- Jefferies has commenced coverage on Philip Morris International (PM, Financial) with a Buy rating, positioning the tobacco giant as a defensive sector favorite.

- Analysts set an average price target of $184.76 for PM, forecasting a 2.22% potential upside.

- GuruFocus estimates a one-year GF Value for PM at $130.99, indicating a potential downside of 27.53%.

Jefferies has started coverage on Philip Morris International (PM) with an optimistic Buy rating. This move aligns with the perspective that the tobacco industry maintains its status as a defensive stronghold for savvy investors. Recent statistics underscore this, as tobacco prices surged by 6.3% year-over-year in June, demonstrating the sector’s continued profitability despite prevailing economic uncertainties.

Wall Street Analysts Forecast

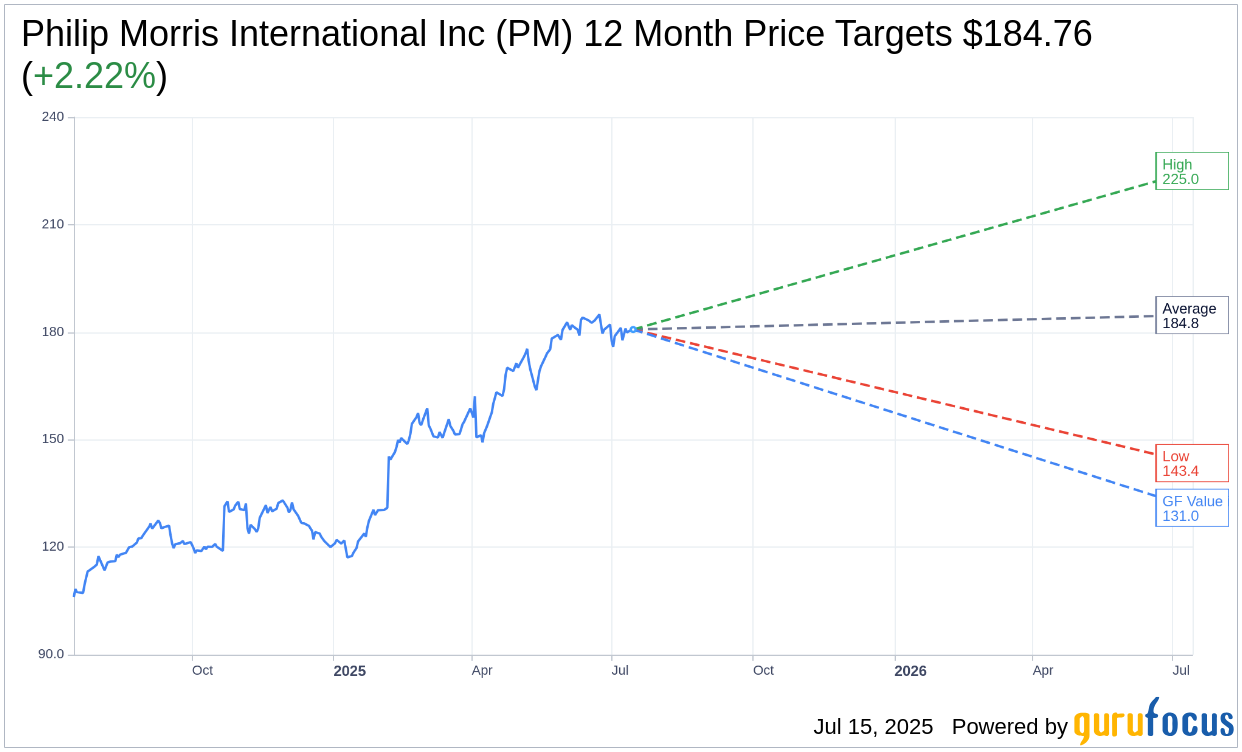

Analysts have set their sights on Philip Morris International Inc (PM, Financial), with 15 experts contributing to a one-year price target. The average target stands at $184.76, showcasing the potential for a moderate upside of 2.22% from the current trading price of $180.75. Among these projections, the highest estimate reaches an impressive $225.00, while the most conservative forecast sits at $143.45. Investors can explore more detailed estimates on the Philip Morris International Inc (PM) Forecast page.

The consensus from 18 brokerage firms suggests that Philip Morris International Inc (PM, Financial) enjoys an average brokerage recommendation of 2.1, translating to an "Outperform" status on a scale where 1 signifies a Strong Buy and 5 indicates a Sell.

According to GuruFocus estimates, Philip Morris International Inc (PM, Financial) is projected to have a one-year GF Value of $130.99, which suggests a potential downside of 27.53% from the current price level. The GF Value represents GuruFocus' assessment of the fair trading value of the stock, grounded in historical trading multiples, past growth, and future performance predictions. For a deeper dive, visit the Philip Morris International Inc (PM) Summary page.