Reinvent Technology Partners, listed under the ticker symbol AUR, is experiencing a significant increase in call options activity. A total of 12,395 call options were traded, which is four times the average expected amount. This uptick in trading activity has led to a rise in implied volatility by over 2 percentage points, reaching 87.36%.

The most actively traded options are the Aug-25 and Sep-25 calls with a strike price of $7, accumulating a combined volume of about 5,400 contracts. The Put/Call Ratio stands at a notably low 0.07, indicating a strong preference for call options among traders. Investors are keeping a close watch on the upcoming earnings report scheduled for July 30th, which could influence future trading behavior.

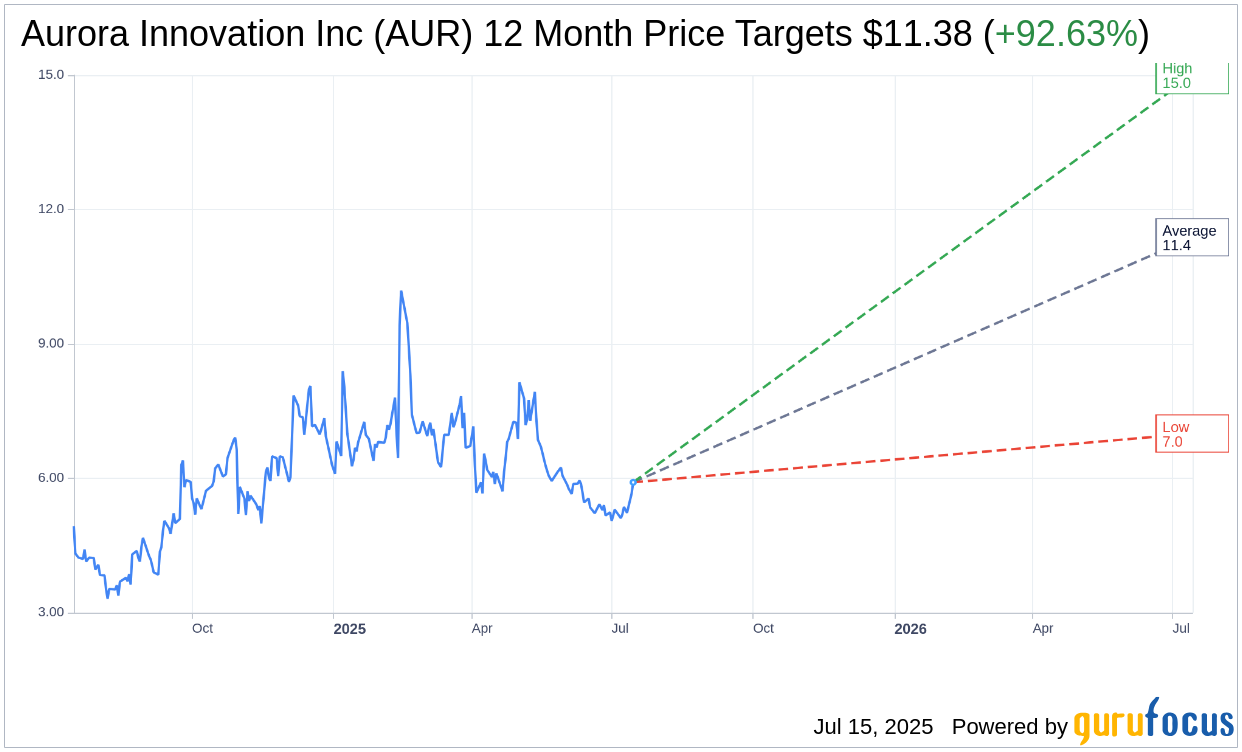

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Aurora Innovation Inc (AUR, Financial) is $11.38 with a high estimate of $15.00 and a low estimate of $7.00. The average target implies an upside of 92.63% from the current price of $5.91. More detailed estimate data can be found on the Aurora Innovation Inc (AUR) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Aurora Innovation Inc's (AUR, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

AUR Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Aurora Innovation Inc (AUR, Financial) has successfully launched driverless trucks operating commercially, marking a significant milestone in autonomous freight technology.

- The company has developed a rigorous safety case framework, which has been widely adopted in the industry, ensuring the safety of their autonomous vehicles.

- Aurora Innovation Inc (AUR) has strong partnerships with major OEMs and Tier One suppliers, positioning it well for large-scale deployment of autonomous trucking.

- The Aurora driver has demonstrated strong on-road performance, with 95% of loads achieving a 100% API metric, exceeding the commercial launch target.

- The company has a robust financial position with nearly $1.2 billion in cash and short-term investments, providing a strong cash runway into the fourth quarter of 2026.

Negative Points

- Aurora Innovation Inc (AUR) anticipates needing to raise $650 to $850 million before achieving positive free cash flow, indicating a significant capital requirement.

- The company experienced a delay in its commercial launch, which shifted its timeline and increased its financial needs.

- There is a high level of execution risk associated with transitioning to new hardware generations, which could impact the company's scaling plans.

- Aurora Innovation Inc (AUR) faces competition from other companies in the autonomous vehicle space, which may accelerate their own advancements.

- The departure of co-founder and Chief Product Officer Sterling Anderson could impact the company's strategic direction and execution.