Summary:

- Advanced Micro Devices (AMD, Financial) experiences a significant 7% stock jump due to resuming MI308 chip exports to China.

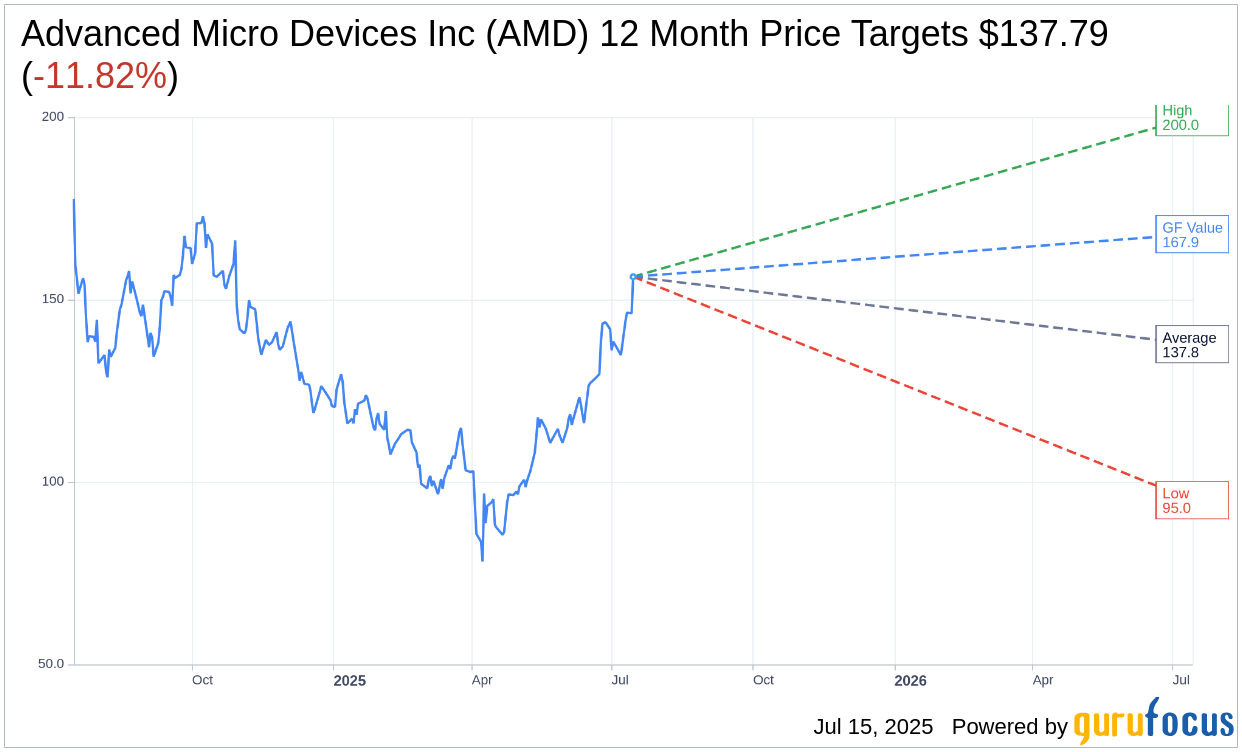

- Analysts offer an average one-year target price of $137.79, creating an 11.82% downside from current levels.

- GuruFocus estimates indicate a GF Value of $167.94, presenting a potential 7.47% upside.

Advanced Micro Devices (AMD) witnessed a promising surge in its stock value, climbing over 7% after receiving U.S. government clearance to recommence exports of its MI308 chips to China. This pivotal development overturns previous export restrictions, hinting at a warming trade relationship with China—a vital market for tech companies like AMD.

Wall Street Analysts Predict Mixed Outcomes

According to projections from 41 analysts, the average one-year price target for Advanced Micro Devices Inc (AMD, Financial) is $137.79. This range encompasses a high estimate of $200.00 and a low estimate of $95.00. Currently priced at $156.27, AMD's average target implies a potential downside of 11.82%. More detailed forecasts can be accessed on the Advanced Micro Devices Inc (AMD) Forecast page.

The consensus recommendation from 53 brokerage firms places AMD at an average rating of 2.1, suggesting an "Outperform" status. This rating scale, ranging from 1 to 5, classifies 1 as a Strong Buy and 5 as a Sell, indicating positive sentiment towards AMD's market performance.

GF Value Suggests Potential Upside

According to estimates provided by GuruFocus, AMD's GF Value for the upcoming year is approximately $167.94. This estimate suggests a potential upside of 7.47% from the current price of $156.27. The GF Value is derived from historical stock multiples and predicted business growth, providing an insightful benchmark for AMD's fair trading value. For comprehensive data, visit the Advanced Micro Devices Inc (AMD, Financial) Summary page.

In conclusion, while AMD faces a mixed projection spectrum, its recent approval to continue chip exports could signify a notable shift in both its market dynamics and future growth prospects. As investors weigh these forecasts and GuruFocus metrics, the evolving trade climate remains a critical factor to monitor.