Enovix Corporation (ENVX, Financial) has issued an additional document addressing Frequently Asked Questions about its previously announced warrant dividend distribution. This document aims to clarify several key issues of concern to shareholders and brokers. Notable topics include potential restrictions for those holding Enovix shares in margin accounts and the timing requirements for share purchases to qualify for warrant eligibility. These clarifications are intended to assist stakeholders in understanding their entitlements and conditions surrounding the warrant distribution.

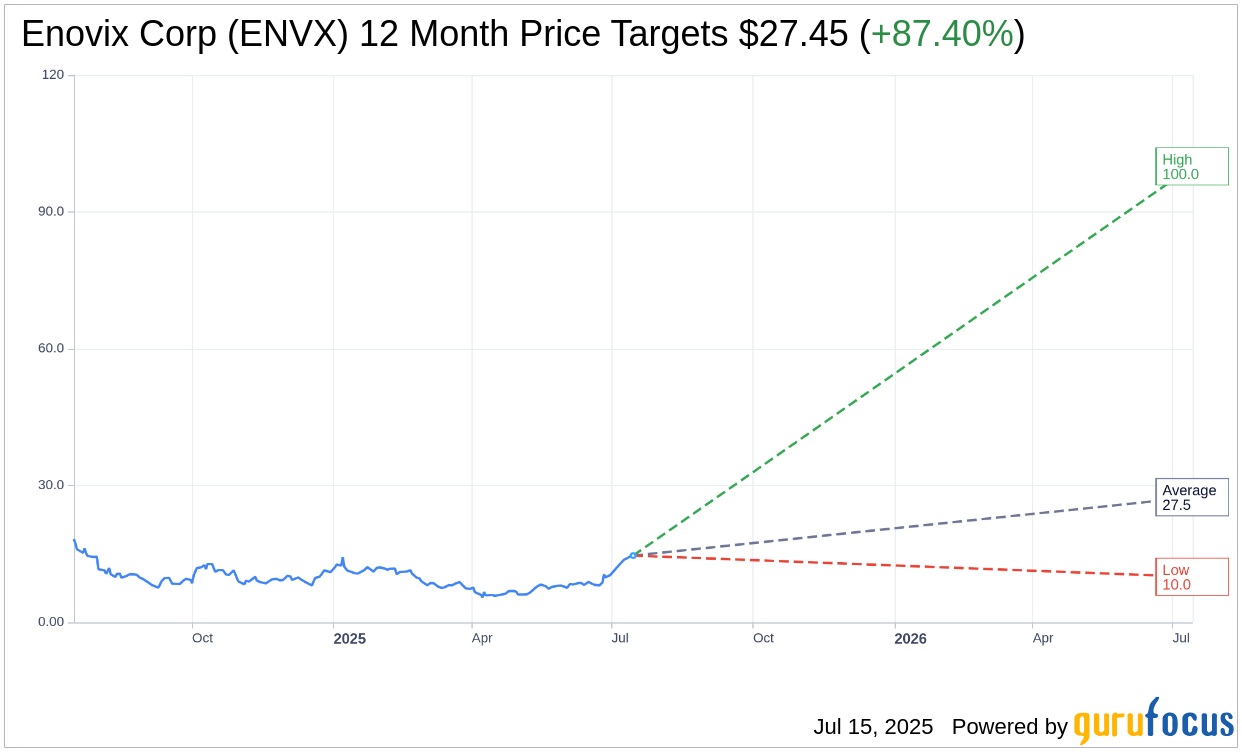

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for Enovix Corp (ENVX, Financial) is $27.45 with a high estimate of $100.00 and a low estimate of $10.00. The average target implies an upside of 87.40% from the current price of $14.65. More detailed estimate data can be found on the Enovix Corp (ENVX) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Enovix Corp's (ENVX, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Enovix Corp (ENVX, Financial) in one year is $31.50, suggesting a upside of 115.02% from the current price of $14.65. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Enovix Corp (ENVX) Summary page.

ENVX Key Business Developments

Release Date: April 30, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Enovix Corp (ENVX, Financial) exceeded the midpoint of their Q1 revenue guidance, delivering $5.1 million in revenue.

- The company secured new defense bookings, supporting growth into the second quarter.

- Enovix Corp (ENVX) commenced the development of a custom smartphone cell for a lead customer, marking progress in their smartphone initiative.

- The company achieved ISO 9001 certification in Malaysia, enhancing their mass production readiness.

- A strategic acquisition in Korea expanded their manufacturing footprint, providing additional coding capacity and supporting local defense customers.

Negative Points

- Enovix Corp (ENVX) reported an adjusted loss of $22.2 million, near the high end of their guidance range.

- The company experienced increased expenses to support manufacturing scale-up in Asia, impacting their financials.

- Non-GAAP net loss per share was $0.15, at the high end of their guidance range.

- Capital expenditures were $6.3 million, and cash used in operations totaled $16.9 million, indicating significant cash outflow.

- The company faces challenges in meeting stringent requirements for smartphone batteries, which could impact timelines and costs.