Revolution Medicines (RVMD, Financial) received attention from financial giant Goldman Sachs as they initiated coverage on the company with a 'Buy' rating. The announcement came from analyst Andrea Newkirk, making a strong case for investment in the stock.

As part of this coverage initiation, Goldman Sachs set a price target of USD 65.00 for Revolution Medicines (RVMD, Financial), indicating potential upside in the stock's valuation. This move signifies positive sentiment from the investment community, potentially boosting investor confidence in the coming months.

The announcement by Goldman Sachs is dated July 15, 2025, detailing their assessment and price target for Revolution Medicines (RVMD, Financial). With the current market dynamics, this initiation could steer significant interest towards Revolution Medicines, making it a focal point for investors seeking opportunities in the biotech sector.

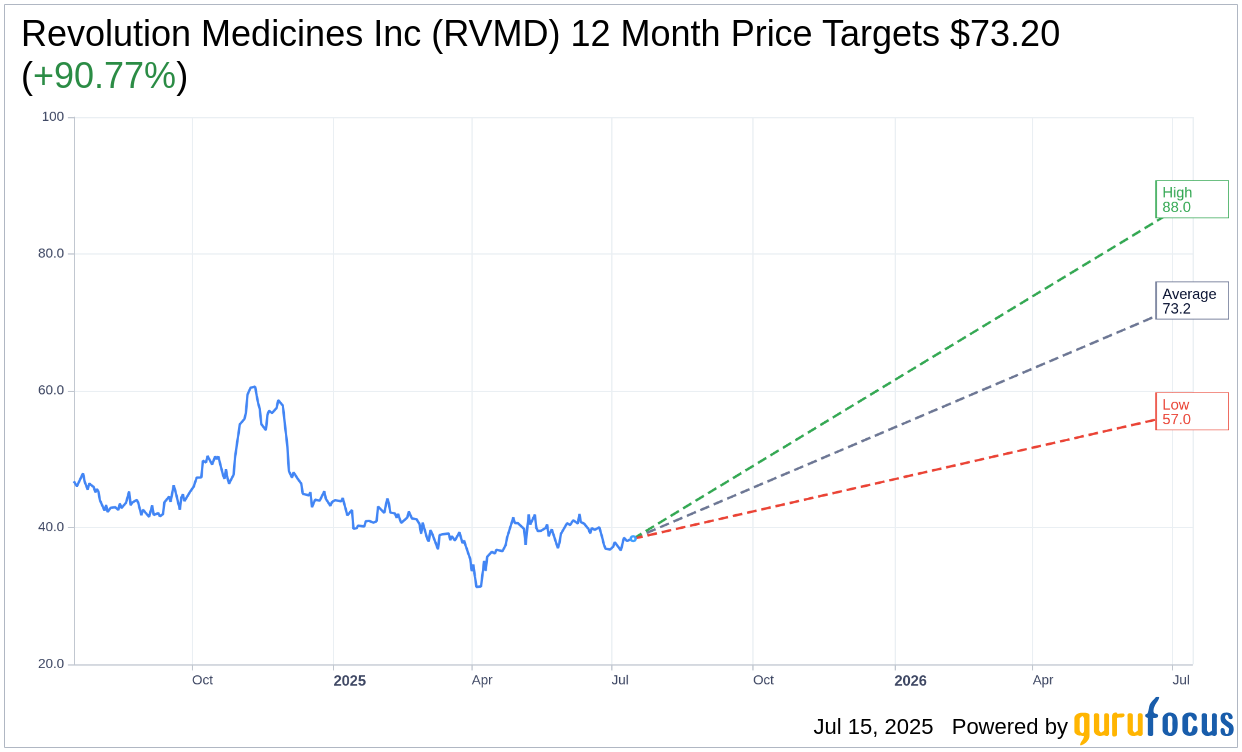

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Revolution Medicines Inc (RVMD, Financial) is $73.20 with a high estimate of $88.00 and a low estimate of $57.00. The average target implies an upside of 90.77% from the current price of $38.37. More detailed estimate data can be found on the Revolution Medicines Inc (RVMD) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Revolution Medicines Inc's (RVMD, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Revolution Medicines Inc (RVMD, Financial) in one year is $8.26, suggesting a downside of 78.47% from the current price of $38.37. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Revolution Medicines Inc (RVMD) Summary page.