Highlights:

- Trade Desk (TTD, Financial) shares experience a significant 14% boost following its addition to the S&P 500 index.

- Wedbush analysts maintain a positive outlook, citing growth potential and reduced competition concerns.

- Projected advances in digital advertising market share fuel optimistic long-term prospects.

Trade Desk's Impressive Surge

Trade Desk (TTD) shares surged by an impressive 14% during premarket trading after the announcement of its inclusion in the S&P 500 index. This development has garnered attention from various analysts, including those at Wedbush, who continue to view the stock favorably. The analysts believe that there is significant growth potential bolstered by decreased concerns regarding competition. Coupled with the anticipated growth in digital advertising market share, the outlook for Trade Desk remains promising.

Wall Street Analysts' Insights

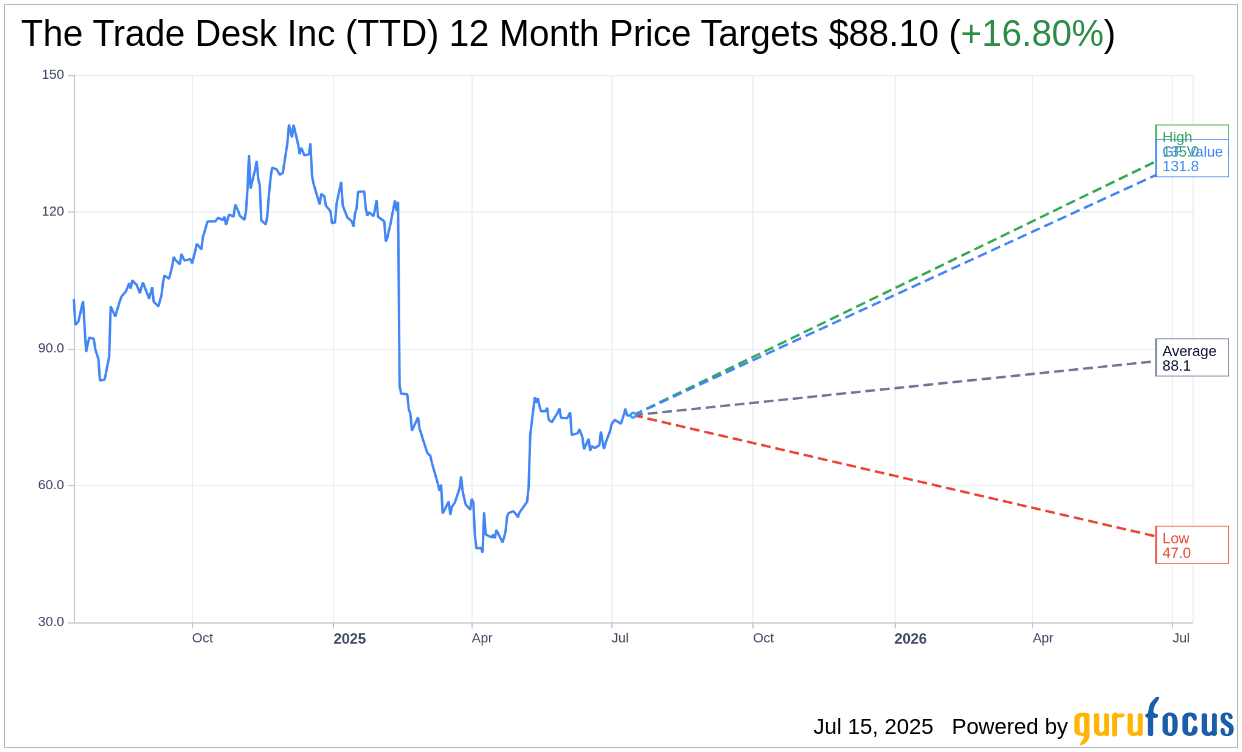

The latest one-year price targets from 33 analysts suggest an average target price of $88.10 for The Trade Desk Inc (TTD, Financial), with estimates ranging from a high of $135.00 to a low of $47.00. This average target represents a potential upside of 16.80% from the current share price of $75.43. For further insights into these projections, visit the The Trade Desk Inc (TTD) Forecast page.

According to the consensus recommendation from 40 brokerage firms, The Trade Desk Inc holds an "Outperform" status with an average recommendation score of 2.1. This rating is based on a scale where 1 indicates a Strong Buy and 5 suggests a Sell.

GuruFocus' Valuation Perspective

From the perspective of GuruFocus estimates, the projected GF Value for The Trade Desk Inc (TTD, Financial) over the next year is $131.79. This figure suggests a substantial upside of 74.72% from the current trading price of $75.43. The GF Value is a reliable estimate of the stock's fair trading value, calculated using historical trading multiples, past business growth, and forecasts of future performance. For more comprehensive data, visit the The Trade Desk Inc (TTD) Summary page.