Oppenheimer has raised the price target for Monolithic Power Systems (MPWR, Financial) from $700 to $800 while maintaining an Outperform rating. This adjustment is part of their second-quarter preview for the semiconductor sector. The firm anticipates that many companies in this group will exceed expectations, largely due to their involvement in artificial intelligence technologies. Oppenheimer continues to hold a positive long-term outlook on semiconductors, recognizing their essential role in AI and the broader technology industry.

Wall Street Analysts Forecast

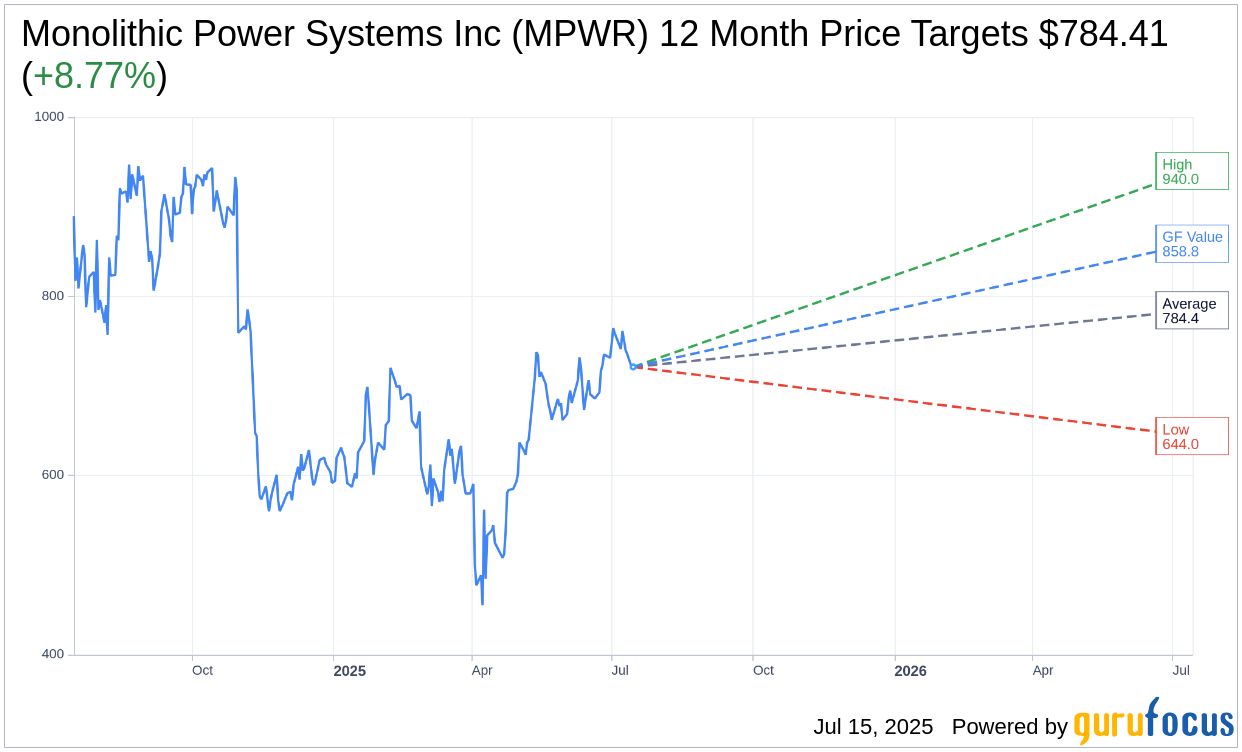

Based on the one-year price targets offered by 13 analysts, the average target price for Monolithic Power Systems Inc (MPWR, Financial) is $784.41 with a high estimate of $940.00 and a low estimate of $644.00. The average target implies an upside of 8.77% from the current price of $721.14. More detailed estimate data can be found on the Monolithic Power Systems Inc (MPWR) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, Monolithic Power Systems Inc's (MPWR, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Monolithic Power Systems Inc (MPWR, Financial) in one year is $858.82, suggesting a upside of 19.09% from the current price of $721.14. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Monolithic Power Systems Inc (MPWR) Summary page.