- Albertsons Companies (ACI, Financial) posted strong first-quarter results, with a notable revenue increase of 2.5% year-over-year, reaching $24.9 billion.

- Despite the revenue surge, the gross margin dipped due to investments in customer initiatives and digital sales.

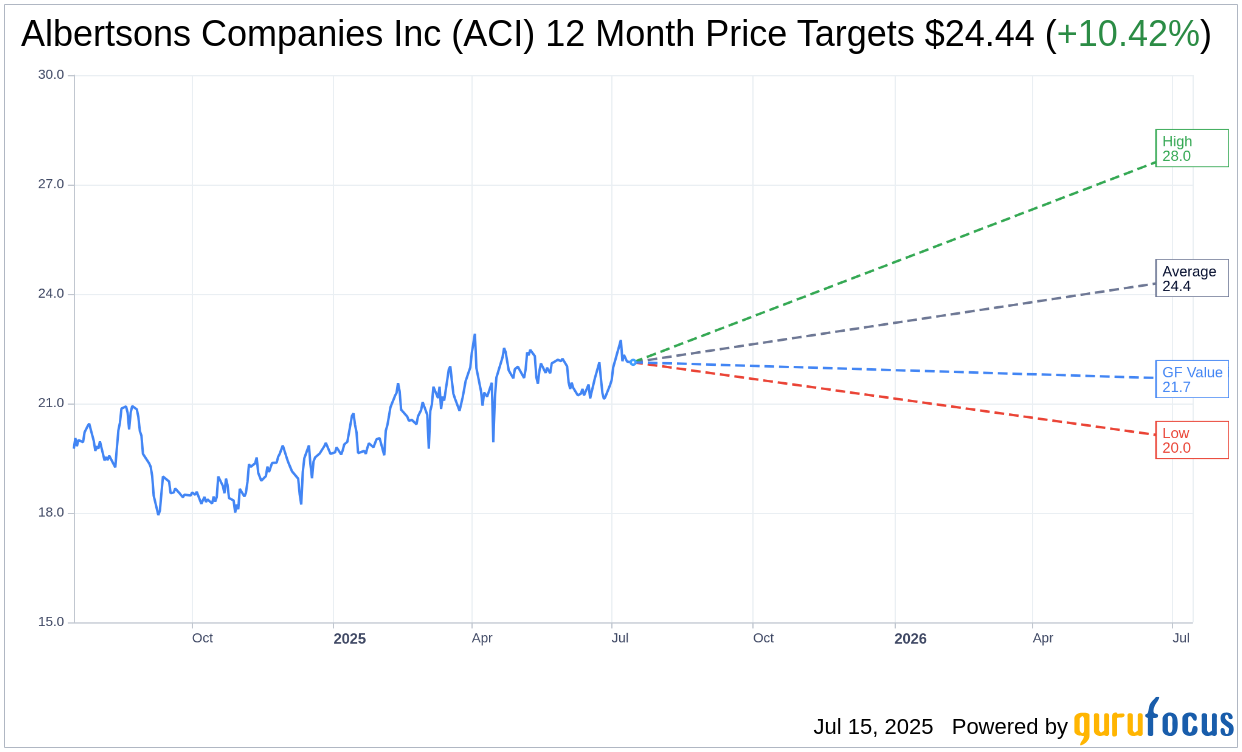

- Market analysts have set a promising average one-year price target, projecting a potential upside of 10.42%.

Albertsons Companies Inc. (NYSE: ACI) has once again surprised the market with its strong first-quarter financial results, demonstrating robust growth and operational resilience. The company achieved a commendable 2.5% increase in revenue year-over-year, totaling an impressive $24.9 billion. This growth was primarily propelled by a significant 2.8% rise in identical sales, largely driven by the strength in pharmacy sales. However, the success came with a slight setback as the gross margin declined, attributed to increased investments in customer-centric initiatives and escalating digital sales costs.

Wall Street Analysts Forecast

Wall Street analysts have set ambitious one-year price targets for Albertsons Companies Inc. (ACI, Financial). The average price target stands at $24.44, with predictions ranging from a high of $28.00 to a low of $20.00. This average target suggests a potential upside of 10.42% from the current trading price of $22.13. For more in-depth estimate data, investors are encouraged to visit the Albertsons Companies Inc (ACI) Forecast page.

The consensus from 21 brokerage firms highlights a favorable sentiment towards Albertsons, with an average brokerage recommendation of 2.4, categorizing it under "Outperform." This rating is on a scale where 1 suggests a "Strong Buy" and 5 indicates a "Sell," reflecting analysts' confidence in the company's growth trajectory.

According to GuruFocus estimates, the estimated GF Value for Albertsons Companies Inc (ACI, Financial) over the next year is projected at $21.67, suggesting a slight downside of 2.08% from its current price of $22.13. The GF Value is a proprietary estimate by GuruFocus, representing the fair market value of the stock based on historical trading multiples, previous business growth, and anticipated future performance. For a detailed analysis of the company's valuation, investors can access the Albertsons Companies Inc (ACI) Summary page.