Key Highlights:

- IMUNON (IMNN, Financial) successfully retains its Nasdaq listing through strategic fundraising.

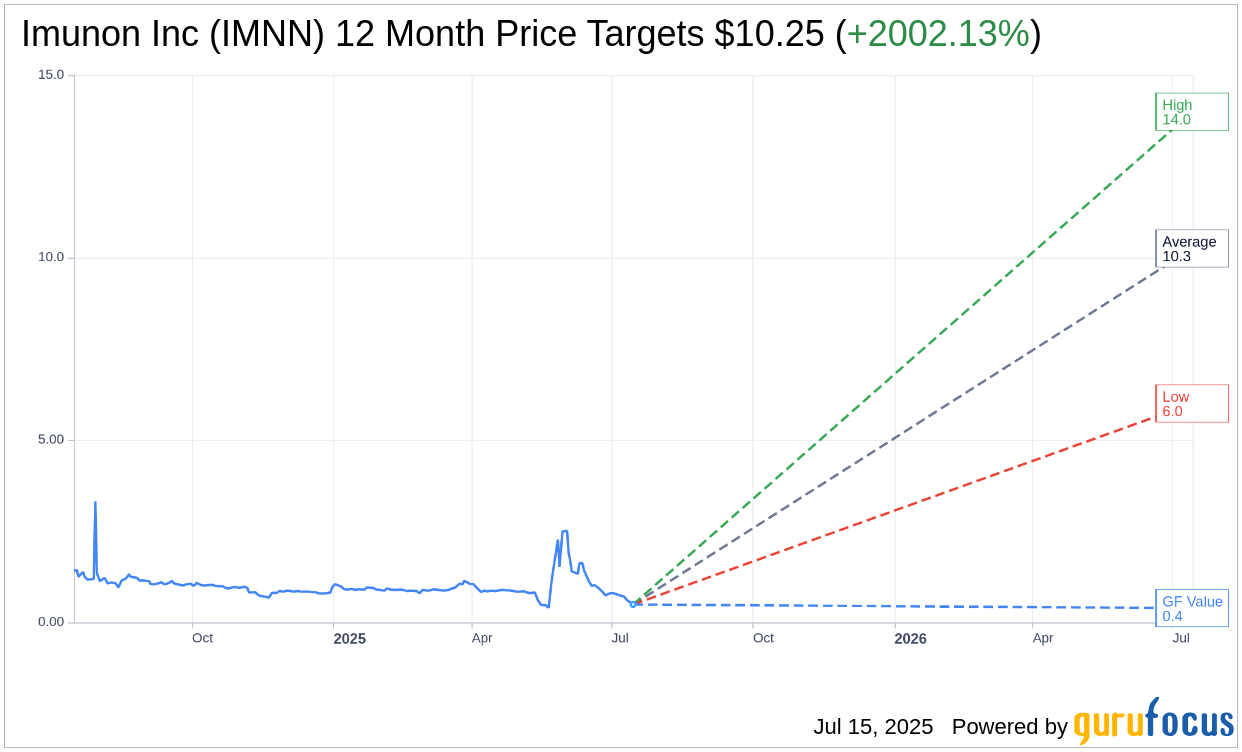

- Analysts anticipate a significant potential upside for IMNN, with a price target indicating over 2,000% growth.

- Despite optimistic forecasts, the GF Value suggests a potential downside in the near term.

IMUNON Secures Continued Nasdaq Listing

IMUNON (IMNN) has successfully maintained its listing on the Nasdaq Stock Market by adhering to the exchange’s equity rules through recent fundraising efforts. However, the company still faces the challenge of meeting the minimum bid price requirement as part of its compliance strategy. Notably, the extension it received is shorter than the anticipated 180 days.

Analyst Projections and Price Targets

According to projections from four analysts, Imunon Inc (IMNN, Financial) holds an average one-year target price of $10.25. This forecast includes a high estimate of $14.00 and a low of $6.00. The average target suggests a remarkable potential upside of 2,002.13% from the current trading price of $0.49. For a more in-depth analysis, please visit the Imunon Inc (IMNN) Forecast page.

Brokerage Recommendations

The current consensus from four brokerage firms places Imunon Inc (IMNN, Financial) at an average recommendation score of 2.3, implying an "Outperform" status. This rating scale, spanning from 1 to 5, ranges from "Strong Buy" at 1 to "Sell" at 5, indicating a generally positive outlook from analysts.

Evaluating IMUNON's GF Value

Despite the bullish analyst forecasts, the GuruFocus estimates provide a contrasting view with an estimated GF Value of $0.39 for Imunon Inc (IMNN, Financial) over the next year. This estimation denotes a potential downside of 20.02% from the current price of $0.4876. The GF Value metric is a calculated assessment of the fair value at which the stock should be traded, grounded in historical trading multiples and the company's past and projected performance. Further details are accessible on the Imunon Inc (IMNN) Summary page.