A recent study from Pure Sunfarms, published in Scientific Reports, emphasizes the significant natural variation in THC levels within cannabis plants. This research, spearheaded by the Village Farms (VFF, Financial) Canadian Cannabis Research, Development & Lab team, examined dried cannabis flowers from commercial production. Researchers assessed potency in different parts of the plant, known as strata, and discovered considerable differences in THC concentrations within individual plants and across various strains.

Currently, Canadian regulations mandate that licensed cannabis producers list a single THC percentage on product packaging. However, the study's findings suggest that this practice may inadequately reflect the actual cannabinoid content due to biological variability. This could mislead consumers regarding the potency they can expect from purchased products. The insights from this study could pave the way for informed policy discussions and potential changes in regulatory standards in the cannabis industry.

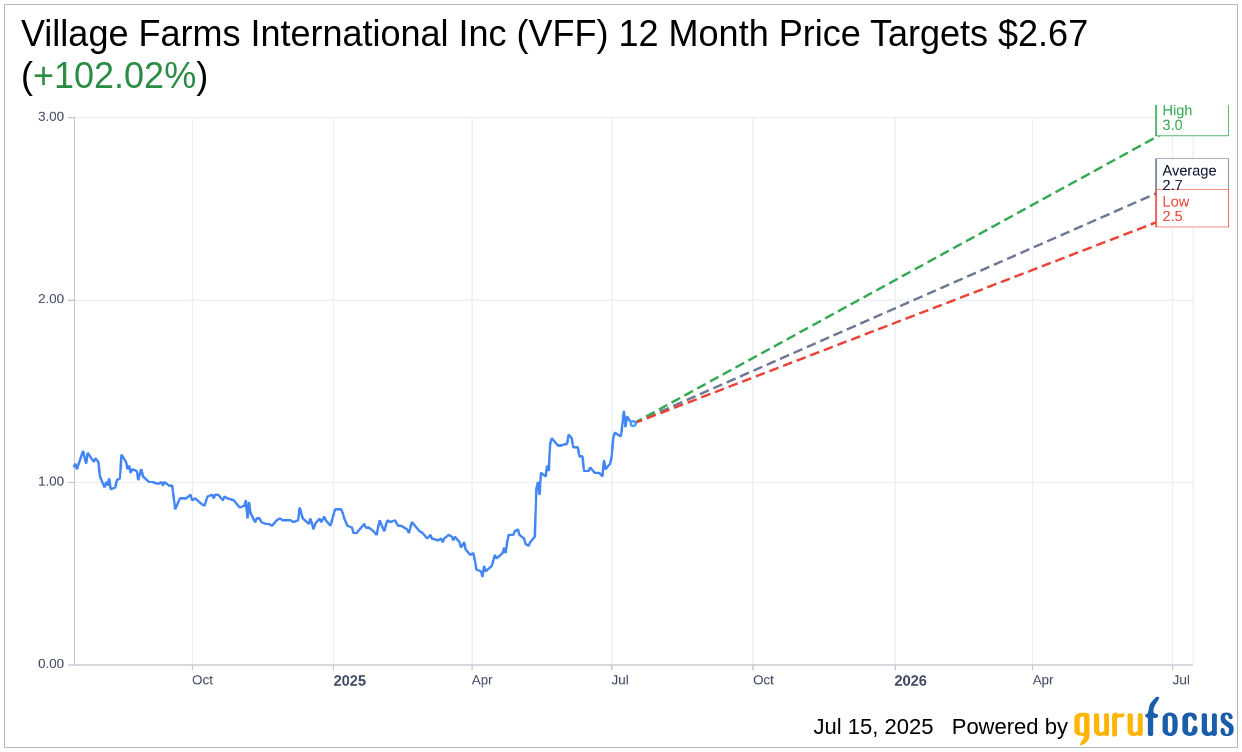

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Village Farms International Inc (VFF, Financial) is $2.67 with a high estimate of $3.00 and a low estimate of $2.50. The average target implies an upside of 102.02% from the current price of $1.32. More detailed estimate data can be found on the Village Farms International Inc (VFF) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Village Farms International Inc's (VFF, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Village Farms International Inc (VFF, Financial) in one year is $0.64, suggesting a downside of 51.52% from the current price of $1.32. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Village Farms International Inc (VFF) Summary page.

VFF Key Business Developments

Release Date: May 13, 2025

- Revenue: USD 77 million, a slight decrease of 1% from the prior year's first quarter.

- Net Loss: USD 6.7 million or USD 0.06 per share, compared to a loss of USD 2.9 million or USD 0.03 per share in the prior year.

- Gross Margin (Canadian Cannabis): Increased from 25% to 36% year-over-year.

- Adjusted EBITDA (Canadian Cannabis): CAD 9.6 million, up 75% from the previous year.

- Medical Export Sales Growth: Increased by 285% year-over-year.

- Net Sales (Canadian Cannabis): CAD 50 million, roughly in line with the previous year.

- International Sales (Canadian Cannabis): CAD 7.7 million, nearly matching the entire 2024 international sales.

- Net Income (Clean Energy): USD 300,000 from royalty payments.

- Cash Flow from Operations: Negative USD 6.4 million for the first quarter.

- Cash Position: USD 15 million at the end of Q1.

- Working Capital: USD 50 million.

- Net Debt: USD 19.3 million.

- Term Debt: USD 34 million at the end of Q1.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Village Farms International Inc (VFF, Financial) announced a transformative transaction to privatize the majority of its Fresh Produce division into a new joint venture, Vanguard Foods LP, which is expected to unlock long-term value.

- The company will retain a 37.9% ownership interest in Vanguard and receive $40 million in cash proceeds, enhancing its financial position.

- Canadian cannabis operations reported a strong quarter with a 285% year-over-year increase in higher-margin medical export sales.

- The company achieved a significant expansion of its gross margin for Canadian cannabis from 25% to 36%, aligning with its targeted range.

- Village Farms International Inc (VFF) reported strong increases in adjusted EBITDA and net income, with a 75% and 291% rise, respectively, reflecting improved profitability.

Negative Points

- The company's net loss increased to $6.7 million from $2.9 million in the prior year, primarily due to weaker performance in the VF fresh segment.

- Dust storms in Texas significantly impacted the company's fresh produce operations, resulting in a 31% increase in cost per pound at the Fort Davis facility.

- Consolidated EBITDA was essentially flat compared to the previous year, driven by challenges in the fresh produce segment.

- Lower retail branded sales in Canadian cannabis were expected as the company shifted focus away from lower-margin categories.

- The US cannabis business continued to face regulatory headwinds, impacting sales, although it returned to positive adjusted EBITDA.