Key Takeaways:

- Rogers Communications has launched a new satellite-to-mobile text messaging service, significantly expanding its network coverage.

- The service will be available for free to "Rogers Ultimate Plan" subscribers post-beta phase, or for C$15 per month to the public.

- Analysts predict a potential upside of 16.81% in RCI stock with a consensus "Outperform" rating.

Rogers Communications Inc. (RCI) is making headlines with the introduction of its satellite-to-mobile text messaging service. This innovation widens Rogers' network reach by an impressive over 2 million square miles, particularly benefitting those in remote areas. Concluding its beta phase in October, the feature promises to be a boon for "Rogers Ultimate Plan" users who will enjoy it for free, while others can access it at C$15 monthly.

Wall Street Analysts Forecast

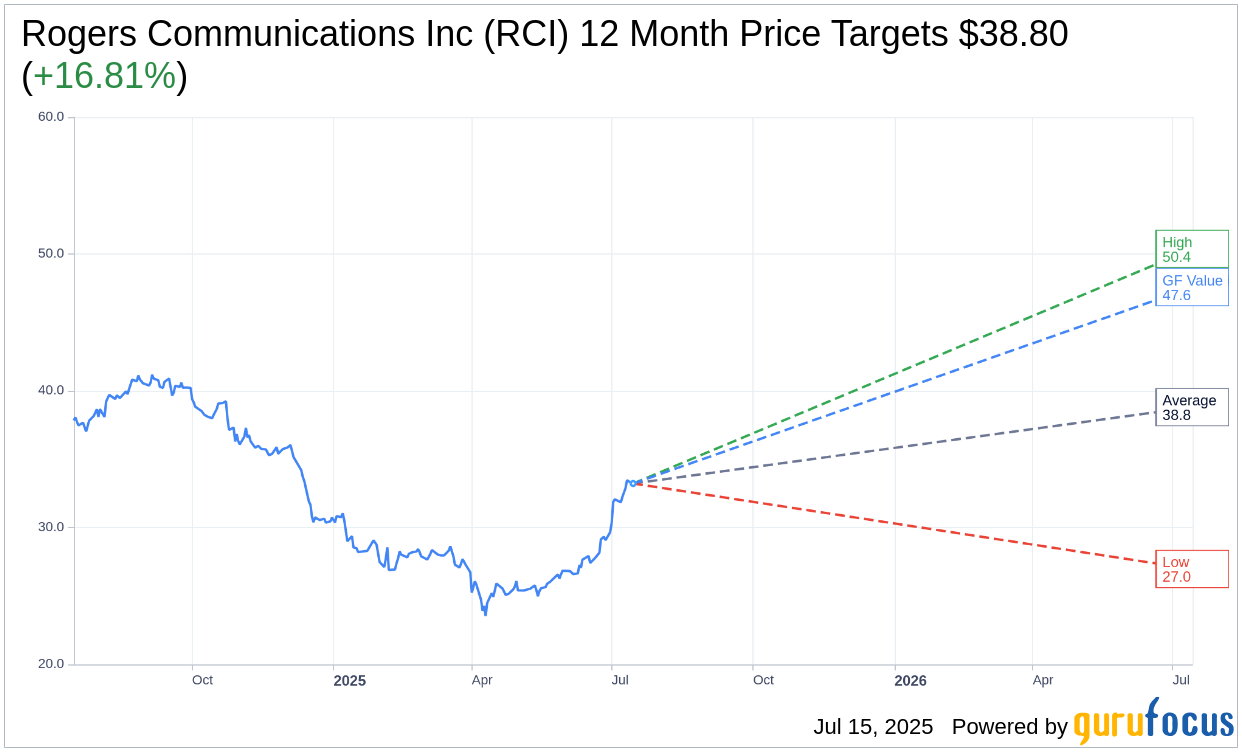

In-depth analysis from 11 Wall Street analysts provides a one-year price target for Rogers Communications Inc. (RCI, Financial), averaging at $38.80. This projection represents a potential upside of 16.81% from the latest trading price of $33.22, with predictions ranging from a low of $26.97 to a high of $50.37. Discover more on the Rogers Communications Inc (RCI) Forecast page.

The consensus among 12 brokerage firms rates Rogers Communications Inc's (RCI, Financial) stock with an average recommendation of 2.3, classified as "Outperform." This rating, based on a 1 to 5 scale where 1 is "Strong Buy" and 5 is "Sell," reflects analyst confidence in the company's future performance.

Further compelling insights come from GuruFocus, which projects a GF Value for RCI at $47.57 in one year. This suggests a significant upside potential of 43.22% from the current stock price of $33.215. The GF Value metric, a GuruFocus proprietary calculation, evaluates fair market value using historical price multiples alongside past and forecasted business growth. For comprehensive data, visit the Rogers Communications Inc (RCI, Financial) Summary page.