CIBC has adjusted its price target for Teck Resources (TECK, Financial), reducing it from C$78 to C$68. Despite this change, the firm continues to rate the stock as an Outperformer. This indicates that CIBC maintains a positive long-term outlook for the company, expecting its shares to perform well in the future.

Wall Street Analysts Forecast

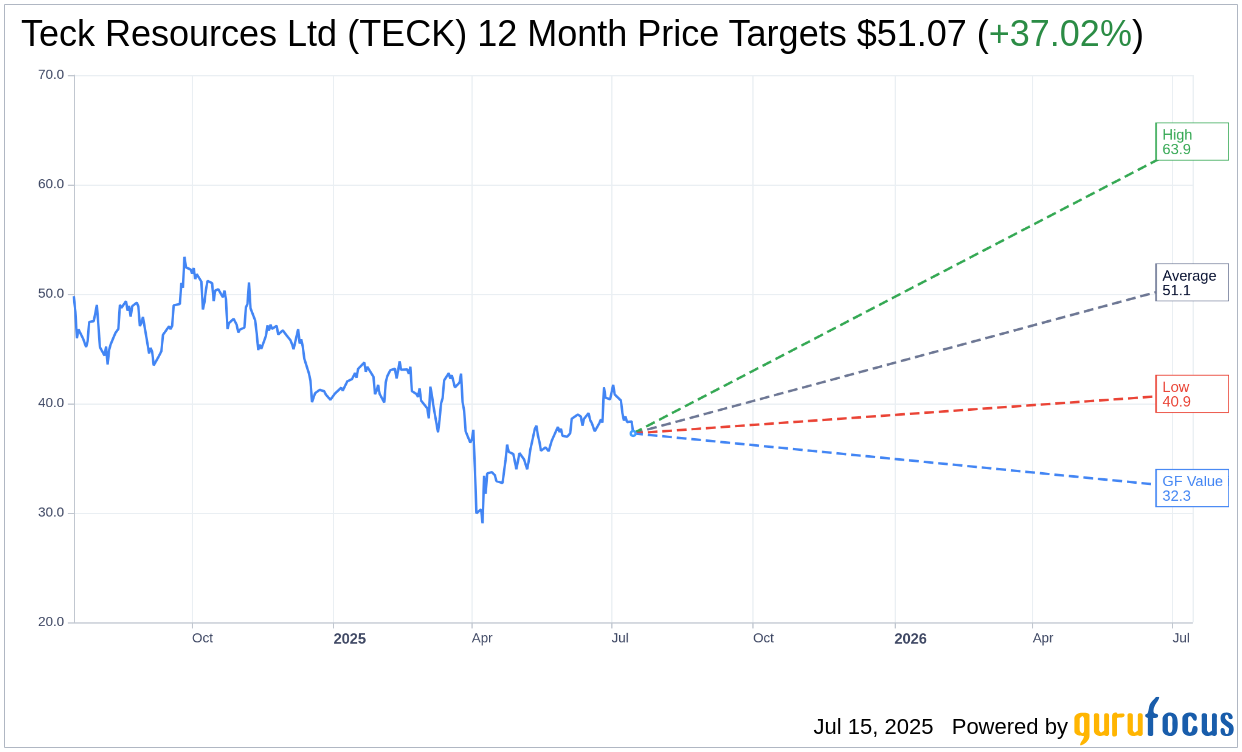

Based on the one-year price targets offered by 14 analysts, the average target price for Teck Resources Ltd (TECK, Financial) is $51.07 with a high estimate of $63.94 and a low estimate of $40.88. The average target implies an upside of 37.02% from the current price of $37.27. More detailed estimate data can be found on the Teck Resources Ltd (TECK) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Teck Resources Ltd's (TECK, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Teck Resources Ltd (TECK, Financial) in one year is $32.27, suggesting a downside of 13.42% from the current price of $37.27. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Teck Resources Ltd (TECK) Summary page.