Key Insights:

- ASML Holding (ASML, Financial) upgraded to "Buy" by Seeking Alpha analysts due to a predicted semiconductor industry recovery and robust AI chip demand.

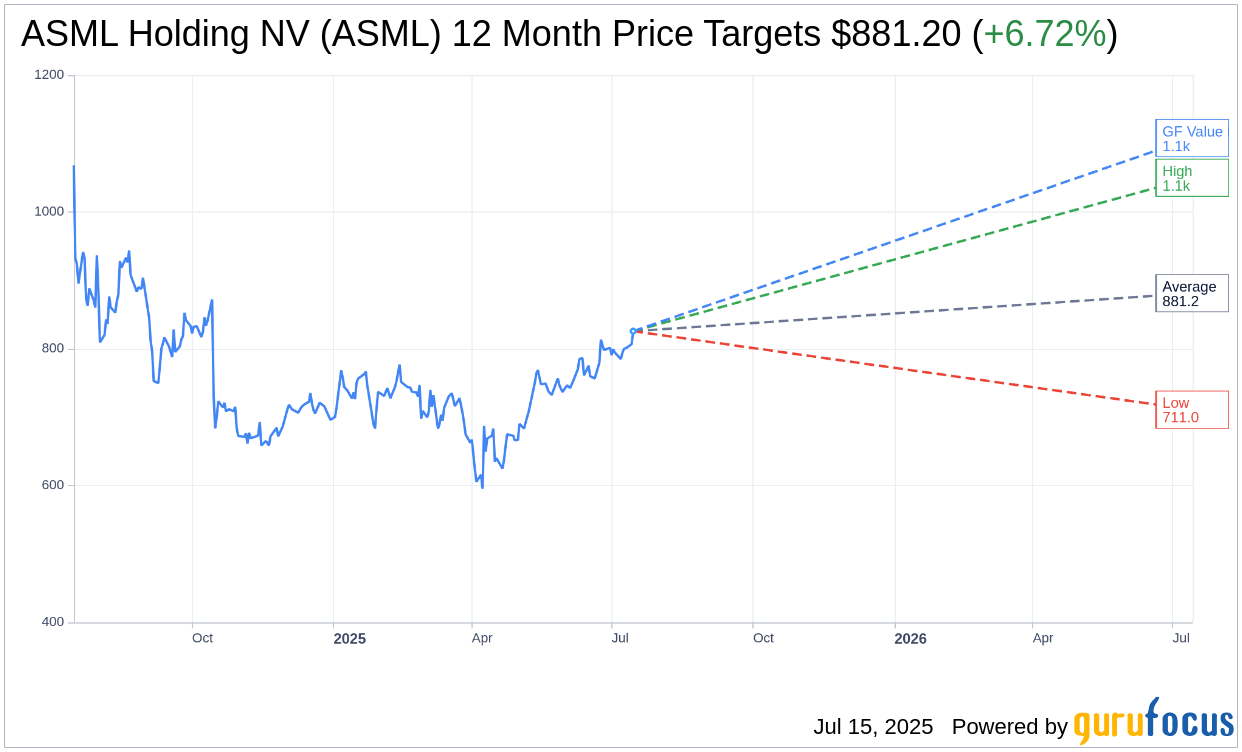

- Analysts foresee ASML potentially reaching the $900s by year-end, supported by strong Q2 earnings.

- ASML's average price target suggests a 6.72% upside from current levels, while the GF Value estimate indicates a significant 34.21% potential increase.

ASML's Promising Forecast: Analysts' Perspectives

ASML Holding (ASML) has garnered attention following its upgrade to "Buy" by Seeking Alpha analysts. The anticipated semiconductor industry recovery and the soaring demand for AI chips are key drivers behind this optimistic outlook. Analysts are confident that ASML's stock could not only break the $800 barrier but possibly soar into the $900 range by the end of the year, propelled by impressive Q2 earnings results.

Wall Street Analysts' Price Targets

According to projections from 12 distinguished analysts, the average one-year price target for ASML Holding NV (ASML, Financial) stands at $881.20. This includes a high estimate of $1,050.05 and a more conservative low estimate of $711.00. This average target suggests a potential upside of 6.72% from ASML's current trading price of $825.70. For those interested in a deeper dive into these figures, comprehensive data is available on the ASML Holding NV (ASML) Forecast page.

Brokerage Recommendations

The consensus recommendation, based on insights from 16 brokerage firms, places ASML Holding NV's (ASML, Financial) average brokerage recommendation at 2.0, signifying an "Outperform" rating. This assessment is part of a rating scale that ranges from 1 to 5, where 1 represents a Strong Buy and 5 indicates a Sell.

ASML's GF Value: A Lucrative Proposition?

Utilizing GuruFocus' proprietary metrics, ASML Holding NV (ASML, Financial) presents an intriguing estimated GF Value of $1108.17 for the upcoming year. This indicates a substantial potential upside of 34.21% from the current price of $825.70. The GF Value is derived from historical trading multiples, previous business growth, and projections of future business performance. Investors can explore further by visiting the ASML Holding NV (ASML) Summary page.