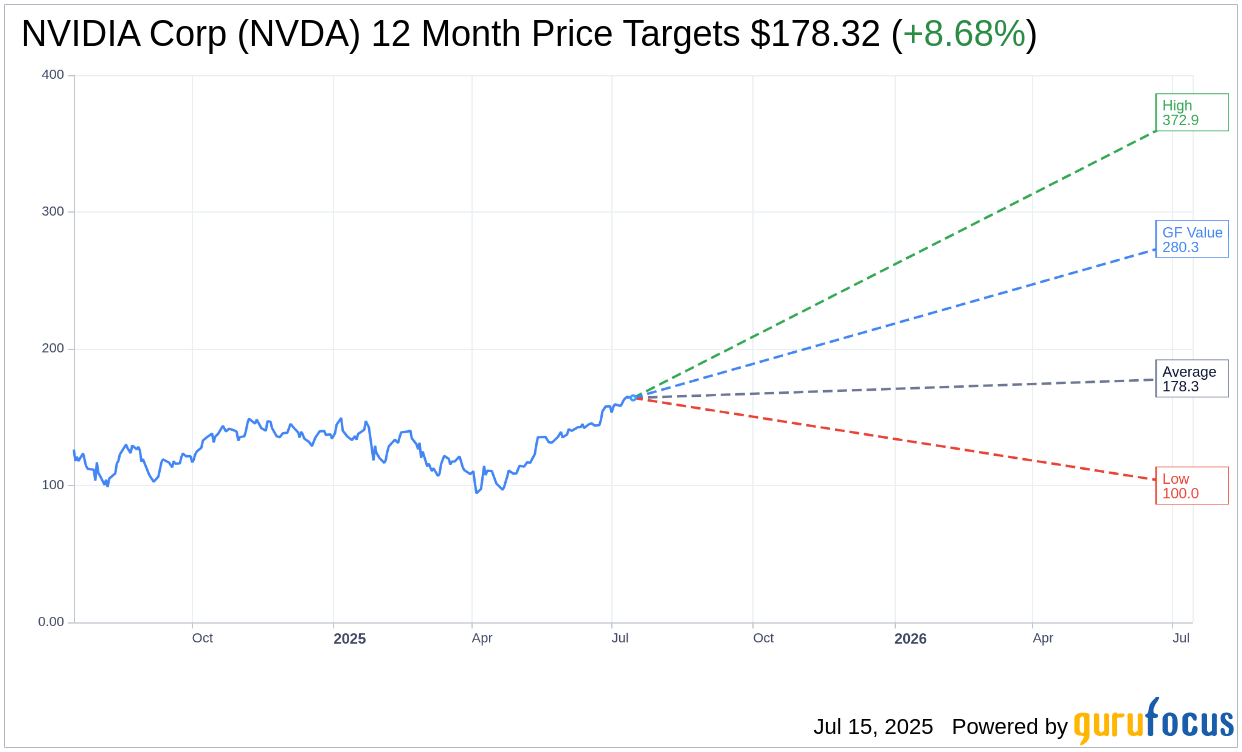

According to one-year price targets set by 53 analysts, the average target price for NVIDIA Corp (NVDA, Financial) stands at $178.32. This includes a high projection of $372.87 and a low of $100.00. The current average price target suggests an upside of 8.68% from the latest trading price of $164.07. Investors looking for more detailed forecast data can visit the NVIDIA Corp (NVDA) Forecast page.

Furthermore, with an average brokerage recommendation score of 1.8, NVIDIA Corp is classified under "Outperform" status. This consensus is derived from 66 brokerage firms, utilizing a rating scale where 1 represents a Strong Buy and 5 indicates a Sell.

Nvidia's GF Value Insights

GuruFocus presents an estimated GF Value for NVIDIA Corp (NVDA, Financial) at $280.31 for the coming year, which implies a substantial upside potential of 70.85% from its current price of $164.07. The GF Value is a critical metric that represents the fair value at which the stock should ideally trade, calculated considering historical trading multiples, past business growth, and future performance projections. For an in-depth view, investors can explore the NVIDIA Corp (NVDA) Summary page.

As Nvidia navigates these promising prospects, investors may find significant opportunity and value in following the company's journey and analysts' insights closely.